Selling Euro Against Pound Sterling Still Makes Sense After ECB says MUFG

- Written by: Gary Howes

Image © Adobe Images

Selling the Euro against Pound Sterling still makes sense following Thursday's European Central Bank (ECB) policy update, according to strategists at MUFG Bank.

The Euro to Pound exchange rate fell after the ECB kept interest rates unchanged but lowered its inflation forecasts, suggesting it was well on its way to hitting its 2.0% inflation mandate on the two-year horizon.

Lower economic growth forecasts accompanied the inflation forecast downgrade, although the ECB reiterated it was no closer to cutting interest rates.

Track GBP and EUR with your own custom rate alerts. Set Up Here

The credibility of waiting until June could wane if upcoming data releases undershoot, which is a possibility as the Eurozone economy is already operating with a sizeable output gap.

"With inflation more likely to fall back to target and economic growth in the euro-zone expected to remain well below potential this year at 0.6%, it is becoming harder for the ECB to justify maintaining the current restrictive monetary policy stance," says Lee Hardman, an analyst at MUFG Ltd.

In a note to clients, MUFG says the ECB's March update has not materially changed its outlook for the euro.

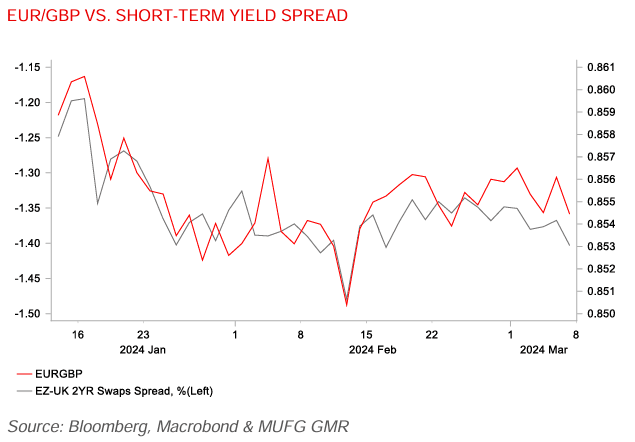

"We continue to recommend a short EUR/GBP trade recommendation which should benefit in the coming months from the ECB beginning to cut rates ahead of the BoE," says Hardman.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes

In addition, the current favourable low volatility market conditions for carry trades that favour the pound more than the euro are expected to continue.

"Key technical support for EUR/GBP remains located at the 0.8500-level," says Hardman.

MUFG strategists target a move to 0.8275, which equates to a Pound to Euro exchange rate of 1.2085.

"We are more optimistic that the outlook for the UK economy is improving at the start of this year. Leading indicators such as the PMI surveys have been signalling that growth is picking up which creates a more supportive backdrop for the GBP," says MUFG in a strategy note dated February 23 in which the details of the trade recommendation are discussed.

"The recent pick-up in business confidence has been stronger in the UK than in the euro-zone," adds the note.