EUR/USD a Buy on Dips say Morgan Stanley

The Euro to Dollar exchange rate (EUR/USD) is likely to weaken near-term before embarking on a sustained rise suggest strategists at global investment bank Morgan Stanley.

Initially the Euro will weaken versus the Dollar in what amounts to a short-term dip.

“We expect the USD to rally modestly against EUR as the market reprices its Fed expectations,” confirm strategists in a briefing to clients dated June 23.

But then the Euro will strengthen due to improving economic conditions in the Eurozone.

USD to Strengthen Near-Term

Initially the Dollar will rise versus the Euro because markets are overly pessimistic about the US and too critical of the Federal Reserve’s interst rate hiking intentions.

In contrast to the ‘market’ consensus Morgan Stanley think that the US central bank will continue to raise interest rates at the current rate.

Higher interest rates would strengthen the Dollar because they attract more foreign capital, so if MS are right and the market is wrong, the Dollar will adjust higher.

The Federal Reserve is itself of the opinion that interest rates will rise quicker than markets expect.

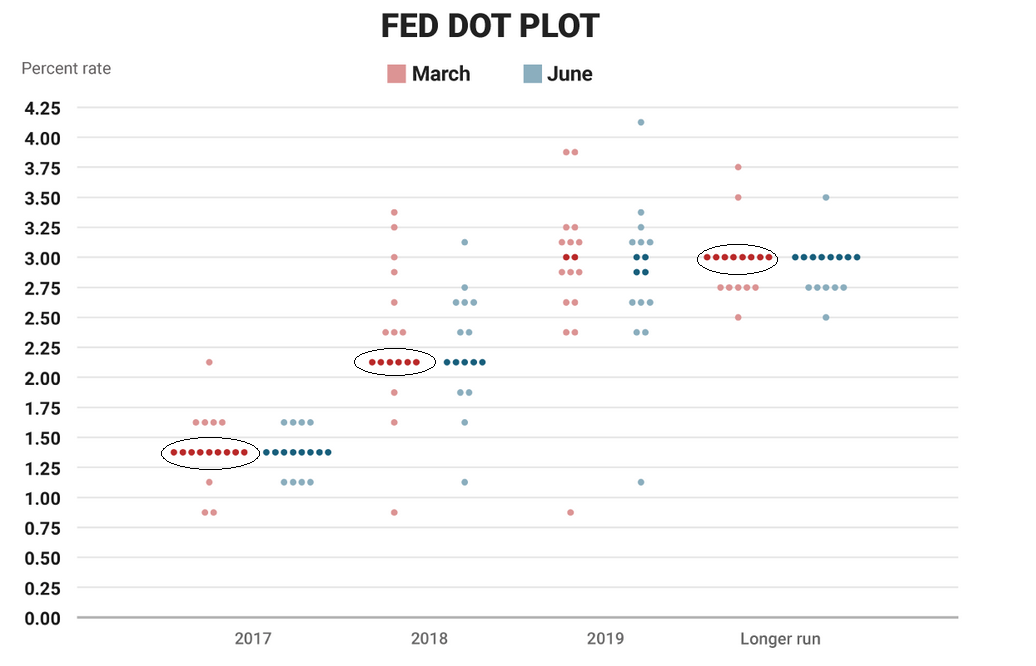

Fed member’s opinions about the course of interest rates are represented graphically in the Fed’s ‘Dot Plot’ diagram.

Each member of the committee is represented by a dot which reflects their expectations about future interest rates.

The Dot Plot after the June meeting shows the majority of dots between the 1.25 and 1.50% level (circled) indicating that the majority of members think interest rates will be at that level by the end of 2017, which is 0.25% higher than their current 1.00-1.25% level.

Some expect them to be even higher, with a total of 14 members expecting them to be 1.25-1.50% or higher by the end of the year, and only 3 expecting them to be at the same level or lower.

