Bank of England Must be Agressive in Order to Avoid a Strong GBP Recovery

With strong arguments against fresh Bank of England policy measures being introduced on the 4th of August, we see the balance of risks lying with a stronger British Pound against the Euro and US Dollar by the time the day is done.

Markets are pricing in at least a 25 basis point cut to the record-low 0.50% basic rate of interest at the Bank of England this Thursday.

The Overnight Indexed Swap markets are actually pricing in a 100% chance of a 25 basis interest rate cut.

The British Pound is therefore priced accordingly, and will likely retain a soft tone until the final outcome of Thursday’s decision is made known.

The intention of any action at the Bank would be to minimise the negative impact to the economy derived from the shock vote by the UK to leave the European Union in June.

There is also the question of whether the bank’s dormant quantitative easing programme will be resuscitated in order to further suppress the cost of borrowing.

“Note that while a 25bp rate cut this week is fully discounted into UK rates, but re-starting QE is not priced in and would likely be the catalyst for the next major decline in Sterling,” says a note on the matter from Citi Economics.

The hope by proponents of any action is that both the rate cut and increased quantitative easing will oil the financial cogs in the economy, thus ensuring downside pressures on growth are minimised.

However, questions have been raised as to just how effective the moves would be with some analysts suggesting cutting rates and boosting quantitative easing could do more harm than good.

We have already reflected on how the measures are likely to impact savers with major banks warning that charging savers to deposit money with them could become a reality.

Policy measures could also simply prove ineffective in achieving their stated aim of stimulating bank lending.

“With interest rates close to zero along much of the curve there is limited room for monetary policy to help. Moreover, unlike the financial crisis, the problem this time round is one of credit demand rather than supply,” notes Robert Wood, economist with Bank of America Merrill Lynch Global Research.

Banks are better capitalised this time around, so the BoE does not believe it is currently at the zero lower bound, and would therefore believe they have space within which to play with their knives.

The Zero Lower Bound is a problem that occurs when the short-term nominal interest rate is at or near zero, causing a liquidity trap and limiting the capacity that the central bank has to stimulate economic growth.

Indeed, a rate cut will help only a little argues Wood:

“It may not be fully passed through to borrowers, or banks appetite to lend could be harmed. Other countries that have pushed rates to or below zero have seen negative effects. However there is likely to be some passthrough, meaning rate cuts will help a little.”

Other analysts are in agreement that there is little room to play.

Arnaud Masset at Swissquote Bank says he believes policy-makers will be best served by opting keep its powder dry.

“The BoE has limited room for manoeuvre before switching to negative interest rates. Therefore, we expect the central bank to leave its benchmark rate unchanged at its next meeting on August 4th, waiting for further information about the implication of Brexit for the UK economy,” says Masset.

Further Quantitative Easing Offers Little Advantages

While cutting interest rates could offer a little support to the economy, Bank of America’s Wood argues that the disadvantages of asset purchases are actually bigger than rate cuts:

“While there are undoubted problems with rate cuts we think those issues are larger for Quantitative Easing (QE). Many of the channels through which QE works are likely to be blocked at present.

“Confidence effects from QE are hard to detect, market liquidity is not impaired currently, and there is no evidence that QE boosts bank lending.”

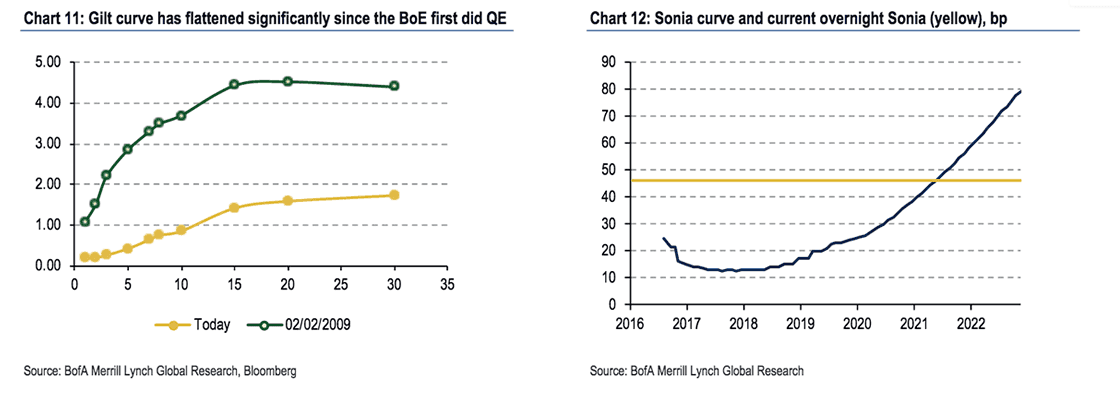

In 2009 quantitative easing was able to shift the front end of the curve by signalling to the market that Bank rate would not be raised in the near future.

“But there is little room for those effects now that the market is already pricing front end rates to remain close to zero for years,” says Wood.

Indeed, analysts at JP Morgan agree with the assessment on QE's potential impact.

They tell clients that their base-case assumption is for a 50bp rate cut with QE of £75bn and for the British Pound, rate cuts will matter more than QE.

“In this regard, the important issues will be the magnitude of rate cuts delivered (as a rule of thumb, every 10bp weakens the currency by 1%) and any forward guidance from the BoE on it’s preferred channel for further monetary policy easing (a preference for QE over rate cuts will limit how much GBP can weaken),” says JPM's Meera Chandan.

However, JP Morgan believe the overwhelming risks to Sterling are to the downside, and recommend a bearish trade on GBP against the EUR as a result.

The trade is predicated not just on lack of concession in the currency, but also on the view that not enough is priced into UK rate markets.

Only 25bp rate cut is priced by markets for August and an additional 10bp of rate cuts are priced in for the next year.

“We recommend initiating shorts in GBP vs. EUR this week,” says Chandan.

A Flat GBP Should the Bank Meet Expectations

The relative resilience of the UK financial markets, the economy and improving business confidence surveys since the referendum, may surprise the Bank of England.

As such, there are increased doubts as to whether the Governor will be able to marshal sufficient support from other members of the Committee to ease policy quite so aggressively at this stage.

If the Bank ‘chickens out’ of a policy move, expect a sharp pop higher in the British Pound as those 100% expectations for a rate cut are rapidly unwound.

Nevertheless, as mentioned, the prospect of a rate cut is near 100%

“We look for a 25bp rate cut, £50bn QE split across public and private sector assets and an extension of the FLS. Because we think the central bank is already modestly behind the curve, we doubt such a combination would surprise the market or the public, limiting its confidence effects,” says Wood.

The risks therefore seem skewed to disappointment in our view, which would surely boost the Pound.

But, the Bank knows this and would be wary that any failure to act on rates could well boost Sterling just at a time when policy makers desperately need the weaker exchange rate to support UK exports.

Therefore, they may deliver enough changes simply to keep the ship steady.

But, radical moves are unlikely.

“With financial conditions having improved in recent weeks, and the efficacy of further monetary stimulus open to question, there may not be unanimous support for a radical easing,” says Adam Chester, Head Economist at Lloyds Bank Commercial.

In the event of a 25 basis point rate cut, and some alteration to the quantitative easing programme, the British Pound could well trade sideways, disappointing bears and bulls alike.

“While it could hint at future action, the Bank may hold off from implementing any changes to the size or composition of its Quantitative Easing Programme for now,” says Chester.

Some members of the Bank’s policy committee may be reluctant to release the ‘policy bazooka’ until there is stronger evidence it is needed or until the Chancellor’s fiscal plans, due out at the Autumn Statement are made clearer.

The entire event could end up being a damp squib for currency market watchers - just what the Bank of England wants.

For Maximum Effect the Bank Should Throw the Kitchen Sink at the Problem

So with confidence on the effectiveness of the Bank of England's policy response clearly lacking, what should the Bank do to get the most bang for its buck?

Bank of America believe the bazooka would have to be deployed arguing stimulus must be overegged.

"Policy is constrained and the potential downside economic risks large, so, in our view, the right prescription is to do 'too much', do it early hoping that reduces the need for further stimulus later and do everything in the hope that at least something works," says Wood.

Ultimately, given the evidence of a significant shock to confidence, subdued current and expected inflation, and the lags with which monetary policy works, the risks of not easing policy next week greatly exceed the risks of stimulating too much.

"Therefore, on Thursday we expect the BoE to act pre-emptively and announce a 'package' of easing measures. In addition to a 25bp cut to the bank rate, we expect it to announce an expansion of the Funding for Lending Scheme - which currently subsidizes lending to SMEs and is due to expire in January 2018 - both in scope and size," says Daniel Vernazza at UniCredit Bank in London.