The Pound is Breaking Fresh Ground Against the Safe-Haven Swiss Franc, Strategists see Further Gains

- GBP/CHF rises to new highs as Brexit risk dissipates

- UBS sees further upside on the horizon

- Possible technical spoiler in the form of broadening pattern

© Kasto, Adobe Images

The British Pound has broken to new highs against the Swiss Franc which seems to be underperforming across the board despite expectations of the opposite given its safe-haven credentials and the global high alert from risk of trade war.

There are suggestions that moves in GBP/CHF could well signal gains in other major Sterling pairs, for instance the GBP/EUR which has been resolutely range-bound for months now.

Sterling has been rising against the Franc through the duration of March, rising from a low of 1.2863 on March 2, to the fresh post-EU referendum high at 1.3538 registered today.

What's all the more remarkable is that the gains are coming against one of the traditional safe-haven currencies which would typically be expected to outperform in times of stock market stresses; just as we have been seeing of late as China and the US ratchet up trade tensions.

The move by Sterling could represent an increase in underlying confidence in the currency which bodes well for gains against other major currencies.

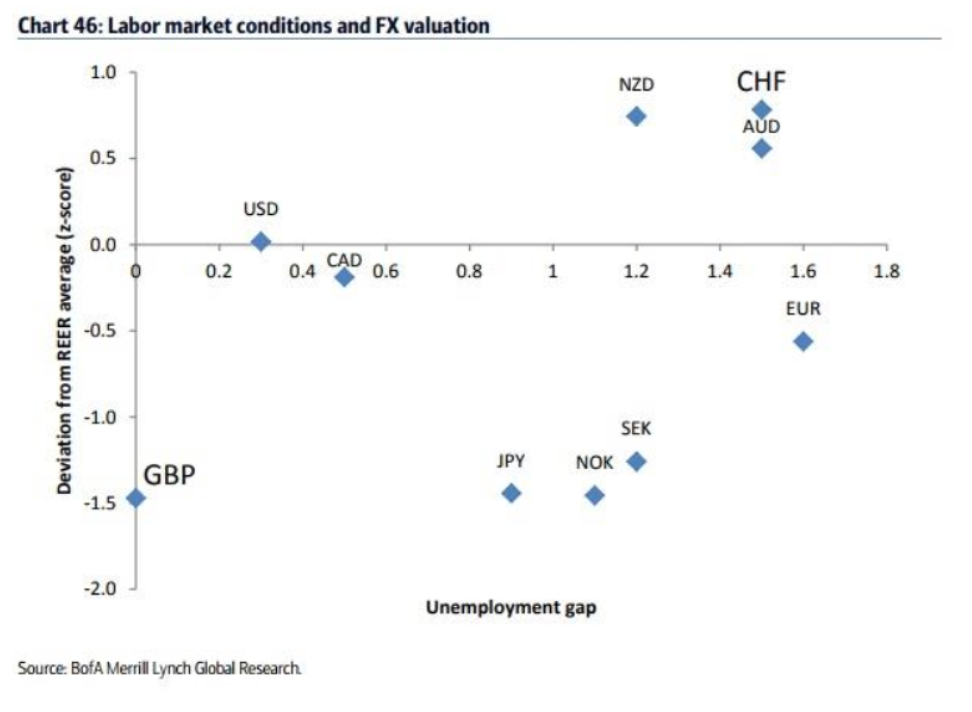

The trajectory falls in the lap of forecasts made by Bank of America Merril Lynch (BAML) that GBP/CHF would rise due to the two currencies asymmetrical relationship in relation to valuation and labour market status.

The Pound was the most undervalued currency in the G10 relative to its positive labour market whilst the Franc was the most overvalued compared to its relatively weak employment situation.

The chart below shows BAML's model with GBP and CHF at extremes.

Since then GBP/CHF has risen strongly as exemplified by the tweet below from Faraday research:

#GBPCHF peeking out above major cycle highs to levels not seen since Brexit vote. Is it leading the way for other #GBP crosses? pic.twitter.com/8Fmbjs3cx8

— Faraday Research (@FaradayResearch) April 4, 2018

That the uptrend will continue appears to be the view of Swiss global investment bank UBS too, who think it will reach a target at 1.39 (current spot price 1.3504).

