Euro / Dollar Rally Forecast to Fizzle Out

The Euro to Dollar exchange rate has bounced above 1.1100 thanks to market conditions that are proving unfavourable to the US dollar.

The US Dollar is under pressure as investor sentiment remains elevated across global financial markets.

There is a sense that markets are in a good place - China continues to grow, the Japanese authorities are promising more stimulus, Brexit fears are receding and the S&P 500 has reached fresh all-time highs.

Markets want yield and they are selling Dollar's in order to achieve this.

As such the EUR/USD rate has bounced from its multi-week lows and is looking higher once again.

The EUR declined 0.8% against the USD over the course of the past week to close at 1.1051.

The pair is trading within an incredibly tight range when compared to other majors, with the obvious area of support being provided by 1.10.

There appears to be a good supply of buying interest in the Euro at this level which could well contain any weakness.

It therefore remains quite difficult to advocate for any kind of substantial game-changing weakness or strength in EUR/USD over the near-term.

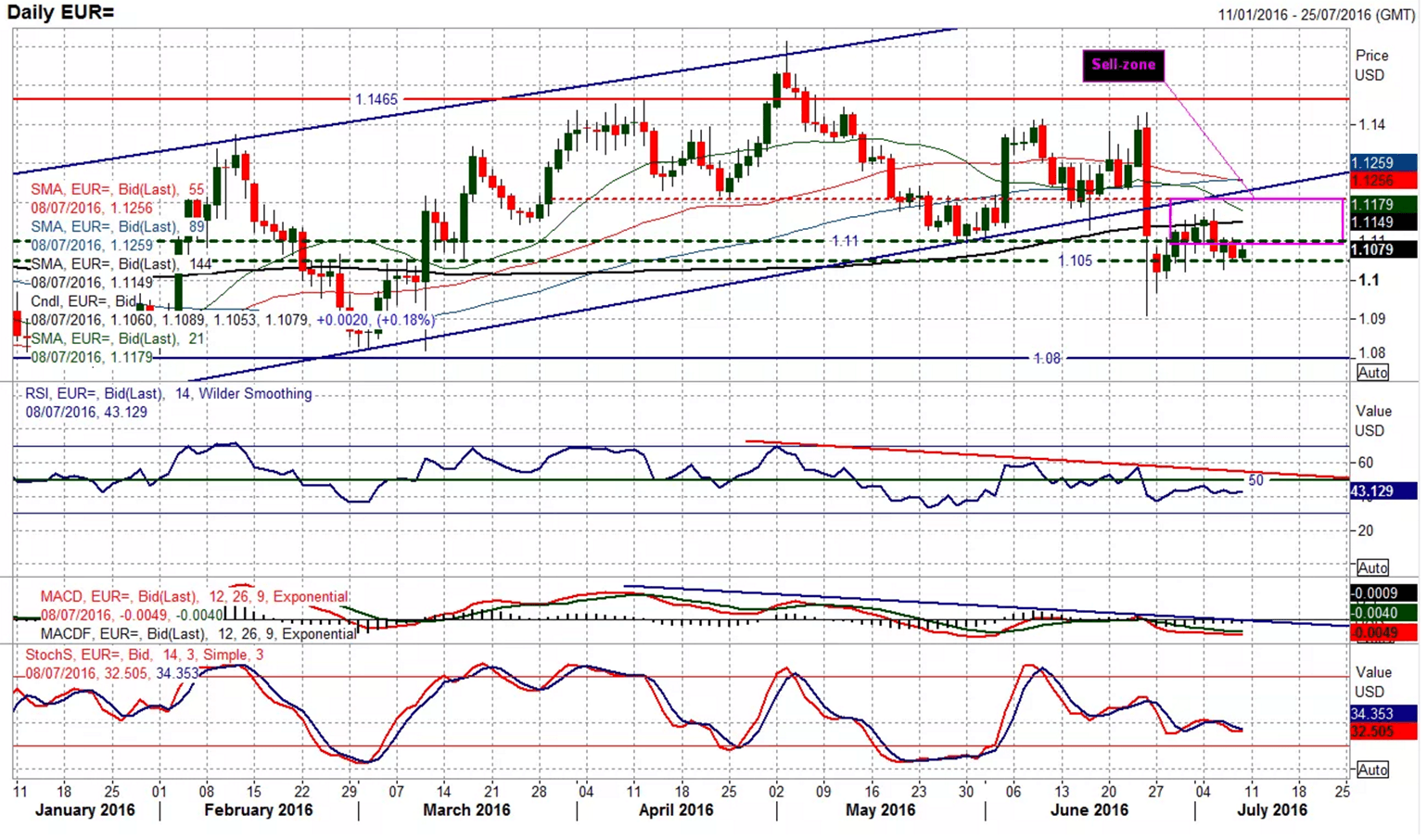

“The euro has now consistently found resistance around $1.1100 and is close to a closing breach below $1.1050 which would confirm the deterioration. The momentum indicators are correctively configured without being overly bearish, however an intraday breach of $1.1022 would suggest that the bears are really beginning to gain the upper hand," says Richard Perry at Hantec Markets.

Perry says the key resistance remains $1.1188 and he see rallies as a chance to sell for a likely eventual retest of the Brexit inspired low of $1.0909.

Furthermore, Perry reads into the hourly chart a band of near term resistance $1.1095/$1.1120 held well and will again be the initial barrier to sustained advances.

Above courtesy of Hantec Markets

The Euro remains well-supported by the Eurozone’s large current account surplus - the Eurozone exports more than it imports, the Euro therefore enjoys a strong fundamental underpinning.

The US Dollar meanwhile continues to trade hot and cold on the changing views regarding a 2016 US Federal Reserve interest rate hike.

The Fed is likely to stay on hold for a while longer, and only when markets get the sense that the Fed is turning notably more enthusiastic to further rate rises will the Dollar be able to propagate enough strength to break the EUR/USD to notably lower levels.

“For EUR to weaken, long-term capital outflows must exceed commercial EUR buying needs generated by EMU's ever-rising current account surplus. Weak balance sheets combined with low nominal bond yields and falling global inflation expectations take currencies within the current account surplus environment higher.EUR has become an anticyclical currency,” says Hans Redeker, an analyst with Morgan Stanley.

Italian Referendum Poses Biggest Political Threat to Euro’s Outlook

Analysts at Barclays have written to clients and warned them of the dangers to the outlook posed by the October referendum on constitutional Senate reform.

While there is certainly no on a scale similar to that posed by the UK referendum it still creates a binary outcome.

Barclays note:

If accepted, it could be Italy’s most significant post-war reform, overcoming a bicameral design that complicated the formation of coalition governments, often leaving Italy in a harmful political paralysis.

If rejected, it not only would maintain the current status quo and, thus, likely prevent any meaningful reforms to be implemented, but also throw the country in a leadership vacuum, as PM Renzi has threatened to step down and possibly leave politics.

“This could worsen sentiment towards Italy and the EU dramatically, especially given Italy’s still-precarious debt dynamics and ongoing banking sector turbulence. According to polls released after the government’s poor results in local elections in early June, the October referendum may not pass,” say Barclays.