Traders Run Scared of Pound Sterling Amidst 'no Deal' 'Hedging Frenzy'

Image © Andrey Popov, Adobe Stock

Reports of a "GBP hedging frenzy" confirm markets are growing more nervous of the prospects of a 'no deal' Brexit transpiring.

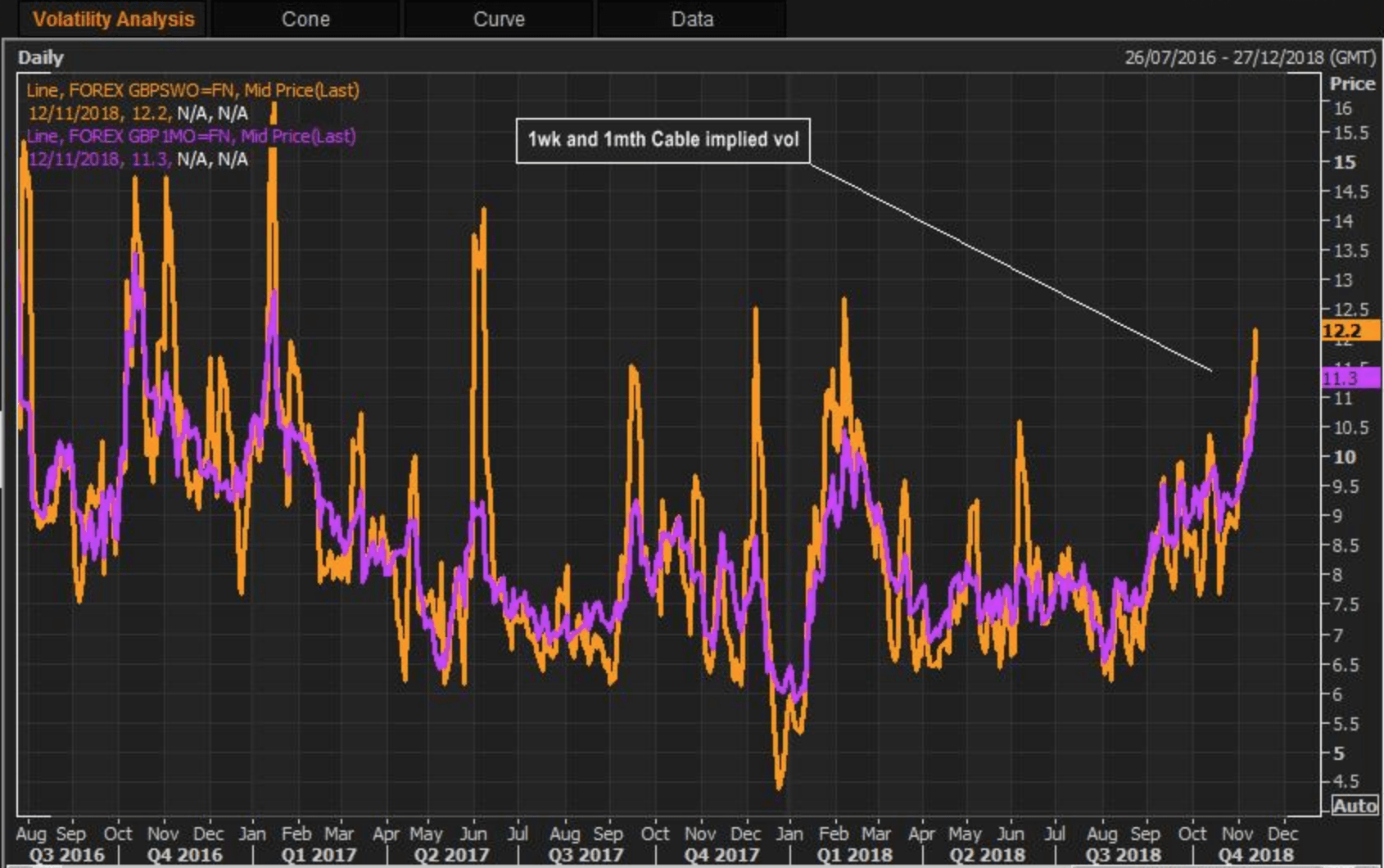

Data from the foreign exchange options market place confirm investors and traders of all types are eagerly buying up protection in case the Pound suffers a notable slide in value over coming days and weeks.

"Brexit impasse fuels GBP hedging frenzy," says analyst Richard Pace with the Thomson Reuters currency desk.

