UK Businesses are now More Confident than they have been Since 2014: Business Barometer

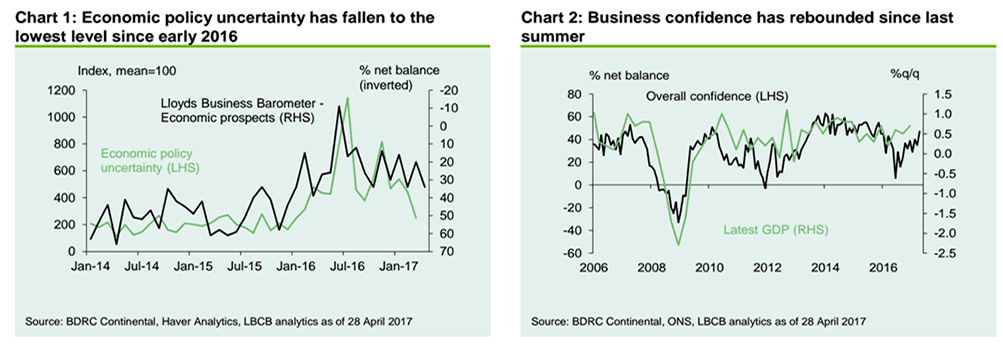

Business confidence surges to a seventeen-month high in April, led by rises in both business prospects and economic optimism according to the latest Business Barometer from Lloyds Bank.

The findings show a pickup in economic momentum at the start of the second-quarter of 2017.

“Business confidence rebounded in April, rising to a seventeen-month high of 47%, up 12 points from 35% in March. It therefore stayed above the survey’s long-term average of 32% and signals robust economic activity at the start of Q2,” say Lloyds Bank.

Sentiment is seen highest among firms in the industrial sector this month, while domestic prices continue to trend higher, especially in the consumer services sector.

Employment prospects edge back this month, but the three-month average stays at the strongest level since the EU referendum.

The survey was taken after the triggering of Article 50, but before the Prime Minister’s announcement of an early general election.

Lloyds report the increase this month was driven by rises in firms’ assessment of their own business prospects, as well as their optimism regarding the wider economy.

The research from Lloyds provides an immediate snapshot of underlying trends in the economy and is therefore useful at providing a timely assessment of trends.

Such survey data does however tend to be less accurate than the official ONS data which is however less timely.

But, the Lloyds Business Barometer does reflect trends in other surveys.

This week we reported that UK retail sales might also be picking up.

The CBI Distributive Trades Survey - released on April 27, retail sales growth accelerated in the year to April, with volumes rising faster than expected.

The report showed a reading of 38, a massive beat on the 6 expected by economists and the 9 reported in the previou month.

"After a dismal quarter for the high street in Q1, the strength of April’s CBI Distributive Trades Survey is welcome news and helps to allay fears that real consumer spending growth is slowing sharply in the face of higher inflation," says Ruth Gregory, UK Economist at Capital Economics.

However, GfK/NOP Consumer Confidence - out on Friday April 28 - showed a decline this month, but the big picture remains that consumers are weathering the squeeze on their spending power from higher inflation well.

The headline GfK/NOP composite index of consumer confidence edged down from -6 in March to -7 in April, in line with the consensus expectation.

Despite the fall, confidence remains above the series’ historical average of -9.

The resilience of the index suggests to Capital Economics that that the sharp slowdown in retail sales growth in the first quarter is likely to abate in Q2.