Pound-Euro Rate at Fresh 4-Month Best Following Hawkish Bank of England

- Written by: Gary Howes

Image © Adobe Stock

The Bank of England's August policy event proved more 'hawkish' than investors and analysts expected, potentially setting the scene for higher Pound Sterling exchange rates over coming weeks.

The British Pound recorded its strongest purchasing levels against the Euro since April after the Bank signalled to markets that a 2022 interest rate rise was likely, which puts it at least two years ahead of the European Central Bank in achieving lift-off.

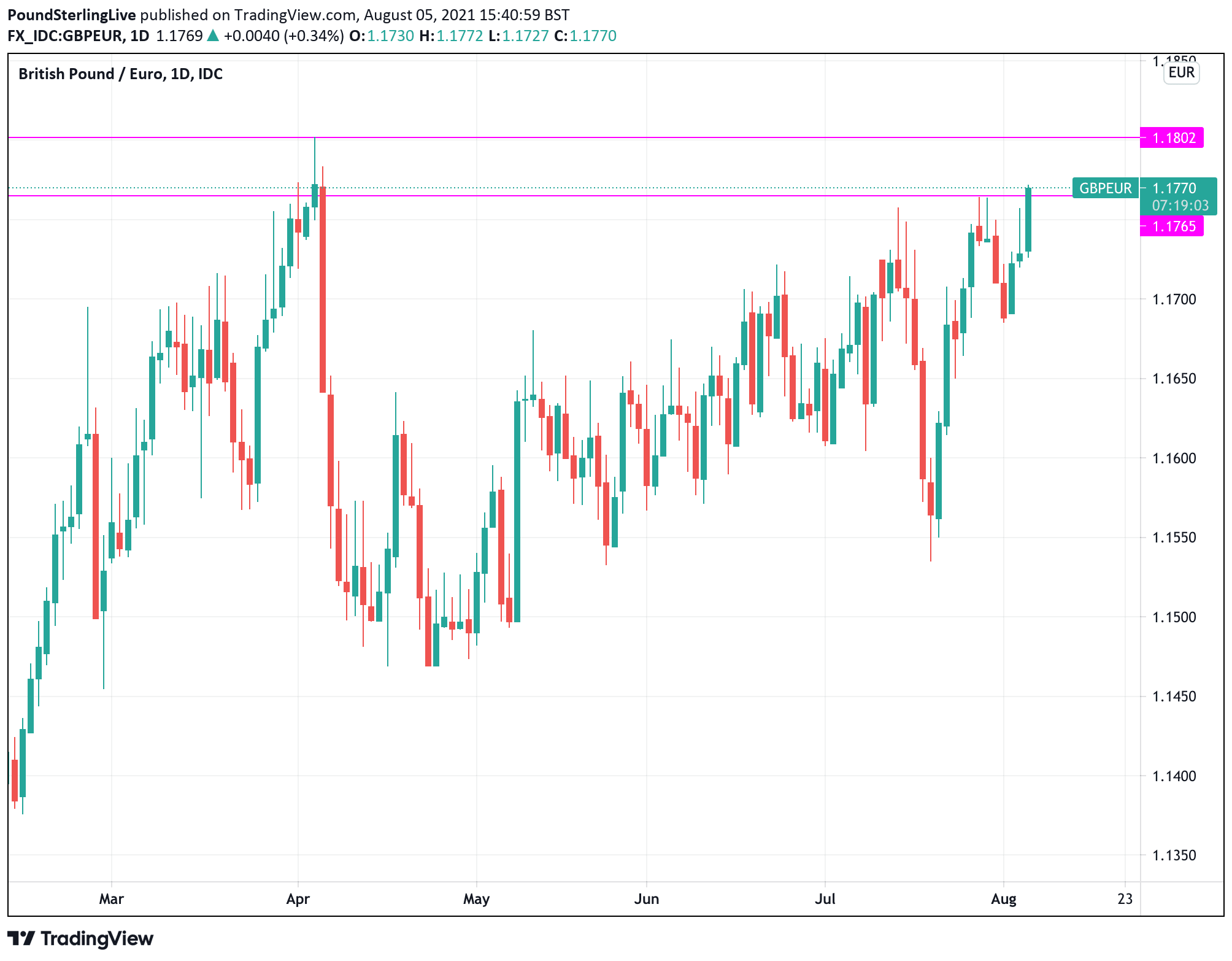

The divergence between the two central banks is said by foreign exchange analysts to be supportive of the Pound-to-Euro exchange rate which reached a best of 1.1772 on Thursday and those watching for stronger levels in the pair will now be looking to April's high at 1.1802 as the next potential milestone.

A technical gaze is however important at this point, given charts confirm the Pound-Euro rate has struggled to maintain itself above 1.1750.

We would caution to readers therefore the UK currency is prone to capitulation around these elevated levels.

Indeed, as the below shows the exchange rate is entering a range at which selling interest will likely build:

Secure a retail exchange rate that is between 3-5% stronger than offered by leading banks, learn more.

"While the pound is yet to return to pre-pandemic highs of 1.20 against the Euro we saw last February, it remains strong and is currently the best rate we’ve seen since April. To get the most from their money this summer, Brits should keep their eye on exchange rates and consider locking them in while they're high,” says Ian Strafford Taylor, CEO at FairFX.

The Bank's August policy statement offered a great deal of interest to economists given the number of guidance shifts on offer.

Having previously said that raising interest rates would not take place "until there is clear evidence that significant progress is being made", it now says that "some modest tightening of monetary policy over the forecast period is likely to be necessary".

The statement also said some MPC-members now regard that the conditions of previous guidance are already met, even if this is not a sufficient condition for tightening at the current time.

"While the Bank of England, as expected, maintained the Bank Rate at 0.1% and retained the target for the asset purchase programme, policy guidance turned more hawkish. It now says that some modest tightening will likely be necessary over the forecast period," says Knut A. Magnussen, an analyst at DNB Markets ASA.

Foreign exchange analysts are of the view that such a 'hawkish surprise' from a central bank is typically supportive of the currency it issues.

Foreign exchange analyst Kit Juckes at Société Générale says there is now scope for the Pound to finally break into fresh highs against the Euro as a result.

"I think the market's bias is such that sterling can gain more on ‘hawkish' news than it loses on unchanged voting. EUR/GBP looks ready to push below 0.85 to me," says Juckes. EUR/GBP at 0.85 equates to a GBP/EUR rate of 1.1765 (see above chart).

{wbamp-hide start}

{wbamp-hide end}{wbamp-show start}{wbamp-show end}

The Bank expects inflation to fall back to just above 2.0% in two years’ time and just below 2% in 3 years’ time, suggesting there is a prolonged period of above-target inflation on the horizon for UK consumers.

Recall, the Bank's mandate is to ensure inflation does not stay above 2.0% for too long, these forecasts are therefore inconsistent with interest rates sitting at record-low levels.

Indeed, the Bank's forecasts for target-busting inflation comes despite them saying they agree with the market's expectations for at least one interest rate rise of 15 basis points to have occurred by the end of 2022.

It is this formulation that confirms the Bank to be signalling a 2022 rate rise.

The Bank of England therefore now looks ready to raise interest rates ahead of a number of other G10 central banks including: the Reserve Bank of Australia, the U.S. Federal Reserve, the Bank of Japan, the Swiss National Bank and the European Central Bank.

On this basis the Pound looks set to remain supported against the Aussie Dollar, U.S. Dollar, Yen, Franc and the Euro, even if it remains in search of other catalysts to drive more meaningful gains.