GBP/EUR Exchange Rate Falls in Wake of CPI Release

- Written by: Gary Howes

In a move that has concerned analysts, the Pound to Euro exchange rate (GBPEUR) declined following the release of CPI inflation data for April which was hotter than expected.

Concerns for the Pound's outlook grew after it fell on news UK inflation rose 8.7% in the year to April, down from 10.1% in March, but well above the 8.3% reading the market was looking for and above the Bank of England's forecast for 8.4%.

Typically, the Pound would be expected to rise following such a strong upside beat.

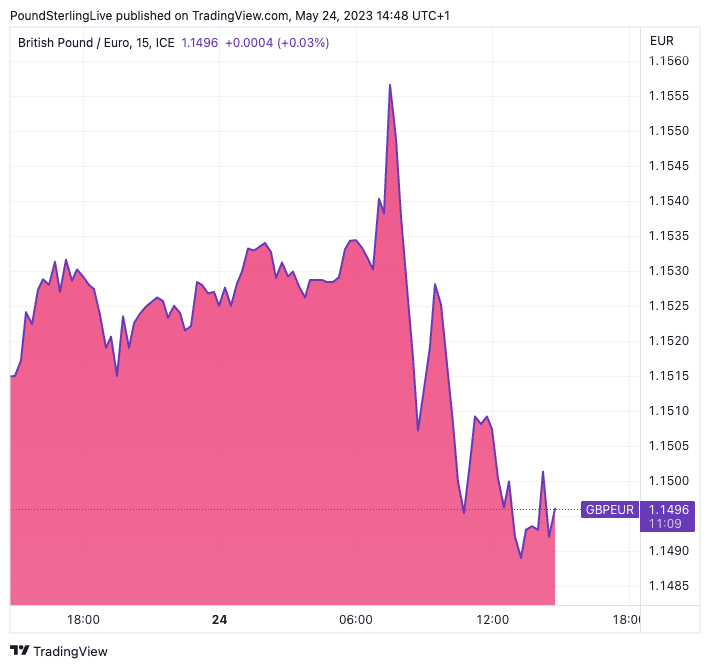

Above: GBP/EUR at 15-minute intervals showing the initial rise followed by a sell-off.

Of particular concern was a rise in core CPI inflation to 6.8% year-on-year, which is above expectations for a reading of 6.2%, and suggests the Bank of England has more work to do.

Markets promptly raised bets for the number of Bank on England interest rates yet to come which in turn boosted UK two-year bond yields.

The Pound typically tracks short-term yields and initially rose, as was expected.

But, surprisingly, the Pound soon fell back in a move one analyst describes as "an ugly look for the currency".

"Sterling has traded slightly lower despite a massive shock higher in UK short rates on the back of a spike in April CPI figures. This is an ugly look for the currency," says John Hardy, Head of FX Strategy at Saxo Bank.

The Pound to Euro exchange rate rose to 1.1563 in the wake of the data - its highest level since December - but it soon retreated to sub-1.15 as markets queried whether strong inflation is really a good thing for the UK economic outlook.

Indeed, this makes sense: the UK's economy is under pressure from rising prices, meaning more inflation means more subdued growth.

There are now three further 25 basis point Bank of England hikes baked into the outlook by market participants, a development that could well prompt a sharp economic slowdown further out.

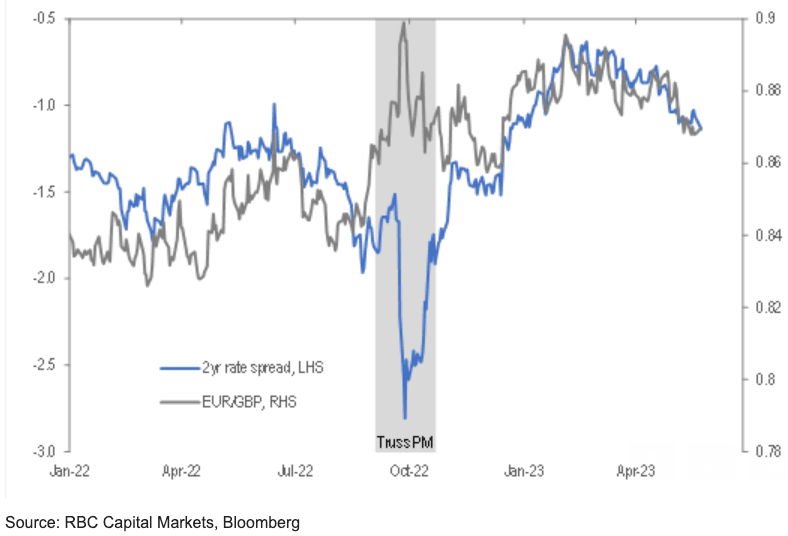

The last time the Pound detached from rates in such a manner was during the time of Liz Truss when investors feared her 'mini budget' would put the UK's finances on an unstable path.

Above: "GBP has become a vanilla rates story" - RBC Capital Markets. The above chart shows that it is only during exceptionally negative events (mini budget) that GBP detaches from interest rate market moves.

Could the Pound's move lower in reaction to the inflation data - despite rising yields - be indicating investors are nervous?

"It is a very ugly look for a currency when a huge leap in more hawkish central bank anticipation fails to support the currency. The Bank of England will have no choice but to continue tightening rates, holding its nose all the while on the knowledge that this aggravates the incoming recession risks again, and this just after it was rolling out a more positive message on the economy," says Hardy.

"With inflation this high, the fiscal impulse may also have to weaken or in any case, a stagflationary economy leaves both fiscal and monetary authorities in a bind with no room for manoeuvring," he adds.

Hardy expects Sterling to break down further.

To be sure, it is still too soon to say a major crisis in confidence is underway, after all, "one swallow does not a summer make."

But this is nevertheless something that has come onto the radar and makes us more cautious about the outlook for the UK currency.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes