Euro / Dollar: Citi Forecast Further Downside "Early" in 2022

- Written by: Gary Howes

- USD tends to appreciate 2% in three months pre Fed hike

- EUR/USD to be pressured in early 2022

- But Citi cautions to "be nimble" on long-USD

© BruceG1001, reproduced under CC licensing

The Euro to Dollar exchange rate is forecast by Citi to extend lower as the Dollar rallies into the first Federal Reserve interest rate hike and the Eurozone struggles with a winter energy price crisis.

In a note to clients released a the start of the year Citi says they see EUR/USD downside "early in the year", consistent with market expectations for an interest rate rise at the Federal Reserve in little over two months from now.

"USD tends to appreciate into the first Fed hike, by 2% on average in the three months into the first hike over the last four Fed hiking cycles," says Ebrahim Rahbari, Chief G10 FX Strategist at Citi.

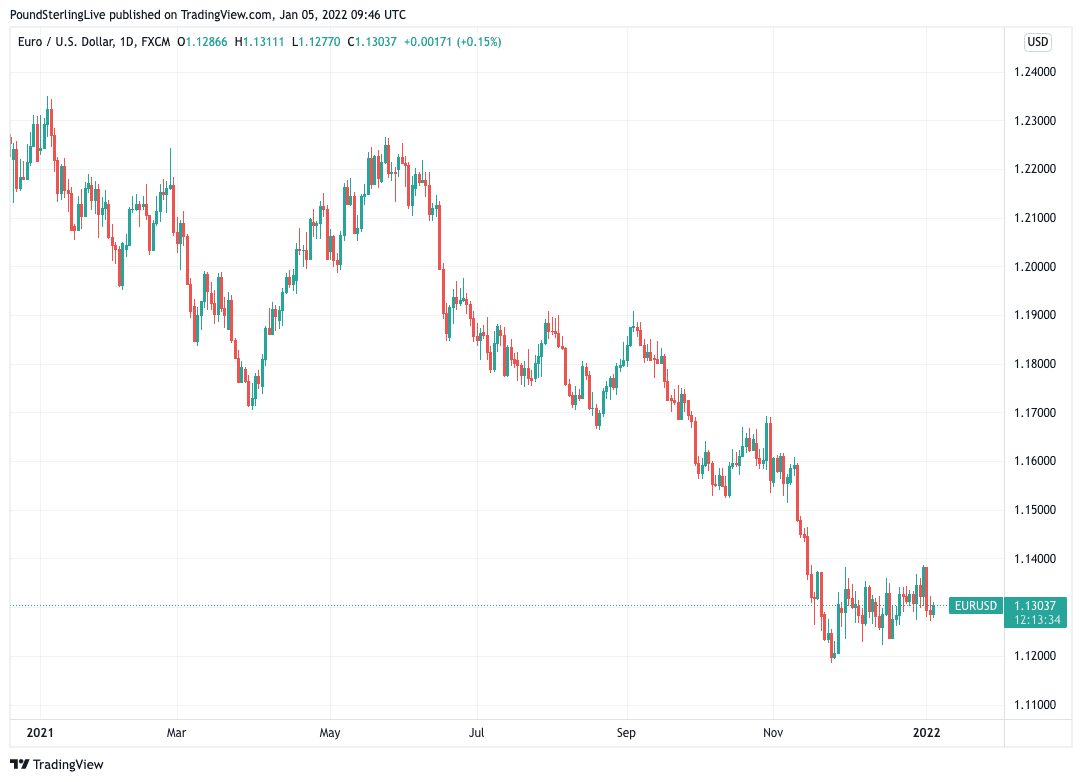

Above: Daily EUR/USD chart showing the pairs decline during 2021.

- EUR/USD reference rates at publication:

Spot: 1.1300 - High street bank rates (indicative band): 1.0909-1.0988

- Payment specialist rates (indicative band): 1.1200-1.1250

- Find out about specialist rates and service, here

- Set up an exchange rate alert, here

The initial hike is likely to be enacted at the March 15-16 meeting, according to market expectations, taking the overnight rate range up to 0.25%-0.5%.

Federal Reserve policy makers indicated in their most recent set of projections that an additional two 25 basis point hikes were likely before the end of the year, citing rising inflation and a resilient labour market.

"The Dollar has tended to appreciate and US yields risen most consistently into the first Fed rate hike rather than out of it," says Rahbari.

The Euro-Dollar rate fell in 2021 from a January high at 1.2350 to a November low of 1.1186.

The pair has since consolidated in a tight range around a pivot at 1.13.

