Pound Sterling Hits 3-Month Best against Dollar, Recovers back above 1.12 against Euro with Key Fed Update Likely to Set the Tone

- U.S. Fed is today's key event for GBP pairs

- Failure to open schools to dent UK economy

- But Bank of America report UK economy is opening up again

Achieve up to 3-5% more currency for your money transfers. Beat your bank's rate by using a specialist FX provider: find out how.

The British Pound has hit a new three-month best against the U.S. Dollar in mid-week trade thanks to a recovery in investor sentiment, with a recovery also being seen against the Euro that takes it back above 1.12.

Today's policy event at the Federal Reserve - the central bank of the United States - will likely impact how the British Pound trades over coming hours and days, with foreign exchange investors likely to boost the value of the Pound if the Fed supports the ongoing multi-week recovery in global financial markets.

The Pound has once again become more reactive to broader investor sentiment now that EU and UK trade negotiators have committed to effectively negotiate right through until year-end, meaning the fear of a disruptive Brexit that concerned markets in May has dissipated for now.

With Brexit anxieties lifted, the Pound on Monday found itself rallying against the Euro, Dollar and Yen in tandem with global stock markets and equity prices, but on Tuesday a sharp reversal in the fortunes of global markets meant these gains were unwound.

Wednesday sees some recovery in equity markets and the market yo-yo is again aiding Sterling higher:

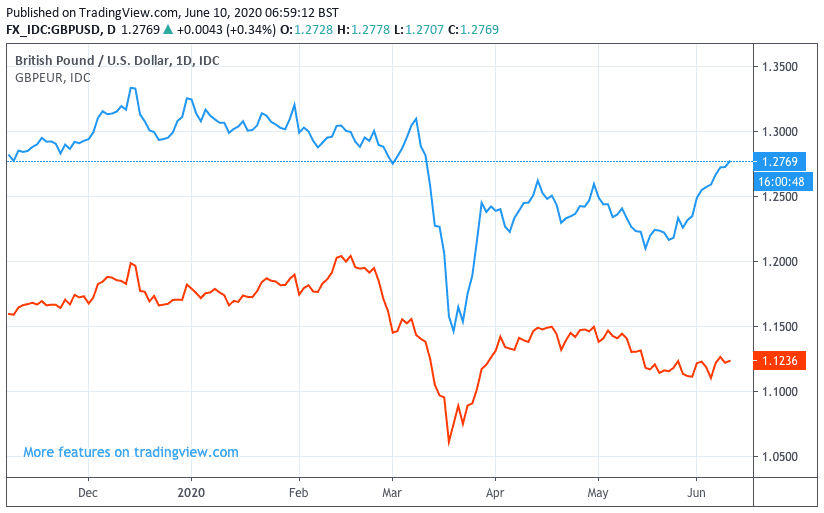

The Pound-to-Euro exchange rate is at 1.1235, having been as low as 1.1186 earlier in the week, meanwhile the Pound-to-Dollar exchange rate is at 1.2758, having been as low as 1.2627 earlier in the week.

Above: GBP/USD (blue line) and GBP/EUR (orange line) at daily intervals.

"The U.S. Dollar has slipped again overnight as the Euro moved above 1.1360 and Sterling rose above 1.2770, its highest level since early March. Meanwhile, government bond yields in both the US and the UK were little changed as markets wait for today’s Fed announcement," says Rhys Herbert, Senior Economist at Lloyds Bank.

The meeting of the Federal Reserve which should ultimately influence whether markets, and by extension the Pound, can maintain winning ways.

"With interest rates already pinned to 0.0% and the Fed steadfastly refusing to entertain negative rates, traders should get accustomed to the central bank relying on non-traditional monetary policy tools for the foreseeable future," says Matt Weller, Global Head of Market Research at GAIN Capital.

