Sell EUR/USD as Political Risks to Heat up Again Soon say Handlesbanken

- Written by: Gary Howes

It would be unwise for those watching foreign exchange markets to believe political risks coming out of the Eurozone have completely faded.

Ever since Emmanuel Macron won the French presidential election markets and analysts breathed a sigh of relief consigning upcoming German elections to a peripheral event.

While 2018 was meant to see Italian elections, markets were happy to put this risk on the back-burner.

However, recent shifts in the Italian political landscape have caught attention and new research by Sweden’s Handelsbanken Bank find that Italian politics are now the most pressing matter for the Euro with regards to political risks.

This has implications for the outlook of the Euro.

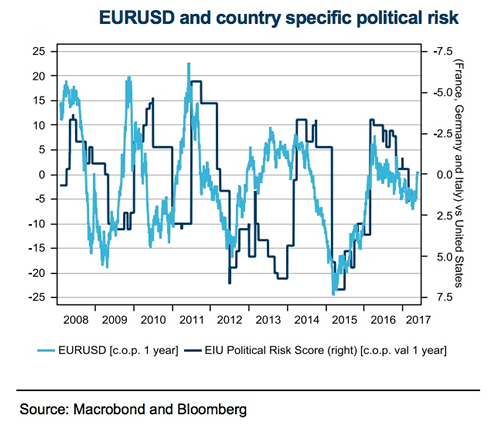

“With the risk for increased political turmoil in the eurozone over the summer, the outlook for the USD is optimistic. The strong correlation between political risk and the EURUSD favours a short position,” says Pierre Carlsson, a Strategist with Handelsbanken in Stockholm.

Since the financial crisis political risk has elevated in the eurozone, particularly over the course of the past year.

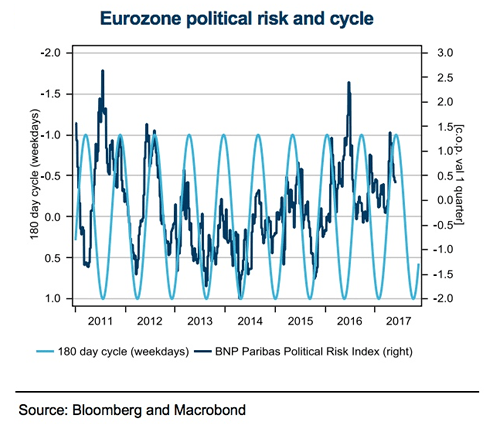

“The political risk appears to demonstrate cyclicality,” says Carlsson in a note dated June 1. “Since 2011 a six-month cycle has managed to capture, quite accurately, most of the volatility in eurozone political risk.”

Since the Brexit vote, this cycle appears to have shifted half a cycle outwards.

“What this suggests is that the political risk will rise as we near the German election in September 2017,” says Carlsson.

The analyst notes the correlation with EURUSD is relatively strong, especially during the past two years.

“If the political risk in the eurozone increases, it will lead to a weaker EURUSD, and the odds for increased political risk over the summer in the eurozone will rise,” says Carlsson.

Handelsbanken are forecasting the EUR/USD exchange rate to be at 1.05 in the third quarter of 2017 ahead of 1.07 by the year-end.

It is forecast up to 1.10 by the first quarter of 2018.

The Italian Risk Factor

The next risk-event on the horizon for foreign exchange markets appears to be the possibility of a new Italian general election being held earlier than previously expected.

The election is seen as a destabilising risk to the Eurozone and the Euro because of the popularity of the maverick 5-star movement who want to see an end to the Euro and a break from the EU.

Rumours of a snap general election were sparked after former Prime Minister Matteo Renzi joined a growing bi-partisan group calling for a ‘German-style’ reform of the voting system which would, if it was successful, put pressure on President Mattarella to dissolve parliament and hold a snap election in September 2017.

"If elections are called by the end of September, there will be renewed worries about a major eurozone country exiting the EUR," says Carlsson.

New proposals would require that a political party would need five percent of the votes to get into parliament.

Parties such as the The Brothers of Italy (BI) and The Left Party (LP) will be in danger of missing out.

This seems to be supported by Forza Italia and, surprisingly, the M5S.

"Nevertheless, the schedule to accomplish this is very tight. First of all, there are still many details to put in place before presenting the actual bill to parliament. This and the vote need to be established before the summer recess at the end of July," says Carlsson.

When in place, the government needs to be voted down in a no-confidence vote after which the President will dissolve the Parliament and call the election no sooner than 50 days later

Risks Contained for Now

Quite apart from the substantial parliamentary leg work required to push through the reforms necessary for an early election, the chances of a majority anti-EU government gaining power from such an election are relatively low, according to analysts at Credit Suisse.

This explains the so far relatively muted reaction to the news from financial markets.