Improved U.K. Finances "Very Positive" for British Pound say MUFG, Longer-Term Gains vs. Euro, Dollar still Possible

- Strategists say improving public finances open door to Bank of England rate rises

- "will certainly help provide support for the Pound"

- Pound-to-Euro rate today: 1 GBP = 1.144 EUR, Pound-to-Dollar rate today: 1 GBP = 1.3945 USD

© Rawpixel.com, Adobe Images

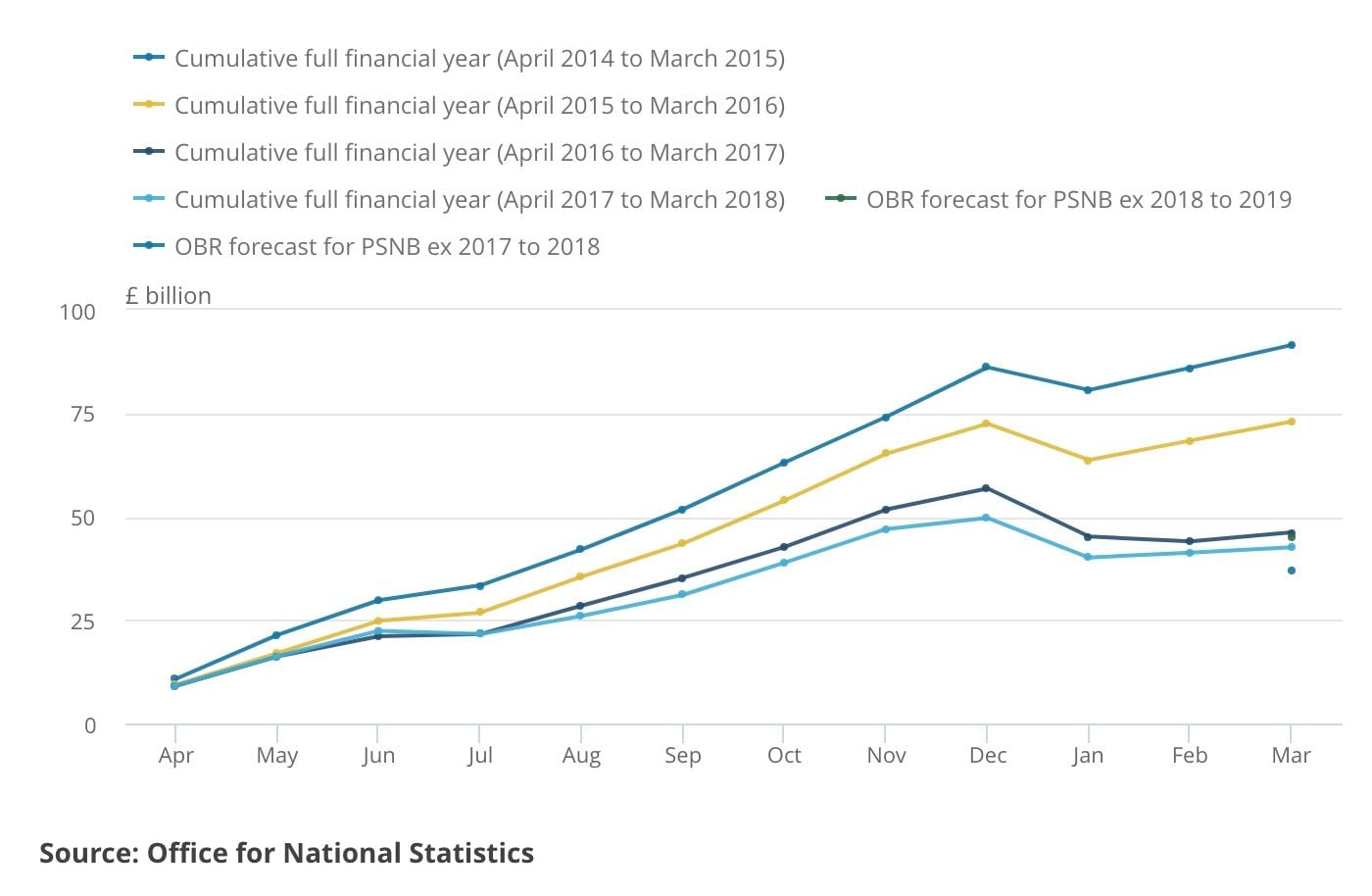

The April release of U.K. public finance data by the ONS showed borrowing continues to fall with the improvement in the country's fiscal position running ahead of analyst expectations, and this is good news for the Pound in the long-run we are told.

Interpretations of the data conducted by analysts at global investment bank MUFG suggest the figures are likely to be supportive of the British Pound going forward as they will allow the Bank of England to be more confident in raising interest rates.

Government borrowing fell by £0.26bn in March compared to February which in turn showed a £0.41bn fall in borrowing, therefore continuing a run of surpluses posted by the exchequer.

The figure beat forecasts that borrowing would increase by £1.1bn in March.

This means public sector net borrowing (excluding public sector banks) decreased by £3.5 billion to £42.6 billion in the latest financial year (April 2017 to March 2018), compared with the previous financial year; this is the lowest net borrowing since the financial year ending March 2007.

"The budget deficit figures for March confirmed that the UK’s finances are in better shape than originally expected. At a time when market participants are focusing more and more on USD downside risks linked to the potential explosion of the US ‘twin deficit’, the news from the UK is very positive for the Pound," says Derek Halpenny, European Head of Global Markets Research at MUFG.

The data shows the U.K. government has now managed to eliminate the current budget deficit for the first time since 2001-02.

Pound Sterling found support on the release of the data with the currency putting behind it the damage suffered during the tumultuous week of April 16-20; Sterling gave up fresh post-Brexit highs against the Dollar and 11-week highs against the Euro.

The declines came largely amidst fears that momentum in the U.K. economy was fading, with Bank of England Governor Carney delivering the Coup de grâce with his message that softer data was not going noticed; markets read this as a suggestion an interest rate rise in May was now less likely.

According to Halpenny, the improving public finances will however potentially offer the Bank of England some confidence to proceed with tightening plans, "the better fiscal position will not go unnoticed by the BoE."

"Revenue growth in March alone was much stronger than expected and provides the Chancellor with an opportunity to ease up on the austerity that has been in place since the financial crisis," says the analyst.

However, MUFG believe any significant giveaways in the near-term are unlikely and with Brexit negotiations ongoing, the government is very likely to maintain the current fiscal policy for now.

"The knowledge that the government is currently in a position to build a bigger buffer to provide scope for some degree of fiscal expansion will reduce concerns over the gradual monetary tightening that the BoE is currently signalling to the markets. The UK government’s very notable contrast to the fiscal position in the US, that is currently contributing to US Dollar weakness, will certainly help provide support for the Pound," says Halpenny.

MUFG believe the profile facing Sterling at the present juncture is near-term weakness, longer-term gains.

"We see scope for further depreciation over the short-term," says Halpenny, "we still expect the MPC to hike on 10th May, but this is now a more finely balanced decision. That leaves the Pound vulnerable to further short-term selling."

But, MUFG say there are still reasons to believe the MPC will look beyond the inflation and retail sales data this week - especially given the distortions related to cold weather in March.

Governor Carney’s comments were not uniformly bearish either as he did also state that it was important to consider the overall momentum of the economy meaning the prospect for a pro-Sterling surprise from the Bank of England in May is still possible.

Advertisement

Get up to 5% more foreign exchange by using a specialist provider to get closer to the real market rate and avoid the gaping spreads charged by your bank when providing currency. Learn more here.