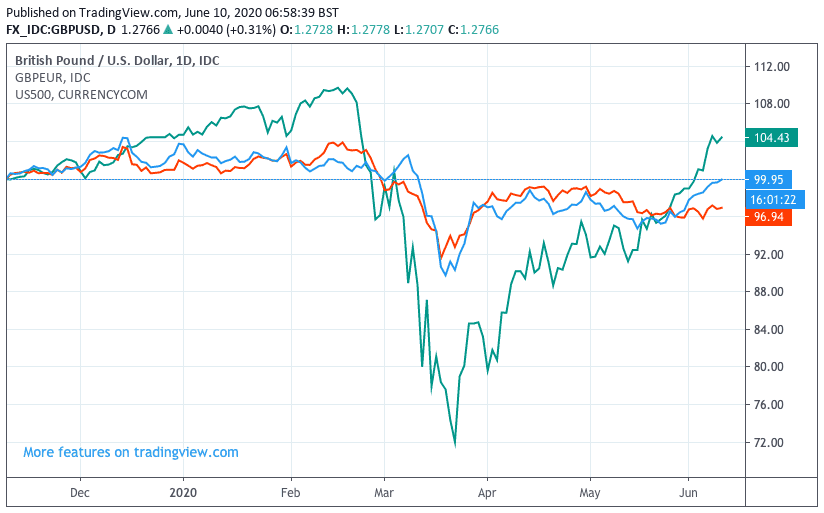

The stock market matters for GBP. Above we can see the S&P 500 (green line) which represents global investor appetite. We can see similar patterns of movement in GBP/EUR (orange) and GBP/USD (blue).

Weller says markets will be watching the Fed for their latest economic projections, potential for Yield Curve Control (YCC) and any hints about reining in easing measures.

It is that latter that could be the biggest threat to the market rally, and by extensions Sterling's performance. Markets and commodity prices have rallied sharply since March thanks to the huge amount of support provided by the Fed, with investors believing the central bank has done enough to prop up the economy during the lockdown which in turn allows for a swift recovery.

Should any hints of that support being withdrawn be forthcoming, markets could turn sharply lower.

However, the Fed will be well aware how their messaging might trip up the recovery, therefore we expect them to play a steady hand that ultimately keeps asset prices supportive, which is in turn Sterling-positive.

From a domestic perspective, the inability to reopen schools in the UK is likely to weigh on the economy according to one analyst we follow, and for a foreign exchange market that is increasingly concerned with the relative speed economies exit lockdown, this could weigh on the Pound.

"The government's decision to shelve plans to reopen primary schools fully later this month will ensure that GDP remains greatly below its pre-coronavirus level throughout the summer months," says Samuel Tombs, Chief UK Economist at Pantheon Macroeconomics.

The government is "not able to welcome all primary children back for a full month before the summer," Gavin Williamson, the Education Secretary told parliament on Tuesday.

Secondary school students would meanwhile likely be back at school from September said Williamson.

The Government has in effect been forced to row back on plans to get all primary school students back in classrooms before the summer holidays, which will have significant implications for the pace at which the UK economy can recover.

Tombs explains that school closures damage GDP directly, "by lowering output in the education sector, and indirectly, by preventing parents with young children from going to work. Both impacts are considerable."

Pantheon Macroeconomics data modelling suggests that school closures subtracted nearly 8% from GDP in April and May.

"This massive shock to the economy no longer is set to fade much this month," says Tombs. We view this finding as being a potentially significant hinderance to Sterling's recovery potential.

Furthermore, an apparent resistance to sending children back to school is a concern, at least from an economics perspective. Department for Education data shows attendance across all schools had risen by only 7% of the usual figure by June 4. Attendance could have risen to at least 20%, if all eligible pupils had returned argues Tombs.

We are seeing economies across the world rapidly emerge from covid-19 lockdowns - such as the entire Eurozone, New Zealand, Canada and the U.S. - and with the UK looking to be a laggard, there is the prospect of underperformance in Sterling.

But while the UK looks set to limp out of lockdown, we can report there is evidence that growth is nevertheless returning.

Bank of America Securities have updated their real-time proprietary UK consumer confidence survey with results showing people gradually returning to work as lockdown conditions are eased.

Converting the findings of the model into growth forecasts, BofA Securities say the economy grew about 3.5% in May and may be on track for 6-7% in June.

While the return to growth will be welcomed, BofA Securities emphasise growth rates are modest relative to the size of the prior downturn.

Indeed, BofA Securities hold a UK growth forecast for 2020 of -12.9%, which assumes the economy now needs to grow by 4% & 7% month-on-month in May and June for such an outcome to be attained. When the views of Pantheon Macroeconomics are considered, it is questionable whether the UK economy will be able to achieve these targets.