Lloyds Cut Forecasts for British Pound against Euro and US Dollar

- Quotes:

- Pound to Euro exchange rate today: 1 GBP = 1.1041 EUR

- Euro to Pound Sterling exchange rate today 1 GBP = 0.9056

- Pound to Dollar exchange rate today 1 GBP = 1.2980 USD

Lloyds Bank have announced they have downgraded their forecasts for the British Pound against the Dollar and Euro.

The high-street lender's downgrades to GBP/EUR are seen as being quite notable while downgrades to GBP/USD are more gentle.

The downgrade is the latest in a pattern of declining confidence in Sterling seen at the UK high-street giant; we reported a few months back that analysts were quite optimistic on the Pound’s fortunes with the Pound to Euro exchange rate (GBP/EUR) being forecast closer towards the 1.20 level.

This view then gave way to a more neutral tone on the currency with forecasts for GBP/EUR exchange rate coming down to the 1.16 area.

Now, it appears analysts are a little more bearish having made a substantial cut to their expectations for Sterling and see the GBP/EUR ending the year below 1.10.

The cut to Sterling’s outlook, particularly against the Euro, is in line with similar moves made across the analyst community.

The Euro is the currency of the moment, with the opposite being true of Sterling.

Changes to the Pound to Dollar exchange rate's forecast are less severe which represents a global view that the US Dollar might continue to struggle to find form for some time yet.

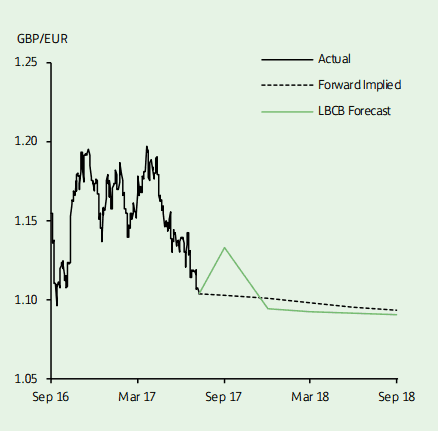

GBP/EUR Forecasts Slashed

In recent weeks, the Pound has remained on the back foot against the euro, declining to yet another year-to-date low, below 1.1050.

“Buoyant economic data in the euro area, the outcome of August’s MPC meeting and uncertainty related to Brexit have all contributed to the extension of the downtrend,” say Lloyds in their August edition of their International Financial Outlook.

The economic outlook for the Euro Area is meanwhile taken as positive, evidenced by Germany’s ifo Business Climate Index reaching a record high in July 2017.

Despite the strong data backdrop, the European Central Bank left policy unchanged in July, while President Draghi’s comments were 'dovish', reiterating that loose monetary conditions were still needed.

However, markets are clearly not in the mood to listen and traders continue to bid up the Euro in anticipation of the ECB cutting its stimulus programme in coming months.

That the ECB didn’t explicitly express concern at the Euro’s recent trend higher was seen by some to be a sign that the Bank is relaxed with the appreciation. (Of course there are some arguing that the subsequent strength could find some robust opposition in due course).

Meanwhile in the UK, the market also viewed the BoE as being 'dovish' following the 6-2 vote in August’s MPC meeting.

Downward revisions to GDP growth also put GBP under additional pressure.

Yet, risks to the Bank Rate profile remain skewed to the upside with Bank of England Governor Carney and his Deputy Broadbent warning that the market might be underestimating the extent to which rates rise in 2018.

The Pound also continues to be weighed down by Brexit uncertainty.

Negotiations have progressed slowly, with EU chief negotiator Michel Barnier stating that the UK needed to provide “clarity” on its position before discussions could be more constructive.

“All considered, we expect GBP/EUR to be relatively range bound, although acknowledge downside risks to our profile given our subdued UK rate forecast, contrasting data performances between the UK and Euro Area and general positive sentiment towards the Euro,” say Lloyds.

Lloyds forecast the Pound to Euro exchange rate to trade at 1.09 by the end of 2017, where it is seen staying through 2018.

In July Lloyds forecast a year-end rate of 1.14 which was also seen being the target for the duration of 2018.

Is the fall in value of Sterling impacting your international payments? Get up to 5% more foreign exchange by using a specialist provider by getting closer to the real market rate and avoid the gaping spreads charged by your bank for international payments. Learn more here.