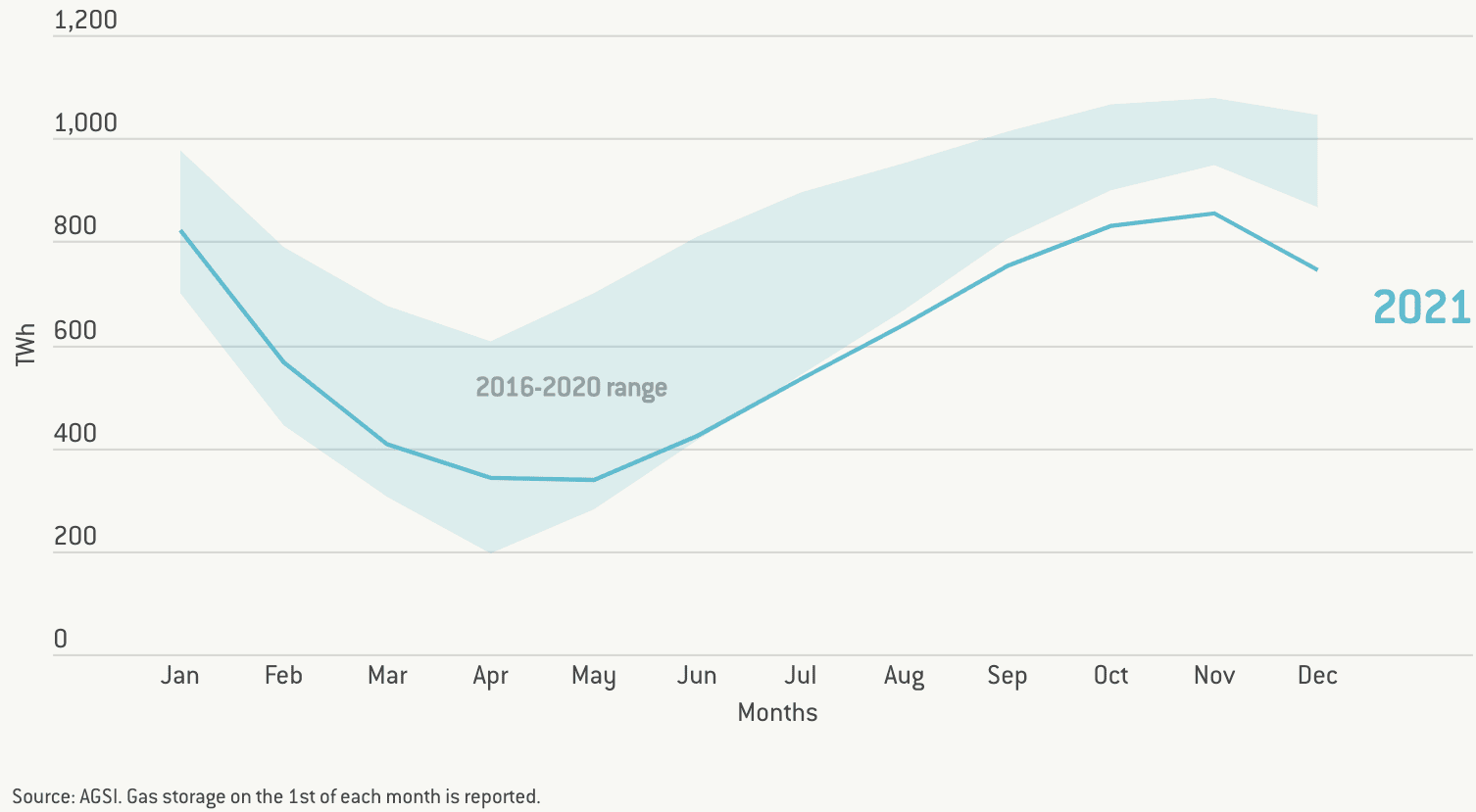

The Euro is expected by Citi to be constrained by an ongoing energy crisis that has seen prices for gas surge amidst strong demand and limited supplies from Russia and other sources.

Citi anticipates energy prices to remain volatile during wintertime in Europe.

Above: EU27 natural gas storage levels. Source: bruegel.org

Secure a retail exchange rate that is between 3-5% stronger than offered by leading banks, learn more.

Citi say their expectation for a stronger Dollar in 2021 is also built on an expectation for the Dollar to benefit from a continuation of strong U.S. growth relative to the rest of the world.

"In our base case – global growth is OK but the US has a growth advantage, and market pricing of Fed tightening advances relative to other G10 peers, USD should appreciate," says Rahbari.

The Dollar can also benefit during periods of "defensive" positioning by investors during periods of softer investor sentiment.

"We think investors will aim for moderately defensive positioning for now and the Dollar appeals as a defensive asset that offers some carry," says Rahbari.

But Citi are also cautious of "being dogmatically bullish USD".

One reason is that expectations for U.S. Dollar appreciation in 2022 has become a consensus position amongst market participants and analysts alike:

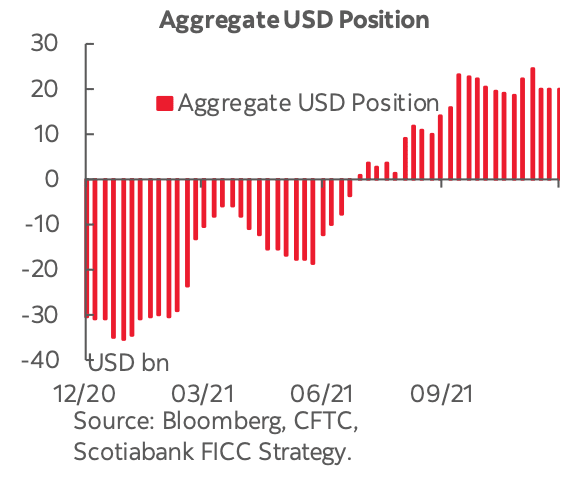

Above: The market remains positioned for further USD gains. Source and credit: Scotiabank.

"Even though positioning appears to have moderated somewhat into year-end, markets remain long the Dollar, so we do not expect investors to aim to further boost Dollar

holdings as risk-off hedges at present," says Rahbari.

"Being long Dollars appears to be a pretty consensus view among investors and

sell-side analysts," he adds.

The latest available positioning data from the CFTC shows the market continues to be 'long' on the U.S. Dollar to the tune of about $20BN.

"We note that given positioning and how much good news is priced for the US, it remains opportune to be nimble – 2022 may well be very different from 2021, but it is likely to offer many surprises nonetheless," says Rahbari.