Euro-Dollar Rate Risks A Return to October Lows as Economic "Horror Show" Enters New Chapter

- Written by: James Skinner

- EUR tests bottom of four-month range 2nd time in week.

- As continental economic horror show enters new chapter.

- EU-U.S. growth divergence renews, weighing on the EUR.

- Even before effect of coronavirus shows up in any of data

- A EUR/USD range break to downside just a matter of time.

Image © Adobe Images

- EUR/USD Spot rate: 1.0996 down 0.04% today

- Indicative bank rates for transfers: 1.0612-1.0689

- Transfer specialist indicative rates: 1.0832-1.0898 >> Find Out More About This Rate

The Euro softed against a resilient Dollar Thursday as further signs of economic divergence with the U.S. pushed the single currency into a renewed test of a multi-month technical support level that's increasingly at risk of giving way.

Europe's unified unit tested the bottom of its four-month trading range for the second time in a week Thursday after German factory orders surprised on the downside, providing further support to the idea that the final quarter of last year might have been a write-off for the continental economy.

And the dour growth data is coming in thick and fast for the Eurozone at a time when the global outlook is deteriorating rapidly due to a spread of the new coronavirus in the world's second largest economy.

"A worsening instead of a turnaround. Despite some tentative positive signs from soft data that point to a bottoming out of the manufacturing slump, the hard reality looks completely different. Instead of a turnaround, the drought in order books and the manufacturing slump is getting worse," says Carsten Brzeski, chief economist at ING Germany.

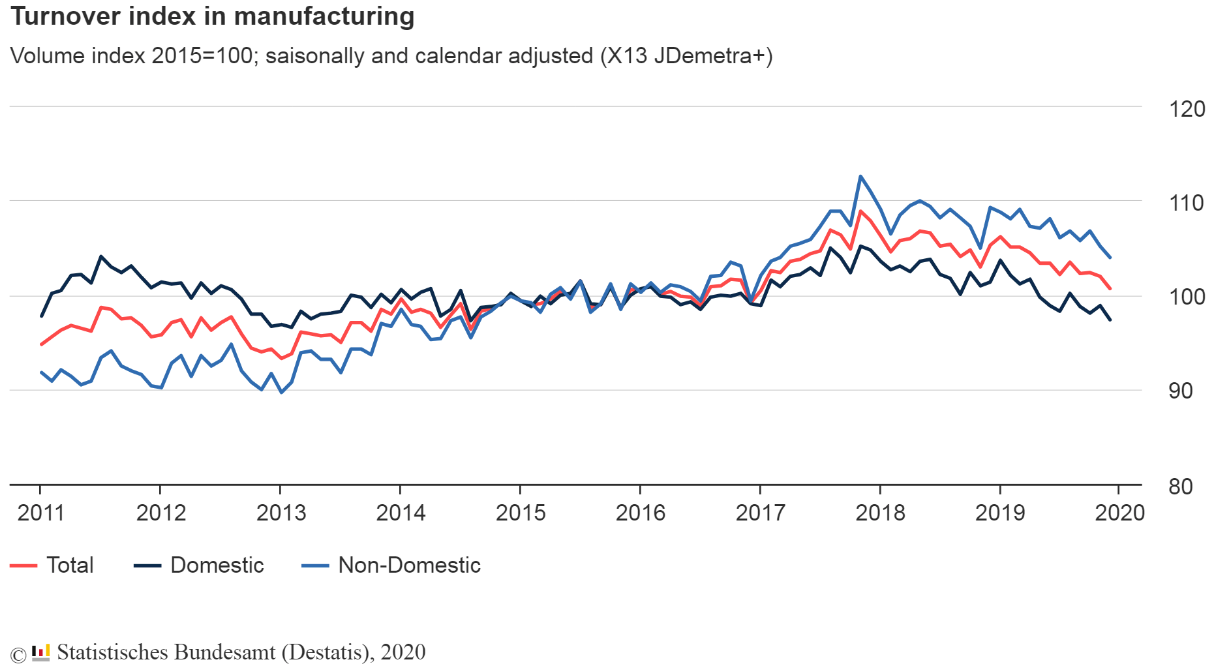

Above: Destatis graph showing breakdown of turnover trends in German manufacturing industry.

