The Australian Dollar Pops after Economic Growth Hits Six-Year High, but RBA Will Unlikely be Moved by the Data

- Written by: James Skinner

- AUD rises broadly after GDP data beats economist expectations.

- Aussie GDP rises at fastest pace in six years during first-quarter.

- But is in line with RBA forecasts so doesn't make rate rise more likely.

Image © kasto, Adobe Stock

The Australian Dollar advanced against the developed world currency basket Wednesday after first-quarter GDP numbers showed the Aussie economy growing at its fastest pace for six years, although strategists say the data will do little to alter the Reserve Bank of Australia's stance on interest rates.

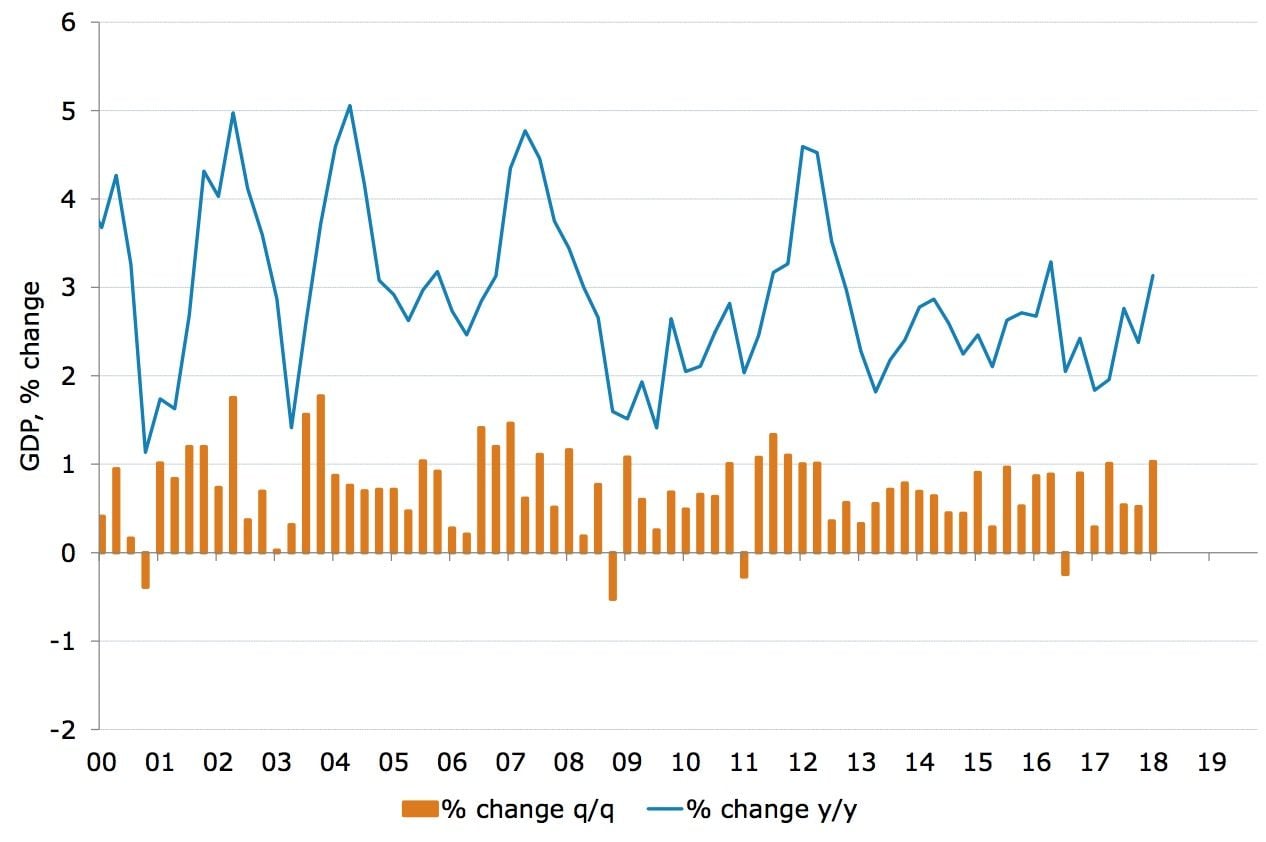

Australian GDP rose by 1% during the first quarter of the year, up from 0.5% during the final three months of 2017, which was ahead of the upwardly-revised market consensus for growth of 0.9%.

