Scale of Conservative's Victory Key for GBP/EUR Exchange Rate's Outlook

- Written by: Gary Howes

Exchange rate market analysts explore the potential impacts on Pound Sterling of the potential outcomes to the Thursday 8 election and give estimates of how far EUR/GBP will go.

- Market Quotes (6-6-17):

- Pound to Euro exchange rate: 1.1484, up 0.14%, day's best: 1.1505, day's low: 1.1451

- Euro to Pound Sterling exchange rate: 0.8708, day's best: 0.8732, day's low: 0.8713

Pound Sterling is seen trading stronger against the Euro, a mere three days before the General Election.

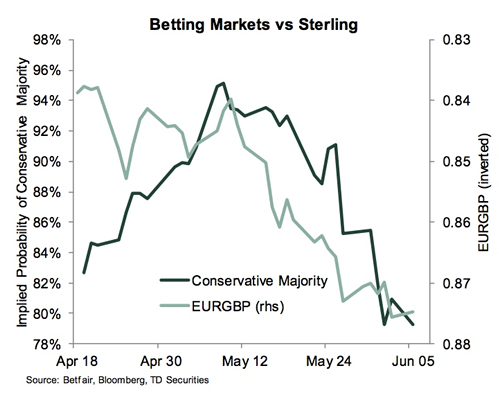

We have noted that the strength might well be a reflection of markets pricing in a strong Conservative majority, despite the tightening seen in the polls. We note here bookmakers are slashing odds on such an outcome while options markets have seen the cost of insuring against an adverse outcome as having fallen notably.

What is for sure, is that near-term price action is wholly dependent on politics.

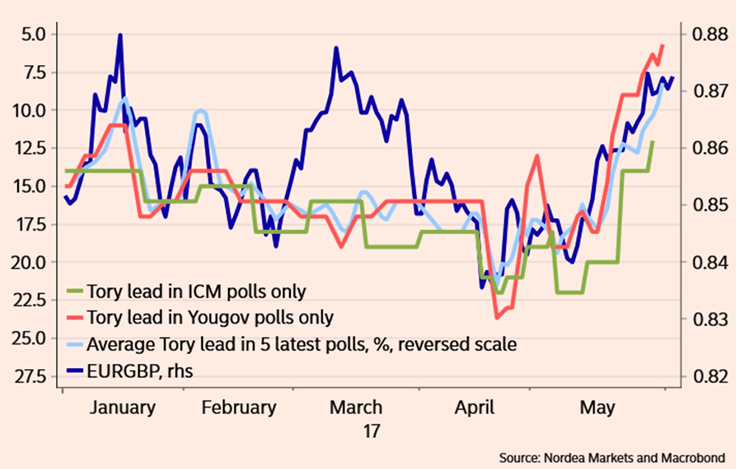

”EUR/GBP has moved in tandem with the election polls in 2017, and especially since Theresa May called for snap elections in April,” says Andreas Steno Larsen, an analyst with Nordea Markets who confirms markets will remain tuned to the election and nothing else over coming days.

The above shows that as the Conservative’s lead falls, so the Euro strengthens against the Pound.

“The upcoming UK election also has a very complex spectrum of potential outcomes that until very recently, were considered only low probability events,” says James Rossiter at TD Securities. “By extension, this has introduced the chance of a significant move for sterling in FX markets—something that we had considered unlikely until only a few weeks ago.”

TD Securities help ram home the idea that EUR/GBP is tracking the Conservative’s advantage in the polls:

While there has been some downside in the Conservative's expected majority, and in the value of the Pound, markets still see a strong Conservative victory.

The Electoral Calculus has the Conservatives as winning 72 seats on Monday, June 5 with all the latest polls having been taken into account. Oddschecker report that the odds on May winning a majority on June 8 have actually been cut.

Conservatives = Continuity = Stronger Pound

But why is a large Conservative majority good for the Pound?

Two popular assumptions are that a stronger Conservative government:

1) Allows for a more flexible approach to Brexit negotiations

2) Allows for a transitional exit period unencumbered by the need to hold a general election in 2019/2020.

“The 8 June vote removes the prospect of a 2020 UK general election, the year after Brexit takes effect, postponing it until 2022,” says David Bloom, Strategist with HSBC. “It increases the probability of political continuity and a Conservative Party government, according to recent polls – an expectation which has proven GBP positive in the past.”

But another theory - that a strong mandate for the Government will somehow give it added leverage against the European Union in the talks - is a weak one.

“We tend to think that it makes very little sense to expect any substantial impact on the balance of power in the upcoming Brexit negotiations from May’s size of majority in parliament. Thus, no matter the strength of the UK mandate at the negotiations, the EU is unlikely to yield easily to UK demands,” says Larsen.

Nordea Markets instead argue that the Pound’s fall is actually just the foreign exchange market showing their nerves towards the Pound in case of either a hung parliament or even a Labour victory taking place.

Scenario 1: Conservative Victory = a GBP/EUR Recovery

The Pound to Euro exchange rate is forecast to rise rapidly by Nordea Markets should Theresa May substantially increase her party’s majority.

“In case of a solid Conservative victory where the party’s majority in parliament remains intact, we would expect the risk premium on EUR/GBP to be scaled back,” says Larsen.

