Bank of England Hikes Again, Pound Sterling Softer against Euro and Dollar in Response

- Written by: Gary Howes

Image © Adobe Stock

The British Pound sold off in the wake of the Bank of England's decision to hike interest rates by 50 basis points, thereby maintaining what is becoming a standard response in the current cycle.

The decline in Sterling could suggest that the initial market assumption is that this is a 'dovish' hike.

But Pound Sterling Live has covered a growing body of research that suggests the reaction function has flipped and it is now likely that 'dovish' hikes are supportive of Sterling and 'hawkish' hikes are consistent with weakness.

Indeed, a closer inspection of the statement and minutes suggests this was a 'hawkish' hike.

The Bank raised interest rates by 50 basis points to 3.5%, in line with analyst expectations. Crucially, however, it also looks set to raise them further over the coming months as policymakers remain concerned that inflation will remain elevated above the 2.0% target without further action.

The Monetary Policy Committee (MPC) voted 6-3 for the move, with two members favouring an unchanged level and one wanting a 75bp move.

The split was therefore not consistent with an imminent slowdown in the pace of hikes.

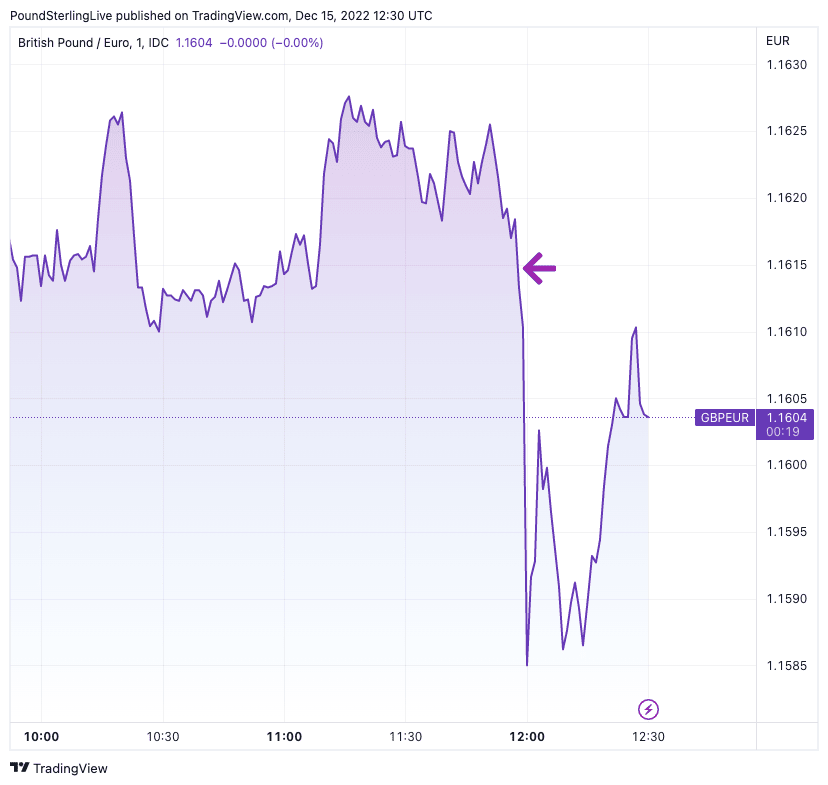

The Pound to Euro exchange rate retreated to below 1.16 following the decision, and the Pound to Dollar was lower by 0.8% on the day at 1.2308.

Above: GBP/EUR showing the initial reaction to the BoE decision.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes

The Bank's statement appeared to err on the 'hawkish' side as policymakers noted the labour market remains tight and was therefore consistent with ongoing domestically generated inflationary pressures.

"The labour market remains tight and there has been evidence of inflationary pressures in domestic prices and wages that could indicate greater persistence and thus justifies a further forceful monetary policy response," read the statement.

Adding to the 'hawkish' guidance was the removal of the explicit push-back against market expectations contained in the November report.

December's key paragraph read:

The majority of the Committee judges that, should the economy evolve broadly in line with the November Monetary Policy Report projections, further increases in Bank Rate may be required for a sustainable return of inflation to target.

November's read:

The majority of the Committee judges that, should the economy evolve broadly in line with the latest Monetary Policy Report projections, further increases in Bank Rate may be required for a sustainable return of inflation to target, albeit to a peak lower than priced into financial markets.

The development could therefore be interpreted with a tacit approval of the market's current expectations for Bank Rate to peak at 4.5% in 2023.

"There’s plenty of smart money out there that thinks the most likely scenario is that rates are higher for longer. That means a deeper recession next year that could blow into 2024," says Samuel Fuller, Director of Financial Markets Online.

"The market is now signalling that inflation is proving too persistent to provide a soft landing. That’s going to have ramifications for the jobs market as the cost of borrowing for consumers and businesses climbs even higher," he adds.

This was a Bank of England decision that was relatively devoid of surprises and won't materially shake the investor community's expectations regarding UK monetary policy, therefore its direct impact on the Pound could prove relatively short-lived.

This will allow the UK currency to revert to taking a cue from global developments, and so far in the final quarter of 2022 they have been supportive.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes