Pound Sterling at Critical Juncture against Euro Following Six Days of Unchallenged Gains

Image © Adobe Images

- GBP/EUR spot at publication: 1.1260

- Bank transfer rates (indicative guide): 1.0960-1.1045

- FX specialist rates (indicative guide): 1.1140-1.1180

- Find out how you can get a specialist rate, here.

The British Pound has arrived at a critical juncture in its recovery against the Euro, with the exchange rate hitting its head on a resistance level that has frustrated advances since June and must be overcome if the multi-month period of sideways trading is to end.

The Pound-to-Euro exchange rate has rallied for six sessions in succession now, taking the pair to new 7-week highs at 1.1274 on Thursday. It is at 1.1260 at the time of publication on Friday.

The fundamental trigger is the signing of the EU-UK trade deal in December, as well as the paring back in expectations for the Bank of England to cut interest rates to negative that took place this week.

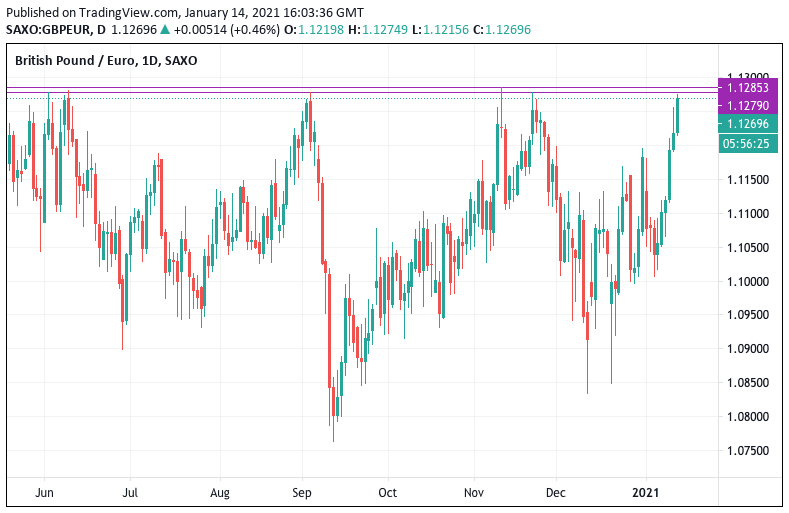

But the technical picture is now in focus, with the below chart explaining why the market has arrived at an important technical level that could be as important for the future of the exchange rate as the fundamentals:

Above: GBP/EUR daily chart showing a discernible resistance area.

As can be seen the Pound-Euro rate has been trending in a sideways pattern since May 2020, the upper limit of the range can be identified by the 1.1285-1.1279 region: these being the two November highs as well as the September high.

But June also saw the Pound's strength fade at this level, creating a template for a multi-month sideways move.

The exact location of the highs is not set in stone given numerous data providers will deliver different numbers, but what is important is that a very discernible band of resistance can be seen and the highs are all remarkably close to each other.

This gives an inidication of a solid fracture line in the market that will inevitably become self-reinforcing as market participants will likely place orders around this level or simply wait for a resolution.

"We still like Sterling but are wary about adding on front of these crucial resistance levels," says a note sent out on Friday to clients of the spot trading desk at investment bank JP Morgan in London. "Plan is to trade the breaks or look pick up sterling on dips".

The question those watching Sterling-Euro will ask is whether January will see the pattern of recent months repeated and a fall back into the range transpires, or whether the Pound breaks into a new higher range that leads to a more durable period of strength.

Secure a retail exchange rate that is between 3-5% stronger than offered by leading banks, learn more.

From a technical perspective, the market is at a proverbial crossroads and Friday's close will be instructive.

Carole Laulhère, FX & Rates Strategist of Corporates at Société Générale SA says a break higher through this resistance level could potentially open the door to exchange rates towards 1.15.

Laulhère says GBP/EUR has recovered towards graphical resistance of 1.1286 where June, September and November highs are to be found.

Until now, "it is worth noting that the price action has remained roughly contained within a range," says Laulhère, noting the pair is now at its upper band of this range.

In case 1.1286 gives way, GBP/EUR could undergo a stronger appreciation towards projections of 1.1363 with possibility to retest the high of April last year near 1.1534.

{wbamp-hide start}

GBP/EUR Forecasts Q2 2023Period: Q2 2023 Onwards |