Euro Exchange Rate Forecast: More Gains as Threat of ECB Action Wanes

Euro to pound and euro to dollar conversion forecasts based on both technical and fundamental studies.

The euro’s reaction to this week's FOMC statement, when compared to its peers, sums up the currency’s newfound strength: whilst the pound and the yen weakened following the announcement, the euro rose against the dollar.

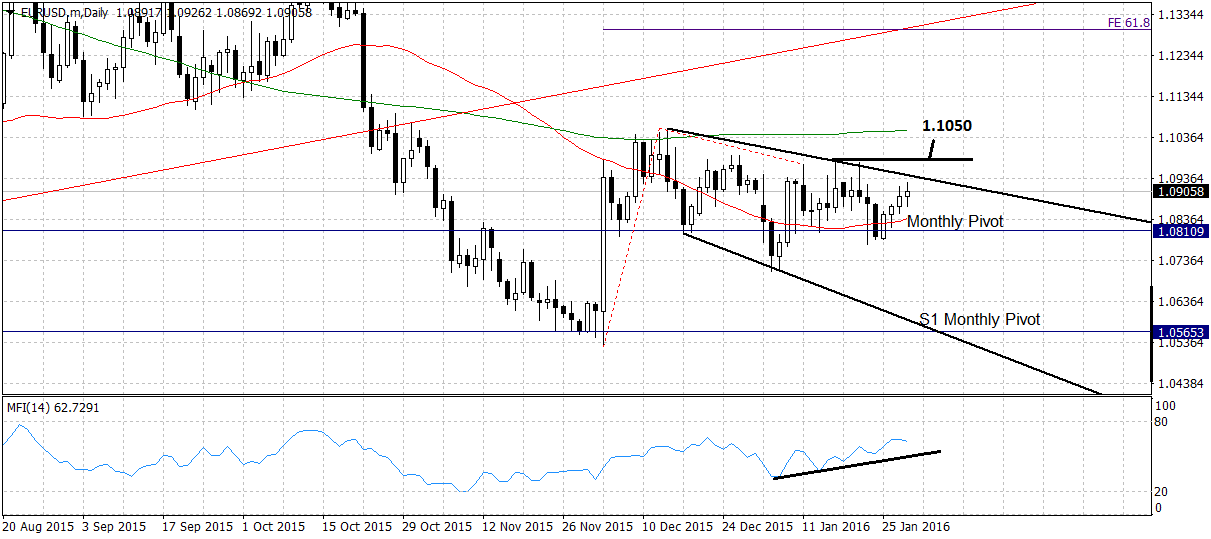

It was not a major rise, as can be seen on the daily chart of the EUR/USD below, however, it was significant in that it represented the euro’s recently-aquired resilience.

The gently-descending column of activity which characterises the currency’s price action in January is beginning to show an upside bias, illustrated by the rising Chaikin Money Flow indicator in the lower pane.

This is a useful indicator to watch during sideways markets as it can give a head’s up as to where the smart money is going, and therefore in which direction the final break will probably happen.

Like all indictors it isn’t fail safe, and we could still see a surprise break lower, particularly given the euro’s less-than-gold-plated background, however, given other elements it favours an upside breakout.

As such, if the exchange rate breaks above the 1.0985 Jan 15 highs, that will probably signal a breakout from the consolidation, and a continuation higher, towards a target at the 200-day MA, at 1.1050.

Euro to Pound Forecast: Strength Not Over?

