Big Break for the GBP/EUR Exchange Rate Looms

After weeks of consolidation in GBP/EUR the prospect of a big break lower, or higher, has increased.

The media has probably done a good job of hyping up recent action in foreign exchange markets, particularly because they like creating a link between political events and the Pound's reaction.

Look at how Theresa May's poor election result has been blamed for a lower Pound.

However, evidence suggests this is not actually really the case.

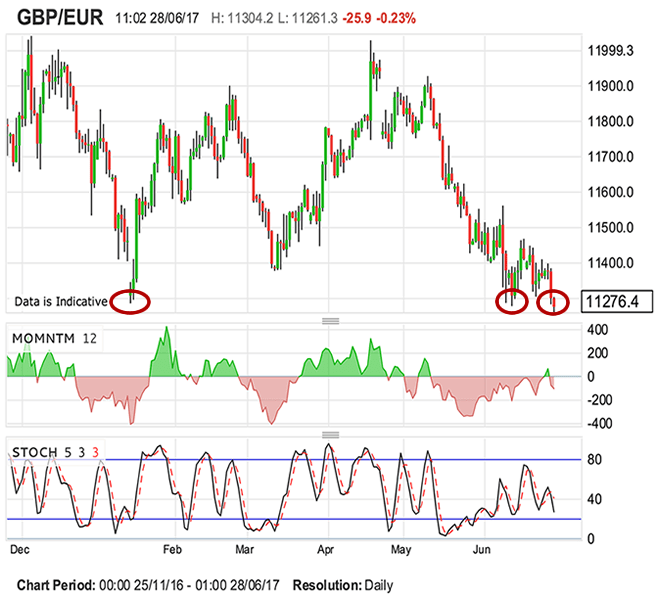

GBP/EUR appears to be effectively caught in an intermediate range of between 1.1300 and 1.2000 with the lower end of the range between 1.13 and 1.15 being tested through the course of June with very little price action taking place in the second-half of the month.

The lull in market conditions is not specific to the Pound as foreign exchange volatility has plummeted with the Pound trading tight ranges against the likes of the Dollar and Euro.

“The summer solstice last week was marked appropriately by year-to-date lows in FX implied volatility,” says Kit Juckes at Societe Generale. “The summer doldrums have thus descended on the FX market. It is difficult to see what would stop the market being lulled into a deeper slumber in coming weeks.”

Volatility has fallen even further since the solstice.

Juckes warns that the decline in volatility cannot keep going on, “but it is a mug's game to speculate exactly when and why it will spike.”

Periods of consolidation - such as that which we are presently witnessing - can tend to give way to big directional moves.

"The Euro held on to support by the matter of a few pips and remains in an uptrend with volatility declining to very low levels, levels not seen since October 2015. This suggests a large price move is in the offing," says Phil Seaton, who runs the LS Trader system.

When the spell breaks, will the Pound shoot higher or lower against the Euro?

Analyst Lucy Lillicrap at Associated Foreign Exchange says we are more likely than not to see the Pound head lower once the market starts trending again.

“The impulsive or trend-like nature of recent erosion suggests re-emergent strength as/when seen should now prove corrective and a negative resolution is thus increasingly likely in coming weeks,” says Lillicrap in a briefing released on June 26.

Lillicrap is a technical analyst who studies the structure of the market via charts for clues as to future direction.

“If 1.1250 area support gives way enough compression already exists to enable a subsequent extension beneath 1.1000 as well and in the meantime only above 1.1550/60 resistance will meaningfully postpone this awaited Sterling sell-off,” says Lillicrap.

But Short-Term, Look for Relief

The last few months have seen a dramatic fall in the Pound to Euro exchange rate due to a combination of softening UK data and increased political uncertainty in the United Kingdom.

By contrast, Eurozone data is improving while political risks ease.

As a result of these factors GBP/EUR finds itself near the bottom of its 1.13 and 1.20 trading range.

Although GBP/EUR has made a half-hearted attempt to recover over the last two weeks, technical studies confirm the pair remains in a downtrend.

However despite this, given the pair is at the range floor, there is an assumption it will continue to respect the range boundaries and eventually start to move back up towards the middle of the range, and perhaps even higher.

The above shows that the Pound has found strong buying interest around 1.1250-1.1270 on three occassions over recent months. The result was a strong recovery.

Will history repeat? Whatever the case, this is clearly an important level to be aware of.

So while the longer-term picture, as painted by AFEX’s Lillicrap, hints at weakness in GBP/EUR, we believe the near-term is more constructive.

A break above the downtrend line - as drawn in the below graph - from the April highs would signal a reversal higher.

Confirmation of such a break would come from a move above 1.1430.

The MACD is also corroborating a bullish forecast as it has formed a bottoming pattern (circled below).

Our initial short-term target should a recovery materialise is eyed at 1.1550.

In the absence of such a break higher then there is still a risk of a piercing below the range lows.

A move below 1.1260 would probably signal such a break and a move down to an initial target at 1.1000.

So be on alert for such an outcome.