Pound Sterling / Euro: BoE-Fuelled Rally Trumped by the ECB

- Written by: Gary Howes

Image © Adobe Images

Pound Sterling looks supported, but the big risk for those readers holding out for higher rates is the Bank of England skips another hike in February.

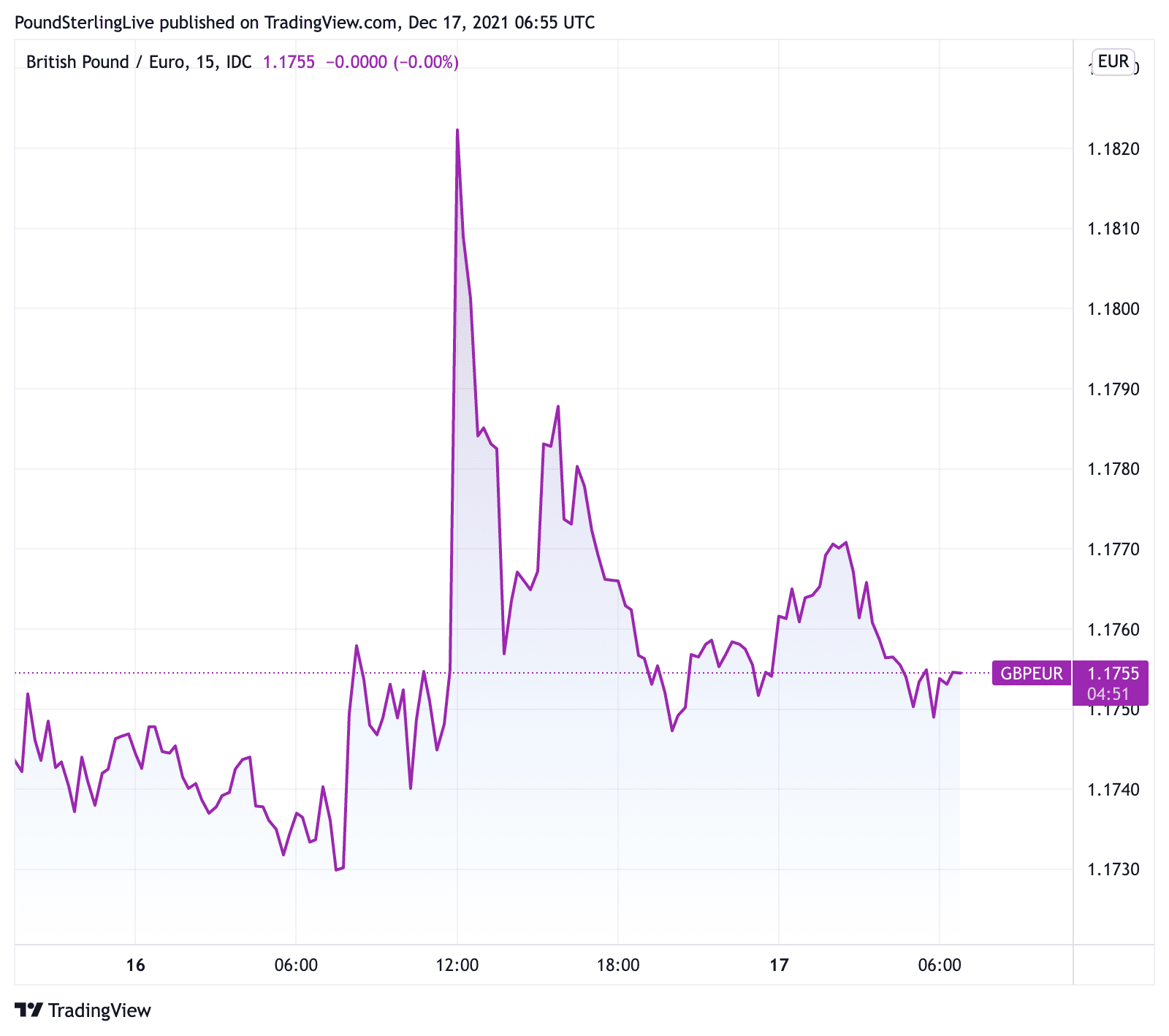

The UK currency raced higher against the Euro, Dollar and its major peers after the Bank of England went ahead and raised interest rates in a move that surprised a good portion of the market.

But a three-quarters of a percent advance by the Pound to Euro exchange rate - that saw the pair go as high as 1.1828 - was soon wiped away by the European Central Bank (ECB) which also had a trump card to present.

