EUR/USD Forecast: "Euro Recovery is Building up a Head of Steam Now"

- Written by: Richard Perry, Hantec Markets

Image © Adobe Images

The EUR/USD exchange rate failed to clear the 1.10 hurdle over the course of the past 24 hours. Richard Perry, an analyst at Hantec Markets takes a fresh look at the exchange rate and considers where it could move next.

The euro recovery is building up a head of steam now.

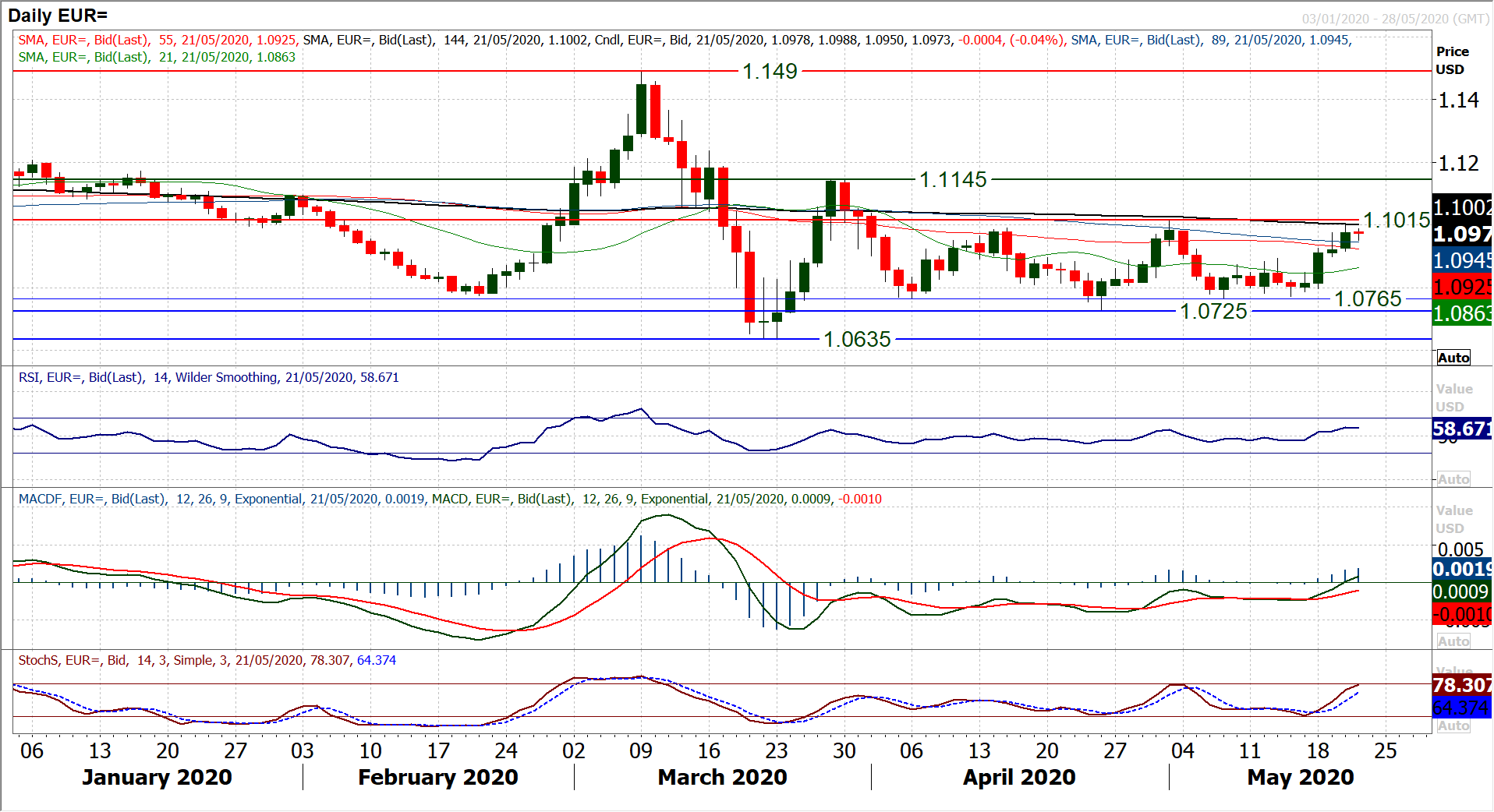

Three positive closes in a row with some strong bull candles are threatening to change the complexion of the medium term outlook. Suddenly the bulls are considering the key range resistance $1.1000/$1.1015.

