Pound Sterling Pops as Bank of England Signals May Rate Rise: Latest Currency and Analyst Reactions

- Written by: Gary Howes

Above: Mark Carney, Governor of the Bank of England. © Simon Dawson, Bloomberg, Bank of England

Coverage of the Bank of England's interest rate decision, the minutes covering the latest MPC meeting, the quarterly Inflation Report and Governor Mark Carney's press conference.

Highlights:

- 9-0 vote in favour to leave rates unchanged

- But Pound surges as Bank signals earlier and more interest rate rises than previously expected

- Growth forecasts raised in inflation report

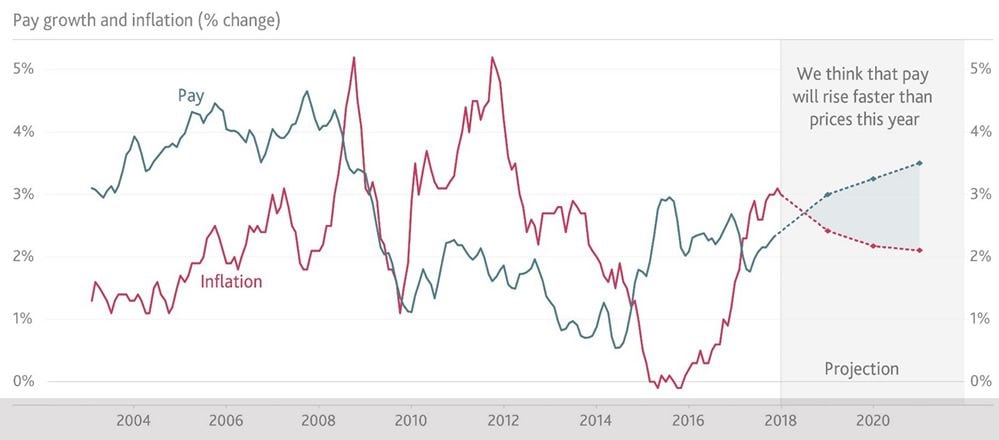

- Wages expected to grow faster than inflation in 2018

- Inflation seen staying above 2% target over coming years, hence need for higher interest rates now

- Pound-to-Euro exchange rate: 1 GBP = 1.1365 EUR, day's best: 1.1450

- Pound-to-Dollar exchange rate: 1 GBP = 1.3938 USD, day's best: 1.4065

- Pound-to-Australian-Dollar exchange rate: 1 GBP = 1.7866 AUD, day's best: 1.7995

The Bank of England has warned that it will be raising interest rates sooner than markets expect, a signal that has markets firmly pricing in a May interest rate rise and making contingencies for a potential second interest rate rise in 2018.

The bringing forward of interest rate rise expectations was an unexpected move by markets, and as a result, Sterling was bid sharply higher.

"Monetary policy would need to be tightened somewhat earlier and by a somewhat greater extent over the forecast period than anticipated at the time of the November report," reads the key element of the minutes to the Bank's February policy meeting.

Furthermore, the quarterly Inflation Report shows, the Bank has raised economic growth forecasts with the 2018 GDP forecast raised to 1.8% where it had been at 1.6% previously. 2019 forecasts are raised to 1.8% having been at 1.7% previously.

Economists at the Bank expect stronger wage growth than they did when they released their last set of forecasts back in November, and more importantly, inflation is still expected to be above the 2% target in three years’ time which gives a good steer as to why Carney and his team are taking a proactive approach to interest rates at this stage.

Above: The Bank of England expects pay to rise faster than prices in 2018 (C) Bank of England.

"Note that the MPC (as we had anticipated) appears to be shifting its view of the appropriate time horizon over which to bring inflation back to target. Until now, it has been happy to let inflation overshoot the target even after three years. However, the Minutes stated that a “more conventional horizon” was now appropriate," says Paul Hollingsworth with Capital Economics.

Capital Economics expect the Bank to we hike a further two times this year, taking Bank Rate to 1.25%.

However, the number of hikes delivered in 2018 could well depend on the behaviour of Sterling with Michael Metcalfe, global head of macro strategy at State Street Global Markets, warning that if the Pound continues to rise, it could well negate the need for further interest rate rises:

"Markets had moved quickly this year to discount more tightening from the BoE. The hawkish tilt of this meeting will at the very least, vindicate these moves and possibly encourage further expectations. What will be key now is to watch how sterling responds, as a much quicker appreciation could produce a faster fall in inflation and potentially nullify the need for a more rapid tightening cycle."

Nice to see the UK Pound £ pushing up towards US $1.40 and above Euro 1.14 as the Bank of England hints at future rate hikes. Take care though as the Unreliable Boyfriend is in charge! #BoE

— Shaun Richards (@notayesmansecon) February 8, 2018

Going into the meeting, the big question was whether the Bank of England would raise interest rates in May with markets assigning a 50-55% probability that this will indeed happen. We warned that where the dial shifts following today's event would move the Pound. If the odds grow for a May rate rise, Sterling will likely rise, if they diminish, Sterling will likely fall.

Following the meeting, market pricing for a May rate rise ticked higher to 67%, hence the rise in the Pound, and a number of analysts are expecting further rises.

Giving an initial reaction to the outcome, analyst Viraj Patel with ING Bank says the,"story is the same... we retain our bullish GBP call (GBP/USD 1.45 & EUR/GBP 0.86 1Q18) on Brexit transition deal and as the UK economy regains its cyclical swagger." Patel stresses that Carney and his team are making any further moves on the rate contingent on continued progress in Brexit negotiations and Patel therefore warns the rise in Sterling to his targets will be deferred.

However, analyst Neil Jones with Mizuho Bank believes that while Sterling has bounced in convincing fashion, gains should ultimately be limited.

"For me though, the bigger picture, its not so much a surprise & flows with the general world central banking theme of increased inflation concerns. However, it should prove somewhat unwarranted in the UK. Think in time the BOE will limit changes. Very very different set of circumstances ahead in the UK."

Above: Mark Carney tells journalists that a gradual rise in interest rates over coming months would be appropriate to cool UK inflation levels © Pound Sterling Live, Bank of England.

Above: Mark Carney tells journalists that a gradual rise in interest rates over coming months would be appropriate to cool UK inflation levels © Pound Sterling Live, Bank of England.

Alex Edwards, head of the corporate desk at OFX, does however believe today's events set Sterling up for further near-term strength:

“The Pound has bounced back as the Bank of England raised growth forecasts and said it will return to targeting inflation on a 2-year horizon. Today’s Inflation Report was more hawkish than many were expecting, with the bank hinting that it may raise interest rates earlier than originally suggested.

“The announcement is likely to support the pound to the end of the week, and another push through 1.40 against the dollar may well be on the cards. Sterling looks like it will be the darling of the currency market once again – and hot on the heels of last week’s rally.”

Seeing gains extending beyond just coming days is Ned Rumpeltin, European Head of FX Strategy at TD Securities who believe the Pound-to-Euro exchange rate is going higher.

"With the USD in the midst of a broader correction, we favour EUR/GBP over cable to express a more positive near-term outlook for Sterling, particularly as EUR hard data surprises may have peaked," says Rumpletin in the wake of the BoE event.

Rumpeltin has recommended clients go "long" on Sterling against the Euro in order to profit on further gains by the UK currency.

Also seeing a stronger Pound is Robert Wood, economist with Bank of America Merrill Lynch Global Research:

"We have been contrarian long GBP since more than a year ago. As we wrote in our last FX weekly, a transition agreement early this year should give another boost to the GBP, potentially allowing the BoE to start hiking at a pace. Today's hawkish BoE tone is a further validation of this view."

Advertisement

Get up to 5% more foreign exchange by using a specialist provider to get closer to the real market rate and avoid the gaping spreads charged by your bank when providing currency. Learn more here.