Dollar Index's "Golden Cross" Keeps EUR/USD Bears Keen as Big Bang Job Report Looms

- Written by: James Skinner

- USD index charts flag bullish 40-60 day outlook

- Supports between 91.40 & 91.80 tipped to hold

- Significance, anticipation of July job data grows

Image © Adobe Images

The Dollar Index has entered the new month on its back foot ahead of a landmark American jobs report, although strategists at BofA Global Research have flagged a “golden cross” formation on the daily charts as a bullish technical indicator for the benchmark and a bearish omen for EUR/USD.

August and the new week have gotten underway with broad declines evident across the U.S. exchange rate complex ahead of Friday’s pivotal non-farm payrolls report, which is always a key informant of analyst, investor and trader expectations of Federal Reserve (Fed) monetary policy.

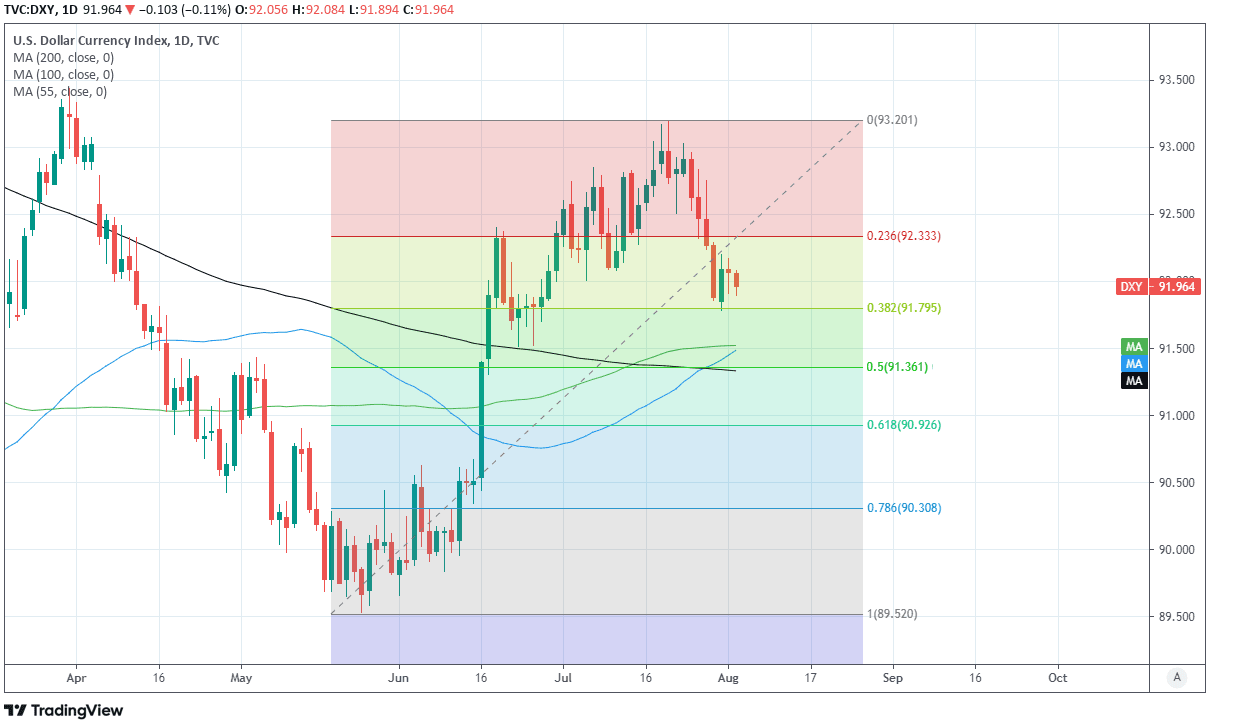

Tuesday saw the Dollar Index quoted one tenth of a percent lower, which deepened its one week decline to -0.5% and left the highly concentrated barometer of the U.S. currency close to major technical support levels that are important for perceptions of the overall trend in the benchmark.