"We expect Sterling to build on its recent strength and make further gains against the Swiss franc and the US dollar over the next 6–12 months," says Dean Turner, an economist at UBS.

The agreement of a Brexit transition deal and relatively robust UK data appears to be the source of their bullish forecast.

"In our view, the pound is likely to move higher in the months ahead, supported by a relatively stable outlook for the economy together with a firmer tone and tighter monetary policy from the BoE. We believe that sterling can trade as high as 1.48 against the USD in 12 months, and hold our long GBPCHF position, targeting 1.39 over the same period," says Turner.

Yet despite the positive fundamental outlook a technical analysis of the pair's price action cautions us to check any bullish over-exuberance.

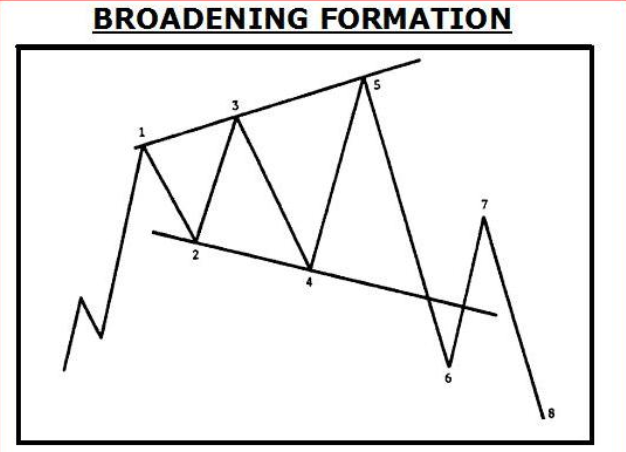

The chart below shows the outline of a pattern which may be forming called a broadening formation.

Note how the current market level is now meeting the rising trendline which encompasses the upper trajectory of the pattern.

Naturally, we would expect the exchange rate to pull-back from this border-line over the next few days, indicating the possibility of at least short-term weakness for the pair.

Another example of a broadening formation can be seen below, from chart website stockcharts.com.

The chart looks eerily similar to the pattern forming on GBP/CHF, further suggesting it could be bona fide.

It is not necessarily a long-term bearish indicator for GPB/CHF, broadening formations can be either bullish or bearish.

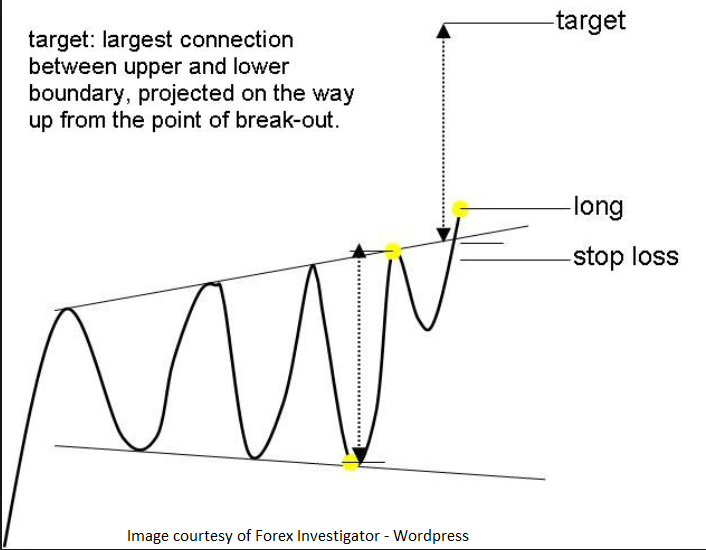

The two varieties are illustrated below, with the bearish first and the bullish second:

Image courtesy of Trader 2 Trader

Yet regardless of which it is, it does suggest at least a correction from the current level back down.

A broadening top is a "type of expanding triangle" which usually occurs at major tops, according to Trader 2 Trader blog, which shows "three successively higher peaks and two declining troughs."

"The violation of the second trough completes the pattern. This is an unusually difficult pattern to trade and is fortunately very rare," concludes the blog.

Clearly, we still don't know yet whether the pattern is, in fact, a bona fide broadening formation or whether it is long-term bearish or bullish, but whichever it is it is potentially short-term bearish and raises a red flag against the uptrend.

Get up to 5% more foreign exchange by using a specialist provider to get closer to the real market rate and avoid the gaping spreads charged by your bank when providing currency. Learn more here.