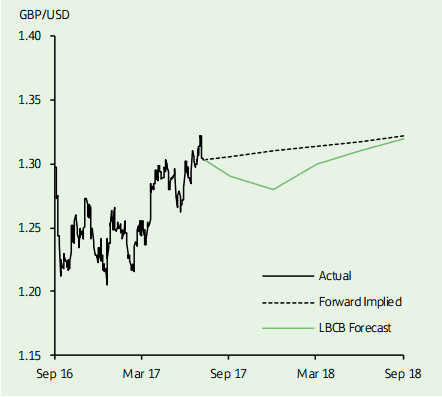

GBP/USD Forecasts Nudged Lower

Sterling continues along a gentle path higher against the US dollar and recently recorded a new year-to-date high, above 1.3250.

The move has universally been attributed to a recent bout of broad-based USD weakness.

The Dollar has struggled amidst concerns at the US Federal Reserve over low inflation, which led the market to lower expectations for further policy tightening.

“Nonetheless, we believe that it will announce its plan to reduce the size of its balance sheet in September and increase rates by 25bp in December,” say Lloyds; a call that is on balance favourable for the Dollar’s outlook if correct.

Political developments - particularly Trump’s failure to pass the Healthcare Bill and concerns about links between his administration and Russia - have also weighed on US yields.

“Overall, we expect GBP/USD to remain range bound in the near term, with upside risks in the medium term due to longer-term signals of undervaluation,” say Lloyds.

Lloyds forecast the Pound to Dollar exchange rate to trade at 1.28 by the end of 2018, 1.30 by March 2018, 1.31 by June 2018 and 1.33 by end-2018.

In July the forecast was at 1.30, 1.31, 1.32 and 1.34, respectively.

Lloyds are meanwhile bullish on the Euro's prospects against the US Dollar which is tipped to retain a soft tone longer-term.

However, shorter-term the Euro is expected to pullback, given Lloyds' expectations that the path of the Fed funds rate is bullish when compared to the market while long EUR positioning may be stretched and momentum shows signs of divergence.

Still, economic and market sentiment gauges remain buoyant with regard to the euro and estimates suggest the pair is undervalued. Lloyds anticipate a move to 1.22 by end-2018.

UK Growth to Slow

The National Institute of Economic and Social Research have released their latest monthly estimates of UK GDP and the findings suggest output grew by 0.2% in the three months ending in July 2017.

So while the economy continues to grow, it is well below the long-run trend of 0.6%.

Looking ahead, Britain's longest established independent research institute are forecasting a modest recovery for the second half of 2017 as the effects of stronger global growth combine with a weaker currency.

However, growth will remain constrained by a slowdown in consumer spending amidst slow wage growth and investment spending held back by Brexit-inspired uncertainty.

"The latest UK growth forecasts from NIESR point towards a gradual slowdown in momentum, with the three months to July expected to fall to 0.2%, from 0.3% in the second quarter. This is the latest in a line of economic indicators that suggest the UK is finally exhibiting the kind of economic slowdown that spurred the Bank of England to cut rates in the wake of the Brexit vote last year," says Joshua Mahony, analyst with IG in London.

In short, here we have yet more evidence that Sterling needs wage growth to pick up if it is to recover.

Markets Eye Mounting Geopolitical Risks - Or is this Just a Summer Distraction

An escalation of verbal sabre rattling between the US and North Korea is seeing markets price in more risk aversion.

Traditional safe havens like the JPY and Gold traded well, while the AUD - which has already been under pressure recently and so far ignoring the very positive industrial metals prices - took most of the pain in G10.

"The real worry, obviously, is that this turns to brinkmanship and then the wrong choice of words forces unwanted action," says Robin Wilkin, an anlyst with Lloyds Bank.

US yields and equity markets recovering from range lows has provided some calm to the markets and seen the USD pare back a little too.

However, markets remain on tenterhooks in regards to geo-political risk, gold and JPY testament to this holding onto recent gains.

Meanwhile base metal and oil prices continue to work higher, but so far hasn't influenced commodity currencies.

In all, we see this war of words between the US and North Korea as just that - words. With little major market-orientated stories to latch onto traders are liable to give such events more weight.

And interesting story on the socio-economic front with an IFS study finding UK men from poor families are twice as likely to be single than their richer counterparts.

The study found that one in three men from disadvantaged backgrounds were single at the age of 42, compared with one in seven from rich backgrounds.

Poor being the poorest fifth of households, and rich being the richest fifth of households.

What about everyone in-between?