Pound Surges vs. Australian Dollar as Westpac Announce Surprise Mortgage Rate Rise

Above: Westpac has raised interest rates on mortgages, signalling funding pressures in the Australian financial system. Image © Westpac.

The Australian Dollar is seen coming under pressure in the wake of news that Australian lender Westpac has raised its standard variable home loan rate by 14bp to 5.38%.

The move is taken as a signal to markets that the Reserve Bank of Australia (RBA) will have to keep interest rates lower for longer than previously anticipated, which in turn draws support away from the Australian Dollar.

The 200-year-old institution states that the rate reflects a sustained increase in funding costs.

"This is a tough decision but we have a responsibility to price our mortgage products in a way that reflects the reality of our funding costs," says George Frazis, Chief Executive, Westpac Consumer Bank. “Wholesale funding is an important component in our mortgage pricing. In particular the bank bill swap rate, which is a key wholesale funding rate for mortgages, increased by about 25 basis points between February and March this year and has remained elevated."

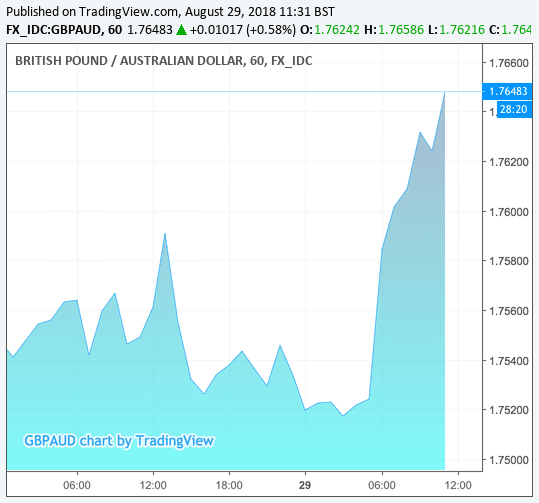

The Pound-to-Australian Dollar has risen in response to the news with 1 GBP buying 1.7601 AUD on the inter-bank market, taking the most competitive rates for international payments back up above 1.75 again.

The AUD/USD exchange rate is now half a percent lower at 0.7373.

But why has the Australian Dollar reacted negatively?

This move by Westpac has important implications for future moves at the Reserve Bank of Australia; in short they are unlikely to raise interest rates in the foreseeable future if they believe Australian financial markets are tightening up.

"The decision will also keep the central bank side-lined for longer. 2-year sovereign yield dropped more than 4 basis points to 1.97%, its lowest since late May as traders lowered their expectations on timing of the next rate hike," says Arnaud Masset, an analyst with Swissquote Bank in Gland, Switzerland.

What will be key is whether other lenders follow Westpac's lead.

Indeed if more lenders follow talk of an interest rate cut could grow as the RBA is forced to supply more money into the banking sector via lower interest rates.

Interest rates are important as international capital tends to flow to areas that offer high returns, and Australia has over the years offered a superior return via its high interest rates relative to the likes of the US, Europe and UK.

This advantage has kept the value of the Aussie Dollar elevated but it has slowly ebbed away over recent years as global central banks raise interest rates while the RBA stands pat.

"An absence of RBA policy changes over recent years has allowed household debt to balloon," adds ING's Patel. "Meanwhile, the property market across almost the entire country is beginning to cool, and we doubt an about-face in lending standards by APRA will be sufficient, or fast enough to turn it around," says Viraj Patel with ING Bank N.V.

ING tell clients to expect weakness in the Australian Dollar over the medium-term with the odds of AUD/USD running down to 0.70 being greater than a recovery above 0.75.

Advertisement

Get up to 5% more foreign exchange for international payments by using a specialist provider to get closer to the real market rate and avoid the gaping spreads charged by your bank when providing currency. Learn more here