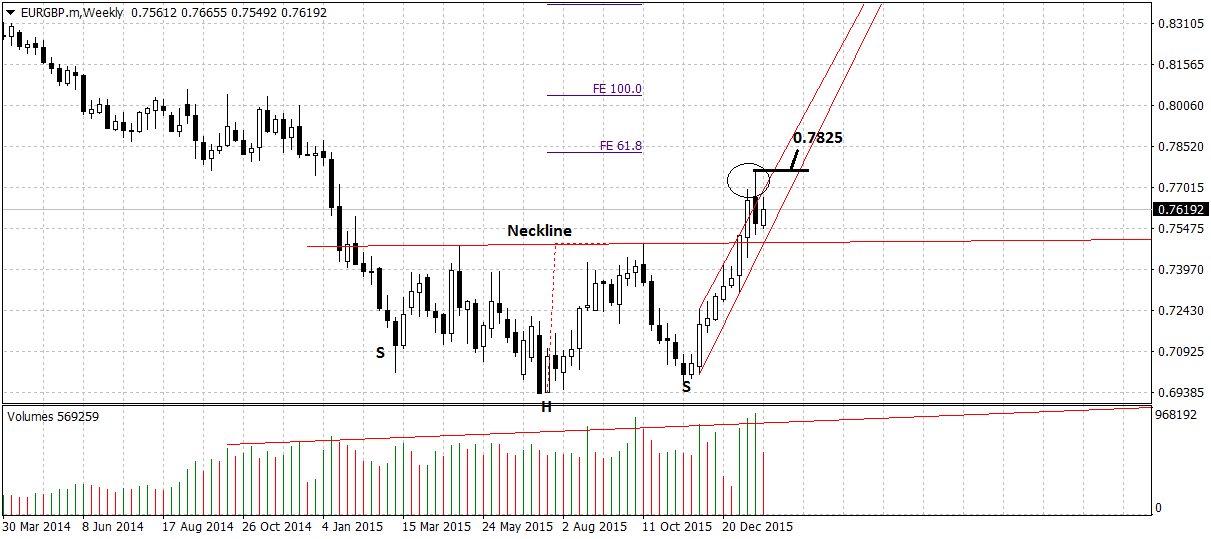

Moving on now to the chart of euro-pound and we immediately see an inverted head and shoulders pattern across the bottom of the chart, with volume increasing on the right shoulder as expected.

The exchange rate has breached the neckline already and moved up a fair distance, but has not reached the 61.8% extrapolation of the height of the pattern higher, which is the minimum price expectation, and minimum target for the breakout.

Nevertheless, the picture is complicated by the exhaustion blow-off circled on the chart, where the exchange rate moved out of the top of its channel and then reversed.

Overall, however, the evidence is still bullishly-biased and I expect the exchange rate to recover eventually and push higher, with a fresh up-trend confirmed by a move above the 0.7755 highs, and an initial target at the 61.8% extrapolation at 0.7830.

From a fundamental perspective there is a lot of support for more euro strength.

The euro is being supported by a steadily improving economic picture, which includes modest renewal in several key sectors, the most noteworthy of which include housing, bank-lending and employment.

The major downside risk remains deflation.

ECB Will Struggle to Engineer Weaker Euro

Analyst Petr Krpata, of ING Bank, in a report, this morning, entitled: “It’s much more difficult to generate a weaker Euro”, suggests it will get harder for the ECB to engineer a weaker euro, removing a major risk factor for more euro-downside:

“It is likely to get harder and harder for the ECB to generate weaker EUR given that (a) its toolkit is narrowing and (b) some factors behind the stronger trade weighted EUR look to be beyond the ECB’s influence.”

Krpata says ING’s economists share the current voguish view that the ECB will probably introduce a 10 basis point cut to the deposit rate in March, with a possible 5 to 10bn per month QE add-on, however, he sees this as having “limited downside for EUR/USD” since “ a 10bp cut is now fully priced in while the modest increase in QE should only send EUR/USD lower by around one big figure.”

A stronger dollar is therefore required to take the euro -dollar exchange rate lower, but given the FOMC rather dovish statement, which actually seemed to reflect the markets recalculation of its tightening trajectory radically lower, a rate hike now seems much less likely than at the start of the year.

However, Krpata goes on to say that although “theoretically” a much more aggressive increase of 40-50bn in monthly asset purchases by the ECB would push the EUR/USD down, this is unlikely due to “technical constraints”, which include a lack of supply of available bonds.

Whilst such a problem could be resolved through a widening of the eligible assets, for example by including corporate bonds into the mix, the ING analysts sees the likelihood of the ECB doing this as small:

“this would be only possible if the scope of eligible assets to purchase is broadened (ie, to corporate bonds). However, the bar for this to happen is very high.”

He also points out that is is becoming harder to prevent the Euro’s Trade Weighted Index from strengthening, and this is pushing higher and “uncoupling” from the EUR/USD rate, due to the combination of safety and yields investors seem to be finding so attractive in the form of euro-zone assets.

He ends the report saying:

“As long as these idiosyncratic (non-monetary) drivers remain place, it will be difficult for the ECB to lean against the trade weighted EUR strength.”