Recall, it is believed some of the recent move from 0.84 towards 0.875 in EUR/GBP has been driven by headwinds to the Conservatives in the polls.

“That’s why a short-term correction towards at least 0.86 is on the cards no matter the size of the potential Conservative majority,” says Larsen.

EUR/GBP at 0.86 translates into GBP/EUR at 1.1628. If this is a rate you are looking to secure I would suggest you contact a FX specialist to automatically book this rate when it is achieved.

But this post-election move is expected to be as exciting as it gets for Sterling with Nordea not expecting strong trends in EUR/GBP heading towards the “duller” summer period.

“If anything, risk is tilted slightly to the downside,” says Larsen.

There are however risks to the view that Sterling is due to recover following the election result, and of course this largely rests with various scenarios concerning the Thursday vote.

Scenario 2: Hung Parliament

Understandably this outcome will not be a good one for the Pound.

“If neither main party wins a clear majority, markets will have to deal with considerable uncertainty as to who will form the next government and what compromises the eventual prime minister will have to make to get the support of other parties,” says Larsen.

The Brexit negotiations with the EU are due to begin on 19 June and they could be delayed, leaving an even tighter timetable to resolve the host of complex issues.

“A hung parliament is surely not a GBP-positive scenario,” says Larsen. “Rather it could prove to be the long-term worst scenario for GBP although we would not expect a major beating to the GBP in any of the potential outcomes of the election.”

So the message is not to expect a sudden crash in the exchange rate.

A hung parliament will likely prompt Nordea to revise their EUR/GBP forecast higher as the uncertainty around the Brexit negotiation outlook will continue to weigh on the GBP.

However, analyst Oliver Harvey at Deutsche Bank says if a hung parliament were to result in a ‘rainbow coalition’ - i.e Labour, Lib Dems and Scottish National Party Governing together - the impact on Sterling will be positive.

It is argued that the support of the SNP, Liberal Democrat, Green and Plaid Cymru parties for a Labour government would be conditional on a ‘soft Brexit’ approach, such as EEA membership, and perhaps a second referendum on EU membership.

An increase in Government spending is also seen as being positive for economic growth.

“We see the prospects of a softer Brexit and fiscal stimulus outweighing the impact of policies such as rises to corporation tax rates. We do not see SNP influence as necessarily leading to a second Scottish independence referendum,” says Harvey.

We seriously question this as there are no signs that Nicola Sturgeon will ever compromise on her core objective - an independent Scotland. Indeed, she now sees the country as being independent by 2025.

Scenario 3: Corbyn Victory

Markets and analysts believe a Labour Party win is the most unlikely scenario at this stage.

The required swing, combined with the polls, suggests this would require a gargantuan effort. And we believe the BBC Question Time appearance will have delivered ‘peak-Corbyn’.

Corbyn pledges to retain membership of the EU’s single market and customs union although that could prove difficult as he also pledges to end the free movement of people, which EU leaders say the UK must retain if it wants to maintain market access.

Labour also says that leaving the EU with no deal would be the “worst possible” option.

“While a victory to Jeremy Corbyn’s Labour Party, based on the surprise effect alone, will send EUR/GBP markedly higher (also higher than in a hung parliament scenario), the long-term effect of a Labour victory is a bit more difficult to judge,” says Larsen.

Markets have to a certain extent indicated that a soft Brexit is preferable to a hard Brexit.

But in the aftermath of Theresa May’s “we are prepared to accept hard Brexit” speech on 15 January, EUR/GBP actually dropped from 0.88 to below 0.85 in the following weeks.

It is suggested that the effect of Corbyn’s softer approach to Brexit is probably slightly GBP positive, but Nordea believe the market might perceive Corbyn as a less-strong and maybe even less-skilled prime minister than Theresa May.

The impact of his promised tax rises on businesses will also be a big question mark regarding the economy’s future.

The stability of the Labour party also remains questionable with huge frictions existing between the harder-Left element that Corbyn represents and the Blairite right of the party.

“It is somewhat hard to see a persistent strong GBP under Corbyn’s guidance, also considering Labour’s less market-friendly policies such as corporation tax and higher public spending.

So there are a lot of question marks around the future of the UK under a Labour government and uncertainty tends to weigh on the Pound.

What is for sure is the outlook for Sterling will be reassessed in great detail by the analyst community if Corbyn walks into number 10 on Friday.

Four Days to Go: Where do we Stand?

This week’s election is closer than many expected though bookies are still ~75% priced for a Conservative majority.

This despite YouGov's new polling system suggesting May will fall well short of a majority.

The Electoral Calculus website - the original parliamentary seat predictor - shows a 72 seat majority, though also gives a 33% probability that it doesn’t happen at all.

The first solid insight into the outcome will be clear by 10pm BST with the exit poll release.

If it is close however, we will have to wait until ~1am for the results from key marginal and ‘target’ seats.

Weekend polls ranged from a 11% lead for the Tories to just 1%.

"Bottom line a Tory majority is still the most likely outcome but as one electoral tracker put it we are a “normal-sized polling error” away from a Labour majority or hung parliament. The risks to GBP are also asymmetric, given markets are still priced for a Tory victory despite the narrowing race," says Adam Cole, an analyst with RBC Capital Markets.