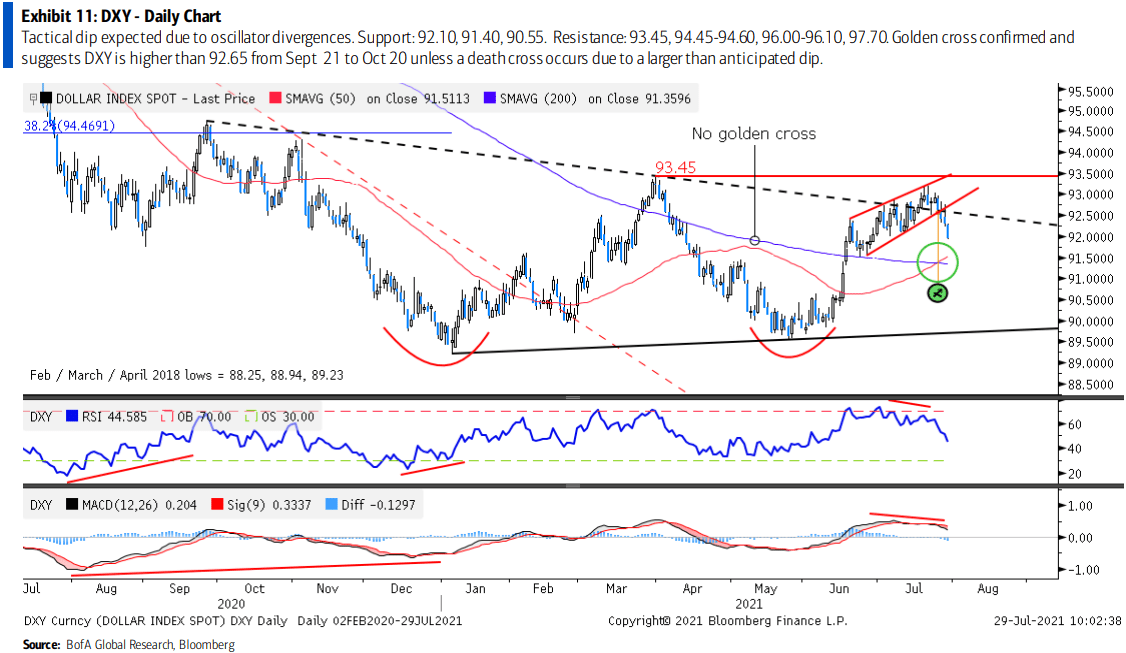

“On July 23 we explained the tactical signals suggesting a dip in the [Dollar Index] was coming due as the calendar moved into August. This dip is underway,” says Paul Ciana, CMT and chief technical strategist at BofA Global Research.

“We look for support in the 92-91.40 area to hold and think this is an area to consider DXY or USD longs,” Ciana says, having flagged a “golden cross” moving-average crossover that just took place on the daily Dollar Index charts.

Ciana cites the “golden cross” formation as a positive signal for the Dollar Index, which is by implication bullish for the likes of USD/JPY, USD/CHF, USD/SEK and USD/CAD as well as a bearish for the Euro-Dollar and Pound-Dollar exchange rates.

A golden cross occurs when the 50-day simple moving-average of prices crosses over and above the 200-day simple moving-average.

Above: BofA Global Research chart showing U.S. Dollar Index, technical indicators and analysis.

Secure a retail exchange rate that is between 3-5% stronger than offered by leading banks, learn more.

According to BofA Global Research data, for the Dollar Index, the golden cross formation has been followed in 23 out of the last 27 instances by a positive performance from the benchmark over the subsequent four-to-six weeks.

