GBP/EUR Tipped Lower at TD Securities; BoE and ECB Cited

- Written by: James Skinner

"There looks to be a hawkish divergence relative to the Fed (and the BOE). If anything, it now looks like the Fed is in the ECB's shadow" - TD Securities.

Image © Adobe Stock

The Pound to Euro exchange rate was trading at substantially reduced levels ahead of the weekend but could have further to fall if the TD Securities strategy team is on the money when looking for Sterling to slip lower to around 1.13 in the fortnight or so to come.

Sterling was licking wounds below 1.15 on Friday after Europe's single currency strengthened against many counterparts following a European Central Bank (ECB) interest rate announcement that was followed by an almost seismic rout in global stock and bond markets on Thursday.

Governing Council members matched counterparts on the Bank of England (BoE) Monetary Policy Committee when lifting interest rates by half a percentage point but struck a notably more 'hawkish' tone in warning that they expect to raise borrowing costs "significantly" further over the coming months.

"It certainly suggests there may be more upside around terminal rate. We think the ECB's hawkishness at this meeting may also be an attempt to have EUR do some of its work for them on the fight against inflation (or at the very least, anchor the currency at 'elevated levels')," says Mazen Issa, a senior FX strategist at TD Securities.

Above: Pound to Euro rate shown at hourly intervals.

Above: Pound to Euro rate shown at hourly intervals.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes

"There looks to be a hawkish divergence relative to the Fed (and the BOE). If anything, it now looks like the Fed is in the ECB's shadow," Issa writes in a Thursday note advocating that clients sell GBP/EUR around 1.1540 in anticipation of a fall to around 1.13.

Almost as importantly as Thursday's interest rate statement, the ECB said it would begin a slow process intended to reverse the various quantitative easing programmes carried out over the years, which had driven large amounts of capital into other bond markets as well as local and international stock markets.

One important factor explaining the difference in stance between the ECB and Bank of England is the difference between how quickly each expects inflation to return to its two percent target with the ECB projecting on Thursday that inflation would remain above its target even at the end of its forecast horizon in 2025.

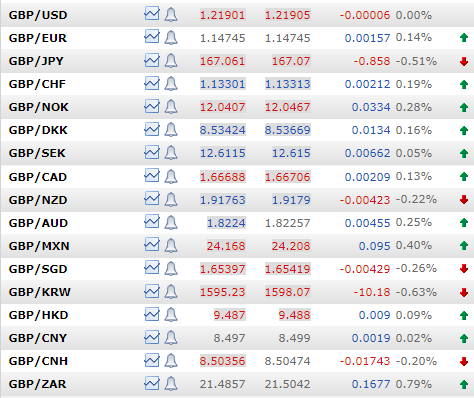

Above: Sterling exchange rates on Friday. To optimise the timing of international payments you could consider setting a free FX rate alert here.

"CPI inflation is expected to continue to fall gradually over the first quarter of 2023, as earlier increases in energy and other goods prices drop out of the annual comparison," the BoE said on Thursday after raising Bank Rate to 3.5%.

The BoE projected in November that inflation would fall significantly next year and below its 2% target before the end of its own forecast horizon.

However, this was based on the assumption of substantial further increases in interest rates and the BoE has acknowledged repeatedly that risks to its forecasts for inflation are on the upside.

"There are considerable uncertainties around the outlook. The Committee continues to judge that, if the outlook suggests more persistent inflationary pressures, it will respond forcefully, as necessary," the BoE said on Thursday.

Above: Pound to Euro rate shown at daily intervals. If you are looking to protect or boost your international payment budget you could consider securing today's rate for use in the future, or set an order for your ideal rate when it is achieved, more information can be found here.

Above: Pound to Euro rate shown at daily intervals. If you are looking to protect or boost your international payment budget you could consider securing today's rate for use in the future, or set an order for your ideal rate when it is achieved, more information can be found here.