The Euro roses after the ECB effectively 'tapered' its quantitative easing programme in a move that surprised a market that had expected the slow-moving central bank to maintain generous monetary settings for an extended period.

A decision to reduce the Pandemic Emergency Purchase Programme (PEPP) in the first quarter of 2022 will see the programme terminated by March 2022, in what amounts to the first tentative attempt by the ECB to towards withdrawing monetary support.

Euro exchange rates rose across the board as markets brought forward the timing of the ECB's first rate hike in the wake of announcement.

"While the Fed having doubled its tapering pace and the Bank of England having just hiked interest rates, the ECB has just laid out its plans for also reducing its monthly asset purchases. It is a very cautious taper," says Carsten Brzeski, Global Head of Macro at ING Bank N.V.

The Euro to Pound exchange rate recovered from post-Bank of England hike lows at 0.8453 back to 0.8500 (GBP/EUR back down to 1.1757).

The Euro to Dollar exchange rate rallied half a percent to quote at its highest level since November 30 at 1.1360.

Above: A decision to raise rates by the BoE boosted Sterling, but the ECB's decision soon erased gains.

- Reference rates at publication:

GBP to EUR: 1.1757 - High street bank rates (indicative): 1.1450 - 1.1530

- Payment specialist rates (indicative: 1.1650 - 1.1670

- Find out more about specialist rates, here

- Set up an exchange rate alert, here

- Book your ideal rate, here

The ECB's Governing Council said economic recovery and progress towards its medium-term inflation target permits a step-by-step reduction in the pace of its asset purchases over the coming quarters.

However, it cautioned monetary accommodation was still needed for inflation to stabilise at the 2% inflation target over the medium term.

"Even if the ECB cannot directly stop inflation, it has definitely run out of arguments for continuing with all emergency measures and ultra-loose monetary policy as if nothing had happened. Today’s cautious taper is only a logical consequence," says Brzeski.

The ECB and Bank of England therefore both delivered a hawkish surprise at their December outings, a shift that meant an initial surge higher by the Pound was ultimately cancelled out by a jump in demand for euros.

The risk for Sterling going forward is that the Bank of England sits back having raised rates in December, a real possibility given the uncertainty surrounding the Omicron variant's march and early signs the economy is rapidly slowing.

Eight Monetary Policy Committee (MPC) members were concerned that not hiking rates today might cause inflation expectations to drift up and voted for a hike, but Professor Silvana Tenreyro said the emergence of the Omicron variant favoured waiting until February.

Secure a retail exchange rate that is between 3-5% stronger than offered by leading banks, learn more.

Daniel Vernazza, Chief International Economist at UniCredit, says the Bank of England will likely bypass a February rate hike, opting to asses any damage caused by Omicron.

"In our view, the MPC should probably have waited a little bit longer before raising rates. The UK economy was already slowing materially before the Omicron variant was identified," says Vernazza in a post-decision note to clients.

He says the sharp rise in Covid-19 cases along with a significant squeeze in real disposable income (from high inflation and reduced fiscal support), low consumer confidence and slightly tighter monetary policy will likely all make for a difficult few months ahead.

"We think these headwinds will likely force the MPC to pause raising rates for some time now, although it will probably be able to do one more hike before the end of next year," says Vernazza.

