Pound's Gains at Risk if Geopolitical Risks Start to Fade

- Pound to Euro exchange rate reference: 1.1785, day's high @ 1.1797, day's low @ 1.1756

- Pound to Dollar rate reference: 1.2511, day's high at 1.2521, day's low @ 1.2479

It appears that the big driver of the Pound at present is geopolitics and as such any impact to the UK currency from the data report could be muted.

As we noted here, the Pound was a major beneficiary of a spike in nervousness amongst the investor community over the course of the past 24 hours with global investors seeking out UK gilts which are of course denominated in Sterling.

With the economic calendar thinning out ahead of the Easter weekend investors will be watching the evolution of geopolitical tensions over coming hours.

On one front, the US administration is increasing pressure on Russians over their support for Syrian President Assad while on another front the US appears intent on ratcheting up pressure on North Korea.

The North Korean situation is arguably more volatile owing to the unpredictability of the regime in Pyongyang.

Trump also brandishes his famous - or infamous - brand of unpredictability which should keep nerves heightened.

Temperattures rose on Tuesday when Trump tweeted, "North Korea is looking for trouble. If China decides to help, that would be great. If not, we will solve the problem without them! U.S.A."

The move caught markets by surprise.

"The Yen surged on geopolitical tensions. The ever-hot twitter account from Trump dampened the risk sentiment as he tweeted 'North Korea is looking for trouble'. Dollar was mixed. The Pound was also stronger for the same driver as the Yen,” notes Holger Sandte, an analyst with Nordea Markets.

Sandte points to an important dynamic in which the Pound is actually being favoured in conditions where markets are nervous.

The UK is looking to be more of a safe harbour with elections in France just around the corner.

Markets have shown increased nerves towards European assets as far-left candidate Jean-Luc Melenchon muddies the playing field and creates a scenario where any one of the main four candidates can now win.

The US Dollar is also not finding its traditional safe-haven characteristics as investors buy safer US bonds which in turn sends the yield on those bonds down which lowers support for the Dollar.

The Pound has long been associated with risk as the uncertainties regarding Brexit loom large ahead - but these risks are well flagged and markets have had months to position accordingly.

So with the Pound being a winner in times of increased risk sentiment, it goes that it will likely be a loser if the situation settles down.

Headlines over the next 48-hours will therefore be key.

For now Trump appears to be intent on showing a strong hand on North Korea. He told the Fox Business Network:

“We are sending an armada. Very powerful. We have submarines. Very powerful. Far more powerful than the aircraft carrier. That I can tell you.”

Note Japan is also now in the mix having agreed to join US operations in the Korean peninsula. "Japan wants to dispatch several destroyers as the Carl Vinson enters the East China Sea," sources told Reuters.

The North Korean response will be important.

“Markets have been on added alert amid speculation that North Korea may conduct its sixth nuclear test or launch another missile to mark 15 April, the birthday of its deceased leader Kim Il Sung,” says Sue Trinh, an economist with RBC Capital Markets in Hong Kong.

Watch Tillerson in Russia: Easing Tensions Could = a Softer Pound

We will also be watching the visit of US Secretary of State Rex Tillerson to Moscow for signs of escalation in the US-Russia standoff over Syria.

Tillerson is meeting his Russian counterpart Sergey Lavrov and the outcome will be important in the story's evolution.

Tensions between the two military super-powers rose after Donald Trump launched cruise missile strikes on a Syrian airbase last week; a move that appears to have threatened Russia who have a heavy involvement in Syria.

As Tillerson began his meetings in Moscow on Wednesday, one journalist covering the event notes the question was not so much whether he could reach an agreement on Syria, but whether he could start any sort of dialogue at all.

Indeed, Putin’s spokesman Dmitry Peskov said on Tuesday that a meeting with Tillerson was not on Vladimir Putin’s schedule “for now”, and the US embassy said it had no information about a potential meeting.

Putin would probably meet with Tillerson only if the sit-down with Lavrov were relatively cordial and productive, Russian analysts told the Guardian.

So, we would see a Putin-Tillerson meeting as being positive for market sentiment as it would be a signal that tensions might be settling.

Furthermore, Trump has reiterated the US has no further plans there and is "not going into" that country's civil war.

On Tuesday his defence secretary made clear the priority remained the defeat of the Islamic State jihadist group. "Our military policy in Syria has not changed," Jim Mattis said.

Should tensions ease we would expect it to be a negative for Sterling which now appears to be favoured when traders are nervous.

"Maybe North Korea and Russia-focused political tensions will blow over," says Kit Juckes at Societe Generale in London. "Watch, wait, and prepare."

Geopolitics to Fade in Importance

"Safe-haven demand is likely to fade over time," says Andrew Kenningham at Capital Economics in London. "On the whole we think financial markets are right not to have reacted too strongly to the recent revival of geopolitical tensions."

Kenningham points out that by comparison to previous bouts of global tension what we are witnessing is actually quite benign.

The increases in the price of gold and in the yen are small in comparison to the falls which followed the US election and are smaller than the moves after some previous crises.

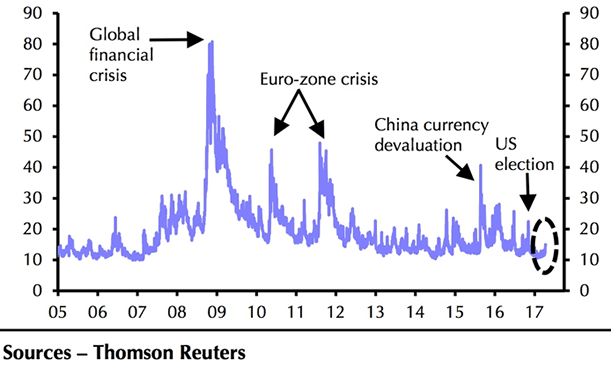

And at around 15, the VIX remains well below its long-run average, and below the levels it reached during previous periods of heightened tension.

“Of course, we will continue watching these geopolitical developments closely. But the upshot is that the outlook for safe-haven assets will probably depend more on economics than on politics,” says Kenningham.

And on the economic from the signs are not too good for Sterling with all major data releases of late pointing to a slowdown in UK economic growth.

This slowdown is only likely to become more entrenched as the UK enters into tense Brexit negotiations with Europe.