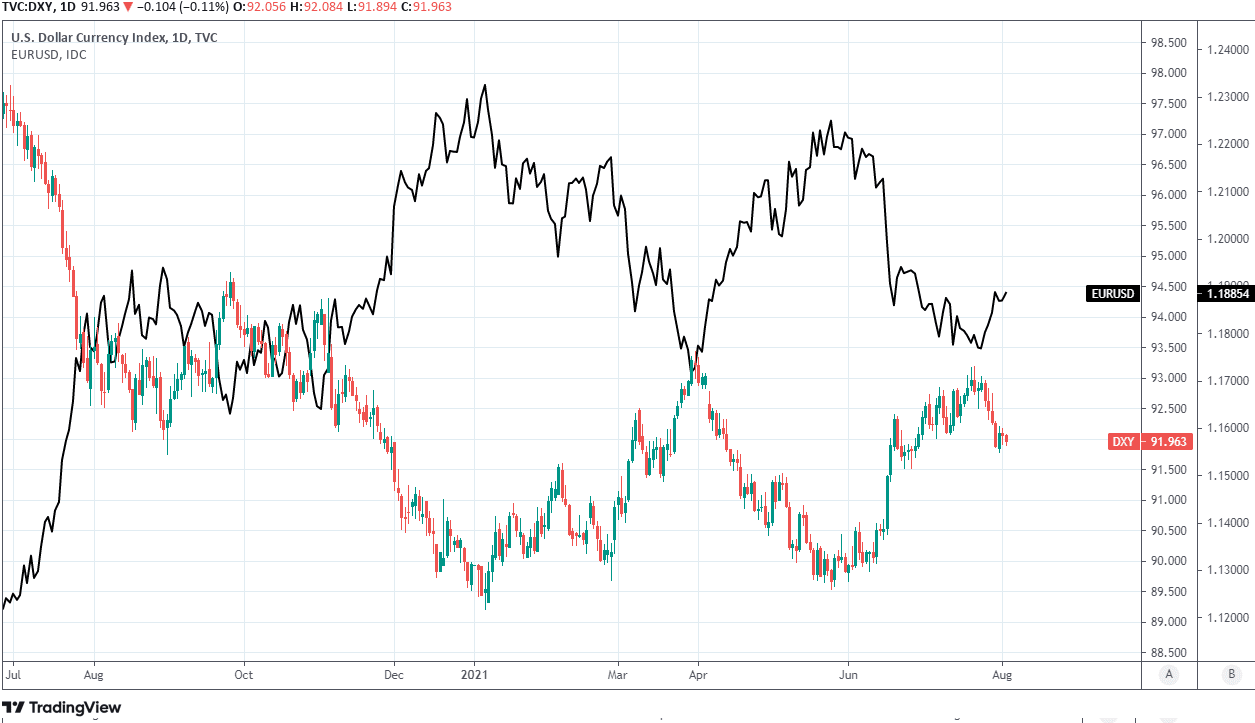

This is a most poignant signal for the Euro-Dollar, Pound-Dollar and USD/JPY exchange rates because they account for the lion’s share of flows measured by the index in question, around 83.1% of them, though it might be most relevant to the outlook for EUR/USD.

“The euro already saw a “death cross” on July 22 (50d SMA crossed below the 200d) with a spot close of 1.1771. History suggests fading a bounce in the euro and expecting lower spot levels in approximately 50 trading days,” Ciana says, referring to the antithesis of the golden cross signal.

{wbamp-hide start}

{wbamp-hide end}{wbamp-show start}{wbamp-show end}

Euro-Dollar has a 57.6% weighting within the ICE Dollar Index while all other currencies have such small weightings the overall composition of the barometer makes it difficult for the index to rise at all without there being declines in EUR/USD.

“History suggests fading a bounce in the euro and expecting lower spot levels in approximately 50 trading days,” Ciana says.

The Euro-Dollar rate was edging higher on Tuesday and the Dollar Index was ebbing lower toward a cluster of support levels referenced by Ciana, which pepper the charts between 91.80 and further down around 90.50, with price action coming as the market waits in anticipation for Friday’s job report.

Above: Dollar Index shown at daily intervals alongside EUR/USD.

The July non-farm payrolls report is out at 13:30 and will be a key determinant of expectations for the timeline over which the Fed announces and carries out a tapering of its mammoth $120BN per month quantitative easing (QE) programme.

Even more so after Federal Reserve Board Governor Christopher Waller, who’s one of seven permanent voters out of the twelve total voters on the bank’s policy-setting Federal Open Market Committee, told CNBC News on Monday that “the next two jobs reports come in as strong as the last one, then we can taper by September.”

Friday’s report is all the more key for the Fed’s taper timeline and the trajectory of the Dollar because of elevated economist expectations heading into the release, which consensus suggests will reveal that 895k jobs were either created or recovered from the coronavirus last month.

That would be the second consecutive month in which the economy will have produced close to 1 million jobs, reflecting back-to-back blockbuster job reports that have not been seen since the U.S. reopening from initial economic closures in the second quarter of 2020.

Such lofty expectations might easily make for a disappointment and further declines by the Dollar but, if realised in reality, a back-to-back jobs blockbuster could put the September month back on the table for a QE taper announcement.

Expectations of a September tapering announcement may have ebbed in some parts over the last week since Chairman Powell said last Wednesday “I would want to see some strong job numbers and that’s kind of the idea,” before he’d view the U.S. labour market as having made “substantial further progress” toward the “full employment” that forms one of the Fed’s two primary policy goals.

Above: U.S. Dollar Index shown at daily intervals, testing the 38.2% Fibonacci retracement of June’s rally, while 55 (blue), 100 (green) and 200-day (black) moving averages sit further down.