The Euro-Dollar Rate Stalls after PMI Surveys Show Industrial Sector Struggled Again in June

- Written by: James Skinner

© Pound Sterling Live

- EUR stalls after June PMIs show industrial sector remains troubled.

- Economy shows signs of stabilising but trade war is key to outlook.

- Without growth recovery, the ECB's inflation target remains in doubt.

- In absence of trade resolution, or lower EURUSD, ECB may cut rates.

The Euro stalled amid a fresh challenge of the week's highs Friday after the influential IHS Markit PMI surveys showed the Eurozone's mighty industrial sector continuing to struggle in June, although the bloc's services remained in rude health this month.

IHS Markit's June composite purchasing managers' index (PMI) surveys suggested the continental economy continued to stabilise in recent weeks, with growth seemingly creeping higher for a second consecutive month, although the expansion is being led almost entirely by services as the mighty manufacturing sector remains troubled.

The flash Eurozone composite PMI output index edged up to 52.1 in May, from 51.8 previously, thanks to a strong increase in the services PMI and a much more modest climb in the manufacturing index.

June's increase in the services index, from 52.9 to 53.4 was faster than markets had anticipated but the minor climb from 47.7 to 47.8 in the manufacturing index was much slower than economists were looking for.

"Output and new orders in services are rising briskly, but the picture remains grim in manufacturing, where production fell at its quickest pace in six years over Q2 as a whole. New orders also declined sharply, though a slower pace than earlier in the year," says Claus Vistesen, chief Eurozone economist at Pantheon Macroeconomics.

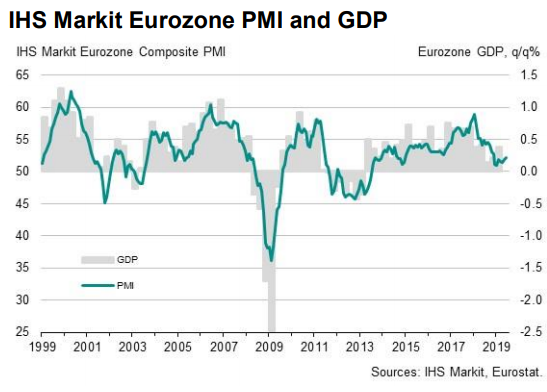

Above: IHS Markit graph showing Eurozone PMI correlation with GDP growth.

PMI surveys measure changes in industry activity by asking respondents to rate conditions for employment, production, new orders, prices, deliveries and inventories. A number above the 50.0 level indicates industry expansion while a number below is consistent with contraction.

Markets care about PMI data because it is an important indicator of momentum within the economy. And economic growth has a direct bearing on consumer price pressures, which dictate where interest rates will go next.

"The PMI points to stable growth in Q2, of 0.3-to-0.4% quarter-on-quarter, but our base case is a good deal lower, at just 0.1-to-0.2%. Base effects are unfavourable across the board for construction, industrial production, manufacturing capex, and consumers’ spending, and we also think that net exports will slow a bit," Vistesen warns.

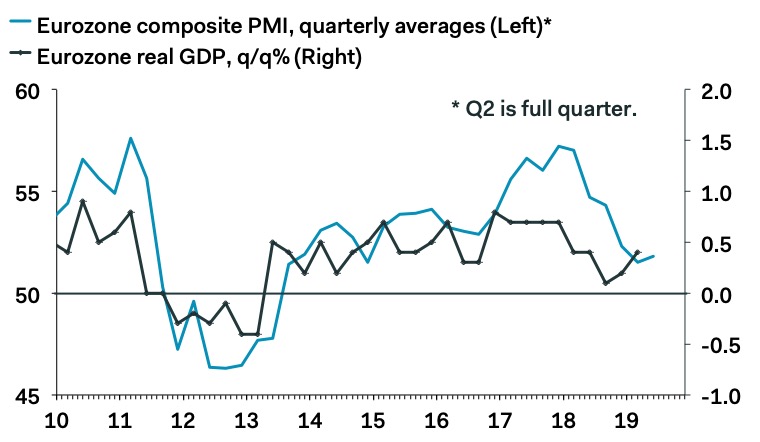

Above: Pantheon Macroeconomics graph showing PMI correlation with GDP growth.

"The small improvement in the flash PMIs for June will not be enough to deflect the ECB from its new plan to ease policy within the coming months. We expect it to cut its deposit rate by 10bp in September," says Andrew Kenningham, chief European economist at Capital Economics.

Changes in rates are only normally made in response to movements in inflation, which is sensitive to economic growth, but impact currencies because of the influence they have on capital flows and their allure for short-term speculators.

Capital flows tend to move in the direction of the most advantageous or improving returns, with a threat of lower rates normally seeing investors driven out of and deterred away from a currency. Rising rates have the opposite effect.

Above: Euro-to-Dollar rate shown at hourly intervals.

The Euro-to-Dollar rate was quoted 0.10% higher at 1.1306 following the report after previously challenging its week-high at 1.1317, although the exchange rate is down 1.39% for 2019.

That performance follows a 0.94% gain for the Euro previously this week and comes as the U.S. Dollar pares earlier losses against most rivals.

"It’s also worth keeping an eye on Euro area banking stocks, where Natixis fell 11% yesterday on fears of poor oversight of one of its asset managers. This won’t help the EUR either. EUR/USD should stay subdued in a 1.1250-1.1320 range," says Chris Turner, head of FX strategy at ING Group.