A tick back lower this morning, tempers an immediate test, but recent moves in momentum are encouraging.

The RSI broke to two month high yesterday, whilst MACD lines are rising towards neutral for their own nine week high.

The EUR/USD hourly chart shows weakness is increasingly now being bought into, with good support growing between $1.0900/$1.0930 for the bulls to buy into. Holding on to the $1.08090 pivot will also be important too.

The bulls will be looking to use this intraday pullback today as an opportunity if they can build support between $1.0900/$1.0930. Attention can then turn back towards $1.1000/$1.1015 again.

Markets Struggle to Find Fresh Exit Velocity

We continue to see markets trying to break key resistance levels, underpinned by an accommodative Federal Reserve.

However, once more sentiment has just been dragged back by US President jabbing at China.

The US is dealing with the worst numbers of the COVID-19 epidemic and President Trump is looking to deflect the blame, with the Presidential election less than six months away now.

It has been often the case in recent weeks where these periods of weakness have tended to be an opportunity to buy risk once more.

We continue to believe that you “don’t bet against the Fed”.

For now though, we see equities coming off once more, and the dollar clawing back some lost ground. There is a raft of data to chew over today and how markets respond to the flash PMI data for May which is released throughout the day will be key.

Data has been showing hints of bottoming as we start to see what May has to offer.

Positive surprises in these flash PMIs could add to the growing hope that April will have been the nadir of the economic crisis. Perhaps then (second waves permitting) we can begin to look forward.

Wall Street closed with strong gains, with the S&P 500 +1.7% higher at 2971.

However, US futures are pulling back, with the E-mini S&Ps -0.7% today. Asian markets have been mixed to mildly lower with Nikkei -0.2% and Shanghai Composite -0.7%. Europe is a similar picture to US futures, with FTSE futures -0.7% and DAX futures -1.0%.

In forex, there is a USD rebound after a few days of losses.

The higher risk AUD and NZD are underperformers, whilst EUR is still holding up relatively well. In commodities, the dollar resurgence is hitting gold by -0.7% and silver by -1.9%.

The continued rally on oil is the standout performer today to fight against the dollar strength.

There is a packed economic calendar today, with the flash PMIs for May key today. Eurozone flash manufacturing PMI is at 0900BST and is expected to improve slightly to 38.0 (from 33.4 in April), whilst Eurozone flash Services PMI is expected to improve to 25.0 (from 12.0 in April).

This would improve the Eurozone flash Composite PMI to 25.0 (from 13.6).

UK Flash Manufacturing PMI is at 0930BST and is expected to improve to 36.0 (from 32.6 in April), whilst UK flash Services PMI is expected to improve to 25.0 (from 13.4) leaving the UK flash Composite PMI to improve to 25.0 (from 13.8).

US Weekly Jobless Claims are at 1330BST and area expected to reduce once more but still add millions more to the jobless numbers, with 2.400m (2.981m last week).

Philly Fed Business index for May is at 1330BST and is expected to improve slightly to -41.5 (from -56.6 in April).

US flash Manufacturing PMI is at 1445BST and is expected to improve slightly to 38.0 (from 36.1 in April) whilst US flash Services PMI is expected to improve to 30.0 (from 26.7 in April). Finally we have Existing Home Sales at 1500BST which is expected to have declined by almost 19% to 4.30m in April (from 5.27m in March).

There are a few FOMC speakers to watch for today. Fed chair Powell is obviously the most important and he is speaking at 1930BST.

However, the FOMC’s John Williams is also speaking at 1500BST and FOMC vice chair Richard Clarida is speaking at 1800BST. Further comments on monetary easing and negative rates will be watched for.