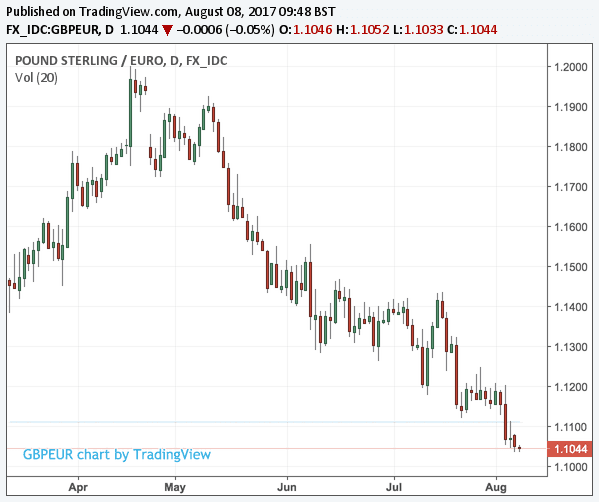

Pound / Euro Rate Tipped to "Grind" Lower as Technicals Grab Control of Markets

- Written by: Gary Howes

As data and events dry up over the peak of the European summer foreign exchange professionals are being increasingly drawn to the technical charts for guidance.

And for those hoping for a stronger Pound to Euro exchange rate, the new isn’t so good as the grind lower looks to be intact.

The Pound to Euro exchange rate recently broke below the 1.11 area following the Bank of England’s super-Thursday event which saw a number of analysts warn that risks of further decline had suddenly become all the more heightened.

“A combination of channel and psychological support around 1.1000 may well prove sufficient to stem further Sterling weakness here initially but damage already done over recent weeks suggests re-emergent strength as/when seen will now prove corrective only in any case,” says Lucy Lillicrap, an analyst with Associated Foreign Exchange in London.

Lillicrap is a technical analyst who studies the structure of the market using price charts to deliver strong clues as to future direction.

The accuracy of technical studies varies and in times of high news flow - think Brexit - this method can lose some of its predictive powers.

However, it does appear that a summer lull in political intrigue and market news flow could mean technical rules are adhered to more so than would normally be the case.

“As data and events continue to dry up over the summer, we think technical analysis, seasonal factors and positioning may become more important market drivers,” says Hamish Pepper, an analyst with Barclays.

With that in mind, Lillicrap says to further reduce immediate downside risks, GBP prices must regain distant/key resistance at 1.1425/35 v EUR.

But resistance to such a recovery is said to begin in the 1.1150 and the 1.1250 areas which will limit recovery scope going forwards.

“Once beneath 1.0990/00 an initial extension towards 1.0875 and 1.0750 would be anticipated,” says Lillicrap.

Above: Associated Foreign Exchange's short-term outlook for currency markets.

Analyst Robin Wilkin at Lloyds Bank says he expects the grind lower in the Pound to extend lower with the Pound to Euro exchange rate hugging the bottom of a channel.

The next main support that could see selling pressures ease lies at 1.0899. Beyond here the exchange rate is exposed to a decline into the infamous flash-crash lows hit in October 2016.

These are in the region of 1.03-1.04 depending on which exchange you are quoting.

According to Wilkin, only a rise up through 1.1161 will invalidate the downtrend. For now, this looks a little out of reach.

There is one glimmer of hope in the near-term - and that is that the Euro is looking overbought.

In fact, the Euro is looking so over-cooked against the Dollar and Pound at current levels one major analyst has recommended that traders don't buy it.

“The EUR has been supported since the start of the week. However, with speculative oriented investors’ selling interest in the single currency rising and as there is limited scope of policy differentials diverging further to the benefit of majors such as EUR/USD, we advise against buying at these levels.

“If anything, still elevated long positioning should leave the currency subject to downside risks,” says Manuel Oliveri at Credit Agricole.

“If anything, still elevated long positioning should leave the currency subject to downside risks,” adds the analyst.

So the trend is your friend for now, and unfortunately this state of affairs is not very helpful for those hoping for a cheaper Euro. But, there could be a few brief opportunities of respite from which to transact when the rally goes into consolidation mode.

Is the fall in value of Sterling impacting your international payments? Get up to 5% more foreign exchange by using a specialist provider by getting closer to the real market rate and avoid the gaping spreads charged by your bank for international payments. Learn more here.