The British Pound is Significantly Undervalued says Deutsche Bank

- Pound to Euro exchange rate today: 1.1683

- Pound to Dollar exchange rate today: 1.2363

Analysts at Deutsche Bank have run the figures and have concluded Pound Sterling to be one of the world’s most undervalued currencies as we head into 2017.

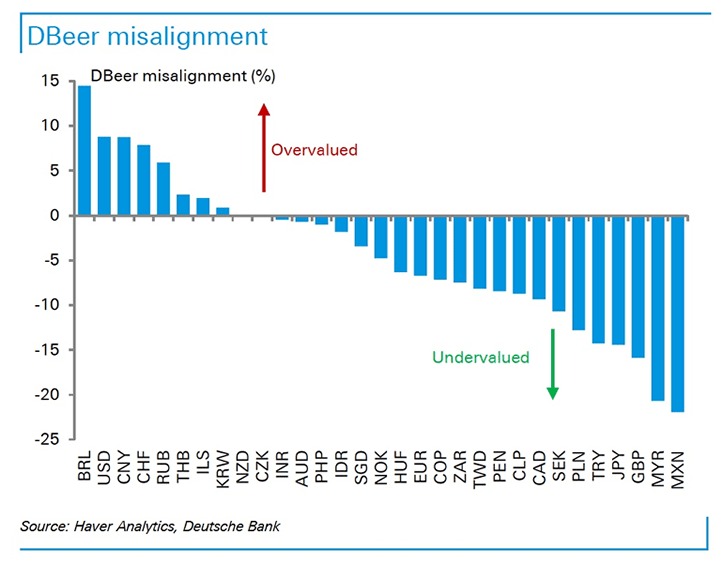

Of 31 currencies analysed by the investment bank, the Pound is the third cheapest based on a DBeer valuation.

The DBeer model is Deutsche Bank’s own version of the BEER model (Behavioural Equilibrium Exchange Rate) which is a well-used method of calculating valuations amongst economists.

The model essentially attempts to gauge whether a currency is over- or under-valued in relation to its economy.

Interestingly, for those looking for a potential trade spat between Donald Trump and China, the Chinese Yuan is now one of the world's most overvalued currencies.

As we note here, this corners Trump into having to change the goal posts when it comes to defining currency manipulators.

An undervaluation on this count would fit with the observation that Sterling fell ~15% in 2016 despite the UK economy being the fastest growing G10 nation for the year.

