Pound Slumps as Post-Brexit Vote Flash PMI Show a Slump in Economic Activity

The GBP/EUR pair declined on Friday after Manufacturing and Services PMI for both the UK and Eurozone, were released and the UK data underperformed.

Analysts, economists, policymakers and traders gained their first significant insight into how well the UK and Eurozone economies are bearing up in the aftermath of Brexit today after major economic data for July was published.

Manufacturing and Services PMI's for both the UK and Eurozone were published this morning, and whilst the Eurozone data came out marginally better than had been expected, the UK data was more mixed, with Manufacturing down - but not as badly as expected - but Services showing a much deeper-than-anticipated contraction.

Analysts had been expecting UK Manufacturing PMI in July to fall to 47.5 from 52.1 previously, however, although it fell, it faired better than expected, coming out at 49.1.

Services PMI, meanwhile, came out at 47.4, when it had been forecast to fall to a lesser 48.7 from 52.3 previously.

Chris Williamson, Chief Economist at Markit, who produce the survey, said:

"July saw a dramatic deterioration in the economy, with business activity slumping at the fastest rate since the height of the global financial crisis in

early - 2009.

“The downturn, whether manifesting itself in order book cancellations, a lack of new orders or the postponement or halting of projects, was most

commonly attributed in one way or another to ‘Brexit’

“The one ray of light was an improvement in manufacturing export growth to the best for two years as the weak pound helped drive overseas

sales, though producers also suffered the flip - side of a weak currency as import prices spiked higher."

Eurozone data holds up suprisingly well

In the Eurozone, Manufacturing PMI came out at 51.9 from 52.8, which was a basis point below the 52.0 expected.

Eurozone Services fell only a single basis point to 52.7 from 52.8 previously, when a steeper drop to 52.0 had been forecast.

The data led to a rise in GBP/EUR following the release of the Eurozone data and then a sell-off of a cent from 1.2045 to 1.1945 after the release of the UK data.

Markit's Williamson commented that:

"The eurozone economy showed surprising resilience in the face of the UK’s vote to leave the EU and another terrorist attack in France.

“The overall rate of economic growth is largely unchanged, suggesting GDP is growing at a sluggish but reasonably steady annual rate of

around 1.5%."

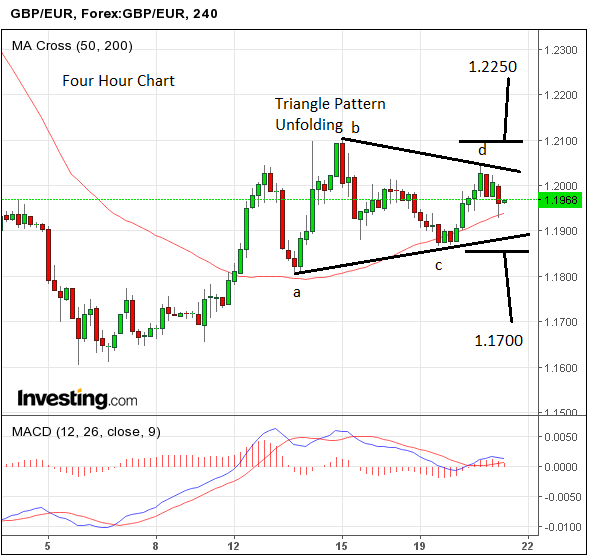

Triangle chart pattern still intact

Despite the minor volatility following the releases, the triangle pattern on the GBP/EUR chart remained intact.

It has now completed the minimum number of constituent waves (5), with a,b,c,d and e all finished.

It is therefore ripe to breakout in one direction or another.

A move above the 1.2100 level would probably confirm an extension up to 1.2250.

Likewise, a break below 1.1850 would confirm a move down to a target at 1.1700.

Targets are generated by extrapolating between 61.8% and 100% of the height of the triangle at its tallest point up or down from the point of the break.

Euro climbs after Draghi underlines the resilience of financial markets

The euro rose as ECB Presidient Mario Draghi read out the governing council’s opening statement on Thursday, with GBP/EUR falling from 1.1970 to 1.1940 (at the time of writing), as the single currency outperformed sterling.

The euro especially gained after Mario Draghi said that financial markets had, “weathered the spike,” caused by Brexit, “with encouraging resilience. “

This was in contrast to the pessimistic view expected by most market analysts, who thought Draghi and the ECB would paint a gloomier picture.

Draghi further added that due to the policies of the ECB, and the reform and recapitalization of euro-zone banks, “market stresses were contained”

He did not dismiss the possibility of using further stimulus to help support the region should the impact of Brexit require it, however, he played for time:

“Over the coming months when we have more information including new staff projections,” we will decide.

Added that, “if warranted to act the governing council will use all the instruments available within its mandate.”

The ECB highlighted how bank lending was continuing to improve in the region, with loans to non-financial institutions rising by 1.4% in May compared to 1.2% in April.

Loans to households rose by 1.6% in May - the same as April.

Draghi was positive about Eurozone banks despite the hit from Brexit, saying, “the problem now is weak profitability not solvency.”

Latest Pound/Euro Exchange Rates

| Live: 1.1499▲ -0.01%12 Month Best:1.2133 |

*Your Bank's Retail Rate

| 1.1108 - 1.1154 |

**Independent Specialist | 1.1338 - 1.1384 Find out why this is a better rate |

* Bank rates according to latest IMTI data.

** RationalFX dealing desk quotation.