German factory orders slumped -2.1% in December, Destatis data has revealed, deepening an upwardly-revised 0.8% decline from November when markets were looking for a 0.6% increase.

The data casts the export side of the economy in a fragile light less than a week after other figures revealed a shock -3.3% decline in retail sales for the same month, details of which were released alongside other figures showing the French and Italian economies contracting in the final quarter.

"We are not convinced that the resilience of the US economy will persist but for now the relative macro picture remains compelling for the US dollar over the short-term suggesting EUR/USD is headed for a retest of the October low," says Derek Halpenny, head of research, global markets EMEA and international securities at MUFG. "For EUR/USD, 1.0981 is the next key support level – marking the low from 29 th November. A breach of that level will open up a retest of the 1.0879 low set on 1 st October."

Above: Euro-to-Dollar rate shown at 4-hour intervals.

For the market the German data simply serves a reminder of the Achilles' heel that is the negative -0.5% European Central Bank (ECB) deposit rate and its near-non-existent offer of upside over the short-term which, when considered alongside the 1.75% cash rate of the Federal Reserve (Fed), leaves the Dollar looking like a no-brainer and renders bets in favour of the Euro a costly affair. Analysts say an increasingly-unlikely Eurozone growth upturn is necessary to turn the tables for the Euro-Dollar rate.

But those unfavourable dynamics are being reinforced on an almost daily basis by continued exhibitions of U.S. economic exceptionalism, with the latest being the Institute for Supply Management (ISM) services PMI that blew away the consensus on Wednesday just days after the sister survey of the no-longer-ailing manufacturing sector surprised sharply on the upside. However, the real rub for the Euro is that annualised U.S. GDP growth was already more than double that of the Eurozone even before then.

"We look for EURUSD to trade at 1.08 in 3M and with a relatively flat profile thereafter (pg 35). EU/US trade disputes will be a key factor for 2020/21; we think the Eurozone will ultimately have to accept a smaller bilateral trade surplus with the US and increased burden sharing on military & defense – both of which have EUR-negative implications. Low term premia in yields, negative carry, the lack of fiscal maneuverability and political fragmentation should also continue to anchor the EUR," says Stephen Gallo, European head of FX strategy at BMO Capital Markets.

Above: Euro-to-Dollar rate shown at daily intervals.

"There is mounting evidence that the coronavirus is negatively impacting on global manufacturing supply chains, as well as tourism flows. Korean car maker Hyundai, and Korean car parts suppliers have shut some production facilities because of a dearth of supplies from China. Like tourism, manufacturing is labour‑intensive and strict controls on labour movements in China have created widespread production bottlenecks," explains Kim Mundy, a strategist at Commonwealth Bank of Australia.

U.S. economic exceptionalism, peppered with occasional bouts of outright Eurozone weakness, has long lifted the Dollar and weighed on the Euro but downside pressures are growing in the Euro-to-Dollar rate at a time when the global outlook is turning increasingly dark. The outlook has darkened with the spread of coronavirus in China, which has turned many of the countries largest cities into ghost towns and is hampering the economy.

"With the outbreak of the coronavirus adding what Christine Lagarde describes as “a new layer of uncertainty” for the euro area economy and Philip Lane confirming that it could have “significant short-term effects” on growth, the outlook from the ECB’s top brass is, unsurprisingly, cautious," says Marchel Alexandrovich, a senior European economist at Jefferies International.

Official numbers for infections and deaths have shown the spread of the infection slowing this week but already meaningful damage has been done to not only the Chinese economy but also others in the region. And Europe's already-struggling economy, especially that of Germany, would be very unlikely to emerge unscathed from a sharp and punishing Chinese economic slowdown. That much was demonstrated by the bloc's growth woes from mid-2018 onward, which came alongside the U.S.-China trade war.

"Further, Airbus and Tesla, among others, have shut Chinese factories and warned of production delays. Starbucks has closed outlets and numerous airlines have halted or reduced flights," Mundy says. "We expect USD to remain firm in the current environment."

Above: Euro-to-Dollar rate shown at weekly intervals.