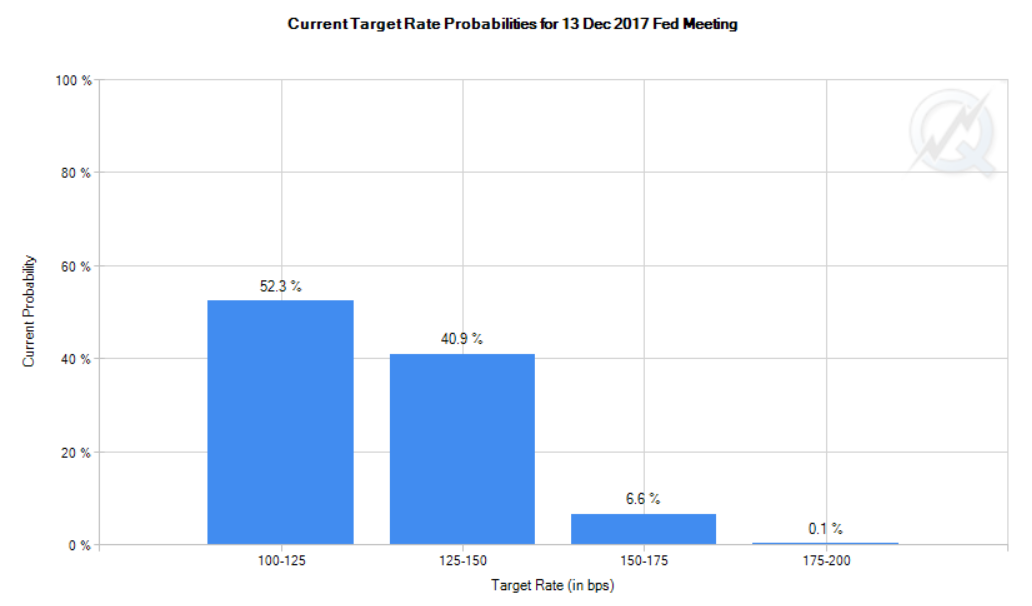

The market, however, is only a showing a 47.5% probability of one or more interest rate rises by the end of 2017.

This is reflected by the Chicago Mercantile Exchange’s (CME’s) Fed’s Funds Futures probability tool, which shows the probability of rate hikes based on demand for interest rate derivatives.

The CME chart below shows the probabilities for interest rates being at certain levels in the future.

It is currently showing that there is a 40.9% chance of one hike and 6.6% of more than one hike by the end of the year.

This gives a total 47.5% chance of one or more hikes, versus the Fed’s Dot Plot which shows 14 out of 17 Fed members expecting interest rates to be higher by year end.

Morgan Stanley see this divergence between what the Fed and what the market expects as likely to ‘narrow’ as the market adjusts its probability higher, and closer to the Fed’s more hawkish outlook.

This in turn will be positive for the Dollar over the short-term.

“Bottom Line: The markets appear to be interpreting the Fed's hawkishness as a policy mistake, as in December2015. We disagree with this view as China is now less of a destabilizing risk, USD liquidity conditions have improved and the global economy is on a stronger footing,” says Morgan Stanley's chief FX strategist Hans Redeker.

Euro to Recover and Endure Substantial Rally

The Dollar’s readjustment higher due to changing market perception of Fed policy will not however translate into a sustainable trend.

Instead Morgan Stanley anticipate the Euro will start to rise versus the Dollar, and make new highs, reaching 1.18 EUR/USD eventually, from a current 1.11.

This makes the coming dip on Dollar strength the perfect buying opportunity for those wishing to get long for the Euro’s rally.

“We expect the USD to rally modestly against EUR as the market reprices its Fed expectations. We would use that rally in the USD to sell vs the EUR,” says Redeker, “we would buy dips to1.1030, with the next resistance area around 1.1370.”

What will the drivers for the appreciation of the Euro be?

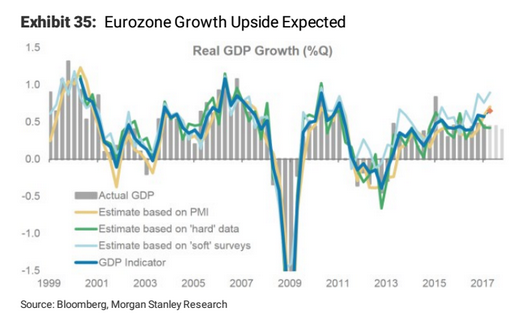

The steady economic recovery in the Eurozone will push up the Euro.

“Positive news from Portugal as Fitch upgraded the outlook from stable to positive reflects continued improvement in the periphery,” says Redeker.

The election of Emmanuelle Macron has given the European Union a new lease of life as he has reinvigorated the institution, bringing greater integration to the cause.

“There are increased signs of pro-integration pressures emerging in Europe, most recently evidenced in the better-than-expected performance of President Macron's party in the French parliamentary elections,” said Redeker.

Finally, the improved growth outlook should bring greater inflows into European equity markets thus increasing demand for the Euro via demand for its assets.

“A stronger growth environment should bring inflows into the equity market. The risk to this trade is a slowdown in equity market,” says Redeker.