Euro Forecast from says NO Parity with Dollar

Those expecting the current cycle of euro weakness to push the EUR/USD rate below 1:1 could be wrong.

There are a number of forecasts out there that see the euro dollar rate falling to, and then beyond, parity.

One such example, made by brokerage AFEX, sees 0.80 being achievable for EUR-USD.

The argument here being that the bull-trend in the USD is by no means over; trend momentum remains squarely in favour of the dollar and betting against the trend is futile.

However, Lloyds Bank reckon such predictions represent an overly pessimistic stance towards the shared currency.

Their viewpoint is similar to a forecast put out by BMO Capital and represents that portion of the industry that see the worst already having passed for the EUR.

The euro to dollar currency conversion set a decade low of 1.0463 in March 2015 ahead of a recovery to above 1.10 in early April.

All signs suggest that these two extremes will now form a sideways-focused band within which the pair will trend in the near future.

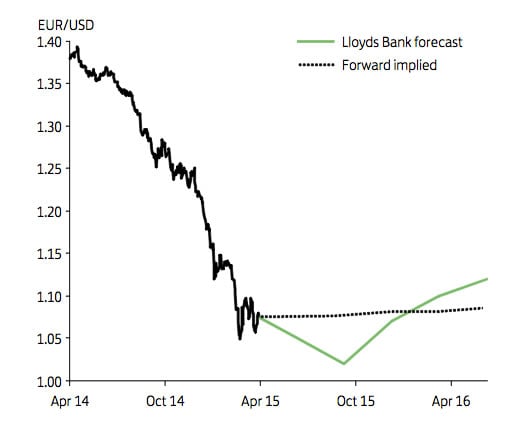

“Over the short term, we expect EUR/USD to continue to trade within a 1.04-1.10 range, with significant downside risks attached to adverse developments in Greece,” say Lloyds.

Arguably the main driver of euro dollar strength has proven to be US dollar weakness after softer US data led markets to push back the timing of the first rise in US interest rates.

Forecasting a Low of 1.02

The longer-term outlook does however remain negative for the shared currency argue Lloyds.

“While better euro zone data are likely to have been modestly supportive, concerns over Greece have intensified,” says the note to clients.

Analysts meanwhile predict US data to strengthen into the summer which will leave the door open to that much-anticipated rise in US interest rates in September.

“We expect this, combined with the ECB’s recent commitment to complete its QE programme, to pull EUR/USD down to 1.02, possibly even lower, by end Q3,” say Lloyds.

However, this represents the low in the forecast.

One factor that should underpin the EURUSD is firmer euro area data, reduced euro area political risk and higher oil prices.

Near-Term: A Ceiling on EUR Strength

In mid-week trade markets appear to be giving Athens the benefit of the doubt that it would ultimately squeak by with a deal to keep the rescue cash flowing.

“The situation remains fluid and precarious, however, which should keep in place a relatively low ceiling above the euro,” suggests Joe Manimbo at Western Union.

The euro found a marginal positive in Germany’s upgraded outlook for Europe’s top economy which it now forecasts to grow 1.8 percent this year compared to a January prediction of 1.5 percent.

Thursday data undermined the shared currency with the release of disappointing German consumer climate data.

Added to this was a weakened flash manufacturing PMI from France and an increased Spanish unemployment rate meant that the Eurozone indices’ positive open couldn’t last long this Thursday morning.

This softness feeds into the theme that there remains scope for declines in the euro v dollar exchange rate in 2015.