Above: Euro-to-Dollar rate at daily intervals, alongside the Dollar Index (orange line, left axis).

"Earlier this week ECB President Mario Draghi effectively changed the Bank’s guidance to say that it will loosen policy unless there is an improvement in the economic data. We don’t think the PMIs released today will be enough to deflect the Governing Council from formally strengthening its forward guidance in July and cutting its deposit rate from -0.4% to -0.5% in September," says Capital Economics' Kenningham.

Friday's surveys come just days after Mario Draghi, head of the European Central Bank (ECB), hinted that fresh interest rate cuts to new record lows and a resumption of the quantitative easing programme that saw the bank buy up a large portion of the European government bond market could be in the pipeline.

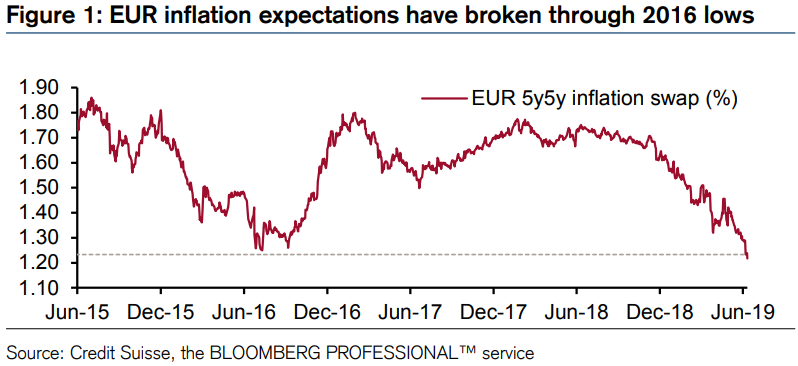

ECB officials have grown increasingly fearful of late that they will not be able to meet the inflation target of "close to but below 2%" at any point over the next five years after market expectations for consumer price pressures up ahead fell to a new post-2015 low.

This is after the U.S.-China trade war, which damaged the Eurozone economy last year, escalated again in May. Previously, the Eurozone economy grew by 0.4% in the first-quarter of 2019, up from 0.2% at the end of 2018, after slowing sharply in the second half of last year.

"Draghi sent a strong signal in the Sintra conference that the ECB was ready to cut depo rates further into negative territory and even resume QE if necessary," says Athanasios Vamvakidis, a currency strategist at Bank of America. "The ECB has very few bullets left in our view. The threat of using them may be more effective for now than actually using them. We would expect the ECB to be reactive rather than pro-active, suggesting policy easing only if the outlook deteriorates further."

Above: Credit Suisse graph of Eurozone inflation expectations.

"We remain sellers of EURUSD on moves towards 1.1400 and won't change that view until levels above March highs around 1.1450 are breached or the EUR 5y5y inflation swaps turns upwards materially," says Shahab Jalinoos, a strategist at Credit Suisse.

Growth forecasts for 2019 were already bombed out when, at the beginning of May, President Donald Trump raised the tariffs already charged on $200 bn of Chinese annual exports to the U.S. and began threatening the other £300 bn of its annual trade with America.

Presidents Trump and Xi Jingping are due to meet on the sidelines of the G20 conference in Osaka, Japan, at the end of June and hopes are high that a further increase in tariffs can be averted by an agreement over China's "unfair" trading practices.

However, if the talks fail and another escalation of the trade war further undermines the Eurozone industrial sector, which does lots of business with China, and the economy then the ECB's pursuit of its inflation target would be undermined again.

The ECB is legally obliged to use monetary policy to ensure inflation averages the target rate over the medium-term and it needs faster economic growth on the continent if it is to have any hope of fulfilling that obligation.

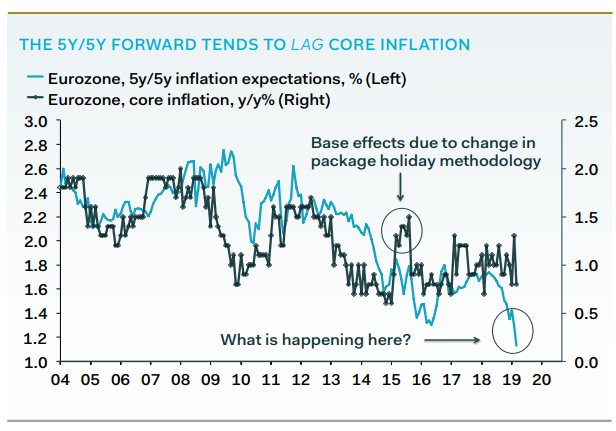

"The issue for the central bank is that markets now are pricing-in cuts. This puts the ECB on the spot, though we reckon a jump in EURUSD and a collapse in trade negotiations are the most likely catalysts for a move, not the 5y/5y forward," says Pantheon's Vistesen.

Above: Pantheon Macroeconomics graph of Eurozone inflation expectaions and actual core-inflation.

Time to move your money? Get 3-5% more currency than your bank would offer by using the services of foreign exchange specialists at RationalFX. A specialist broker can deliver you an exchange rate closer to the real market rate, thereby saving you substantial quantities of currency. Find out more here.

* Advertisement