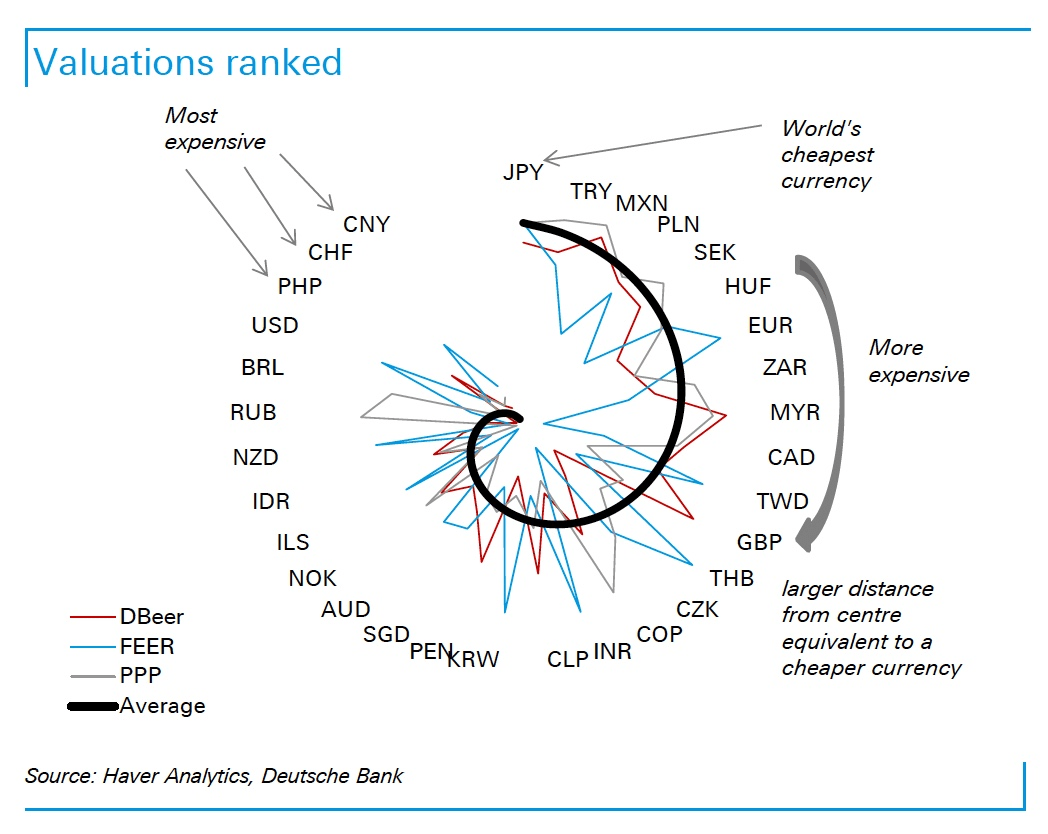

Overall, when other forms of measurements are included, the currency is the 12th most undervalued:

For those with a long-term view to the currency suggestions that it is undervalued could imply the need for a sustained recovery over coming months.

Although a currency can be considered undervalued there is no saying how long it will take to get back to fair-value, therefore we are offered little by way of forecasting ability.

Indeed, a currency can stay undervalued for years.

Commenting on the finding is Deutsche Bank’s Gautam Kalani based in London:

“Our preferred Behavioral Equilibrium Exchange Rate model (DBeer) suggests that the December exchange rate is significantly overvalued (in TWI terms) for CNY and BRL in EM. On the other hand, many Emerging Market currencies have undershot their DBeer equilibrium values, with MYR, TWD, PLN, TRY, HUF, ZAR, CLP, PEN, COP and MXN all significantly undervalued.

“In G10, CHF and USD are overvalued while GBP, JPY, CAD, EUR and SEK are undervalued.”

Pound to get Cheaper as Brexit Negotiations Approach

Sterling has staged a welcome recovery since the October rows were established; indeed the currency was the best performer in the G10 complex following Donald Trump's election victory.

The recovery took place in something of a vacuum of substantive news concerning Brexit.

Yes there has been a lingering debate on hard- vs soft-Brexit, but no details have been forthcoming.

This will change soon - the triggering of Article 50 is expected to take place in March and this should open the door to more substantive Brexit-orientated issues for markets to fix on.

"We believe the broader risks to GBP continue to lie to the downside – at least until the tail-risk of a ‘messy divorce’ has been taken off the table," says Viraj Patel at ING in London.

With the UK government looking to keep their negotiating cards close to their chest post the triggering of Article 50 Patel suspects the guessing game in markets may continue for a bit longer.

"GBP is likely to bear the brunt of this lack of political transparency, while further uncertainty over the UK’s eventual degree of access to the EU single market could see the emergence of new unaccounted risks," says Patel.

Yet, what if businesses and sentiment responds positively to a steady flow of details concerning Brexit?

"As for those who expect that the economy will suffer when the details of the divorce with the European Union are revealed, their logic does not work. It is the uncertainty of what lies ahead that should depress the economy," says Ashoka Mody, Professor of International Economic Policy at Princeton University in an op-ed piece for the Independent.

"Once details become clearer, businesses will adapt. The fact that six months after the decision, the economy is doing so well is a judgement that Brexit could deliver a net economic dividend," says Mody.

This could well support Sterling and propel the currency back to fairer valuations.