Buying Euro-Dollar Dips a Top 2021 Trade at Morgan Stanley

Image © lj16, Reproduced Under CC Licensing

- EUR/USD spot rate at time of writing: 1.1995

- Bank transfer rate (indicative guide): 1.1575-1.1659

- FX specialist providers (indicative guide): 1.1887-1.1930

- More information on FX specialist rates here

Foreign exchange strategists at Morgan Stanley are looking to buy dips in the euro-dollar exchange rate in 2021, but they warn the exchange rate's approach of the 1.20 level might elicit a response by the European Central Bank in the near-term which could make the path higher prone to near-term volatility.

"We forecast DXY to weaken by 4% by the end of 2021. The USD weakness is front-loaded in 1H21. Global growth picking up due to monetary accommodation and availability of a COVID-19 vaccine supports USD weakness," says Matthew Hornbach, Global Head of Macro Strategy at Morgan Stanley.

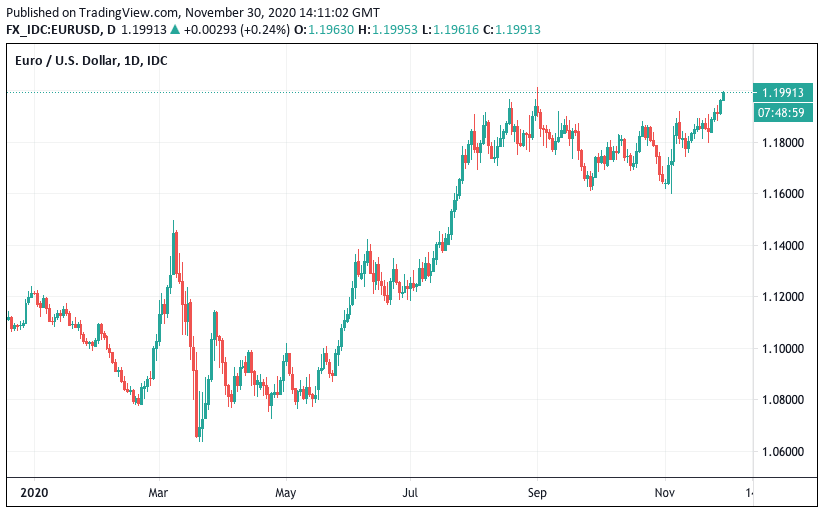

The euro-to-dollar exchange rate is knocking on the door of the technically and fundamentally significant level of 1.20 at the start of the new week: technically significant in that medium-term charts show resistance around this point; fundamentally significant because it is believed to be a threshold beyond which members of the European Central Bank become uncomfortable with the euro's strength.

The pair is quoted at 1.1960 at the time of writing while the day's high is at 1.1996; the highest level reached since September 01.

It was on September 01, when the pair peaked at 1.2011 that the EUR/USD's summer rally halted and reversed:

ECB Chief Economist Philip Lane was on record that day as saying the central bank is watching the rally with interest, leading some market participants to interpret this as a signal that the ECB would act against a rapidly rising euro.

Some analysts attributed the subsequent turn lower on Lane's comments, and have since pointed out 1.20 as being something of a threshold to the euro's upside potential.

"The ECB is likely to sound caution on EUR strength above 1.20 if economic activity has not yet picked up," says Hornbach.

However, analysts at Morgan Stanley say the ECB will ultimately be unable to halt the Euro's advance, largely because a significant driver behind the EUR/USD uptrend is Dollar weakness.

"USD to weaken when risk markets perform," says Hornbach. "The U.S. dollar topped in 2020 and we forecast it to weaken further in the coming year."

Morgan Stanley see the potential for a 4.0% decline in the Dollar index - a broad measure of overall dollar performance - as a result.

"Liquidity from central banks is still ample and expanding, while supportive government fiscal spending should help risk assets to rise, particularly into 1H21. USD tends to weaken when global growth is strong, which we forecast too," says Hornbach.

{wbamp-hide start} {wbamp-hide end}{wbamp-show start}{wbamp-show end}

U.S. real yields are expected by Morgan Stanley to stay low, while catalysts that will potentially push the Dollar weaker include continued announcements of successful Covid-19 vaccine trials and then the distribution of the vaccine which is expected to take place in the first half of 2021.

Also aiding improved risk sentiment - to which the Dollar is inversely aligned - are the following potential developments: 1) an agreement of a Brexit trade deal in the fourth quarter of 2020 2) and a final agreement on the EU recovery fund in the second half of 2021; and 3) the reiteration of low Federal Reserve rates even as economic growth picks up (2021).

"The bearish cycles were on average 6-7 years in length, suggesting that if March 2020 was the peak in the DXY, 2021 will still be in the middle of that downtrend. We forecast that we are still in a down- trend but the journey may not be as smooth as it was in the late 1980s or early 2000s," says Hornbach.

Morgan Stanley forecast EUR/USD to rise to 1.25, with the bulk of the rally coming in the first half of 2021 when the eurozone economies come out of lockdown and Covid-19 vaccine distribution boosts global travel.

"Buy EUR/USD on dips down to 1.16," says Hornbach.

Morgan Stanley expect the eurozone economy to contract in the final quarter of 2020, resulting in more ECB easing in December, "so a near-term EUR/USD rally is likely to be more muted, mostly driven by risk markets and USD weakness".