Data from Reuters shows a spike in demand for options that would protect against wild swings in a currency in the event of unwelcome news concerning Brexit negotiations.

Image courtesy of Reuters.

"GBP/USD options allow holders to capture spot moves in either direction, so no surprise to see implied vol premiums spike higher, as dealers flock to options to cover heightened expectations of GBP volatility over coming sessions," says Pace.

An example of how this might work in practical terms would be an importer buying an option that pays out a profit in the event of Sterling suffering a big slump in four weeks from now.

That profit effectively compensates for the fall in the real, spot exchange rate and therefore allows them to continue importing goods at a more-or-less unchanged exchange rate.

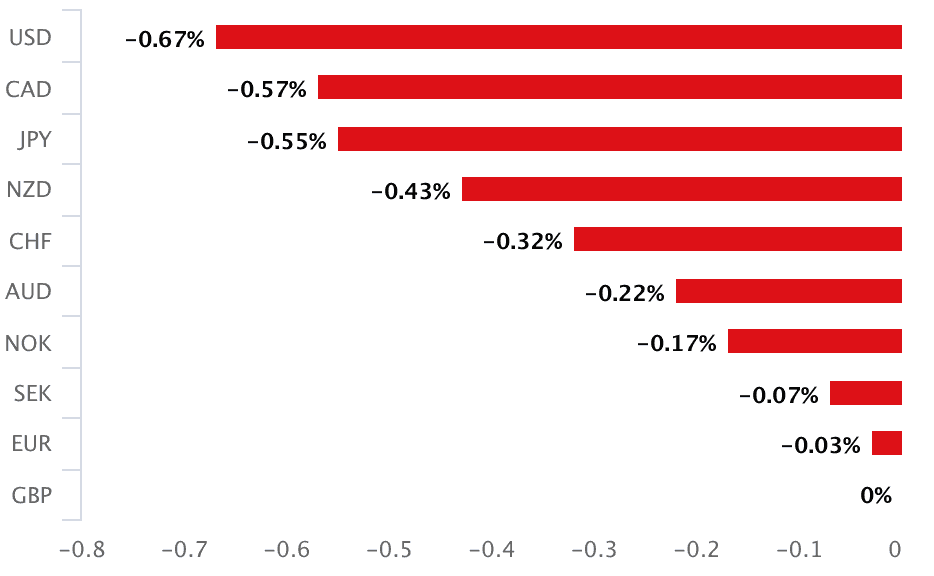

The demand for protection against wild swings in Sterling comes as the currency suffers a poor start to the new week owing to headlines that suggest Brexit negotiations remain in deadlock and signs that the deal in its current form would not be voted through parliament.

Above: The Pound's performance on Monday, November 12.

"The Brexit process, which appeared to be going well early last week, now appears to have reached an impasse, with plenty of obstacles to make a deal ever less likely as the March 29 exit date approaches," says Pace.

"Theresa May’s Brexit deal crashes as E.U. 'turns off life support'" reports the Sunday Times.

"This weekend senior E.U. officials sent shockwaves through No. 10 by rejecting May’s plan, sparking fears that negotiations have broken down days before 'no-deal' preparations costing billions need to be implemented," says Caroline Wheeler, Deputy Political Editor at the Sunday Times.

May wants a U.K.-wide backstop to guarantee no hard border is ever erected on the island of Ireland, she also wants an independent mechanism that would allow one party to exit any backstop; the E.U. apparently won't give her one.

The current Brexit backstop proposed by May, "would lock the U.K. into a relationship with the E.U. which the U.K. could not escape except with the E.U.’s permission," says Stewart Jackson, formerly the Special Advisor & Chief of Staff to David Davis when he was the U.K.'s Brexit chief.

It appears both Leave- and Remain-leaning members of the Conservative party won't accept the current plans based on a potential outcome that leaves the U.K. in a permanent limbo.

"Growing noise about a UK general election and a second Brexit referendum add to the potential for GBP volatility. Shorter-dated implied volatilities have seen another move higher since Friday, with the benchmark one-month contract now trading at its highest level since January 2017," says Pace.

Volatility, both up and down, is therefore the only guarantee we can make on Sterling over coming days.

Advertisement

Bank-beating GBP exchange rates: Get up to 5% more foreign exchange by using a specialist provider to get closer to the real market rate and avoid the gaping spreads charged by your bank when providing currency. Learn more here