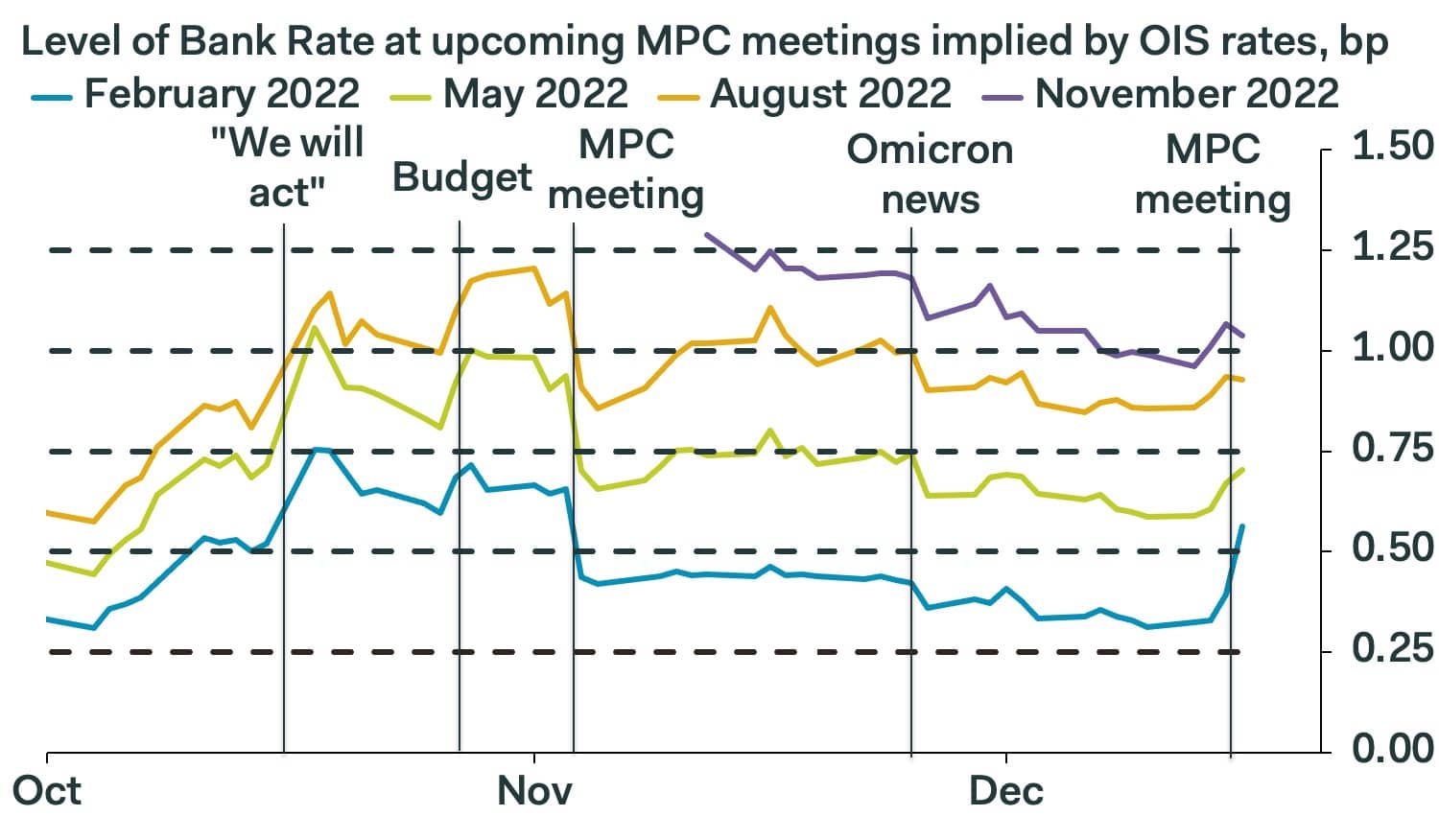

If correct, the market will have to wipe out the hefty expectations for another rate hike in February.

Above: "Next rate hike (to 0.50%) coming in February, according to panicking markets" - Samuel Tombs, UK Economist at Pantheon Macroeconomics. Image courtesy of Pantheon Macroeconomics.

Given the recent hawkish turns at the ECB and Federal Reserve this could leave the Pound exposed to downside.

For Sterling to extend higher February rate hike expectations must hold, at the very least.

ING economist James Smith says the Bank should deliver two, or at most three, rate rises next year.

"Will today’s move be followed by a full 25bp rate hike at the February meeting?" Asks Smith.

"It’s possible but for now we suspect not," is his answer.

The Bank said Omicron probably won’t change the medium-term picture decisively, "but in the short term, it still means turbulence for the UK economy," says Smith.

ING expects policymakers to wait until later into 2022 before hiking again, a call that if correct means interest rate and exchange rate markets will give back some of their recent advance in the early part of 2022.

There are however two variables we will watch:

The market anticipates the UK economy is facing Omicron-inspired headwinds, but what of the U.S. and Eurozone?

The UK's Omicron wave looks to be breaking sooner than the inevitable waves that will hit the the U.S. and Eurozone.

If they too endure a surge in cases in coming weeks it would take out some of the sting coming from a Bank of England decision to skip a February rate hike.

Another variable involves the speed at which Omicron arrives and then disappears: South Africa's wave appears to be peaking some three weeks since it commenced in earnest.

If the UK's wave follows the same pattern this means the wave will be in retreat well before February, which could yet allow the Bank to proceed with a hike.

For now the Pound is supported, but this support appears contingent on how fast Omicron recedes.