This left the economy growing at an annualised pace of 3.1% during the period, the fastest since the height of the mining boom in 2012.

"The Australian economy performed solidly over the past year, against the backdrop of strengthening global growth, which lifted in 2017 to its fastest pace since 2011," says Andrew Hanlan, a senior economist at Westpac.

Graphic source: ANZ Research, ABS

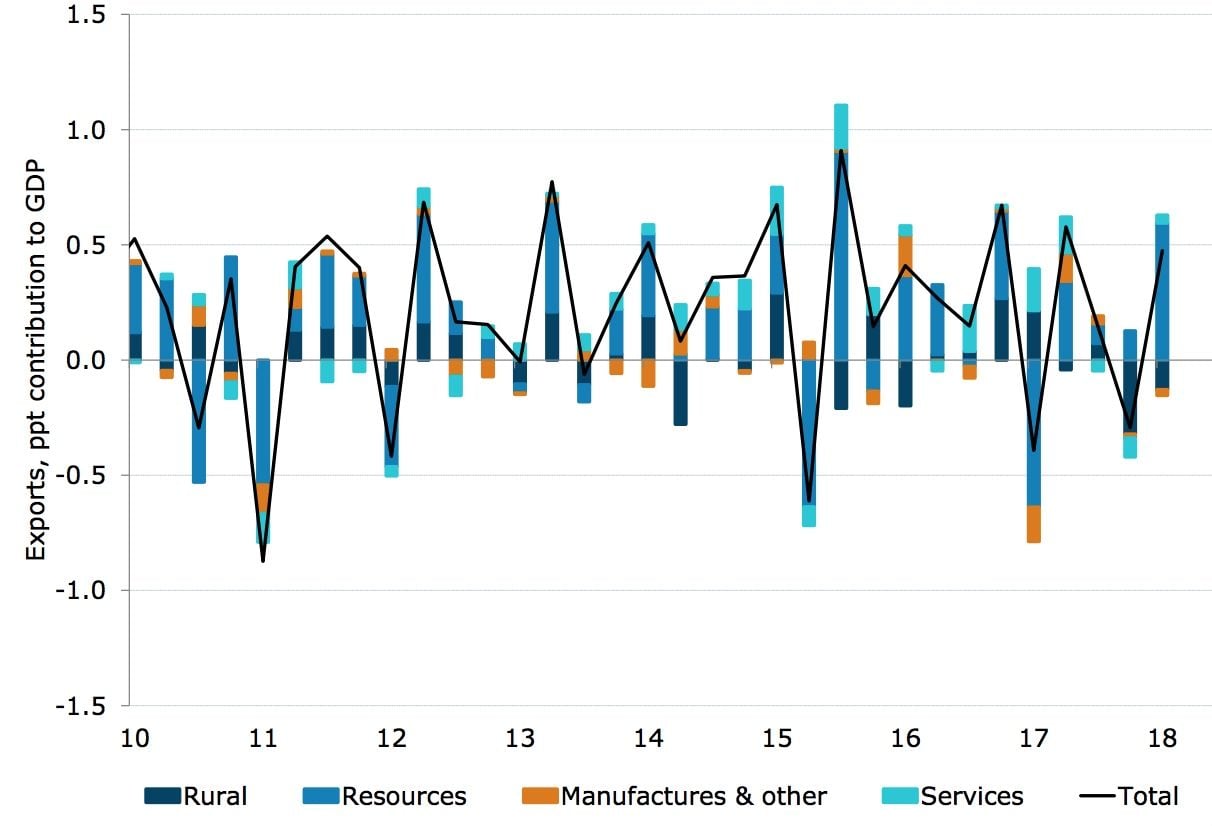

Net exports accounting for 0.35% of GDP growth were a key driver of the upturn in the first-quarter, which comes as welcome news to economists after a fourth quarter 2017 fall saw net-trade detract from the previous GDP reading. Business investment, including non-mining business investment, was also a noteworthy contributor.

Above: Export growth is helping the Australian economy. Graphic source: ANZ Research, ABS.

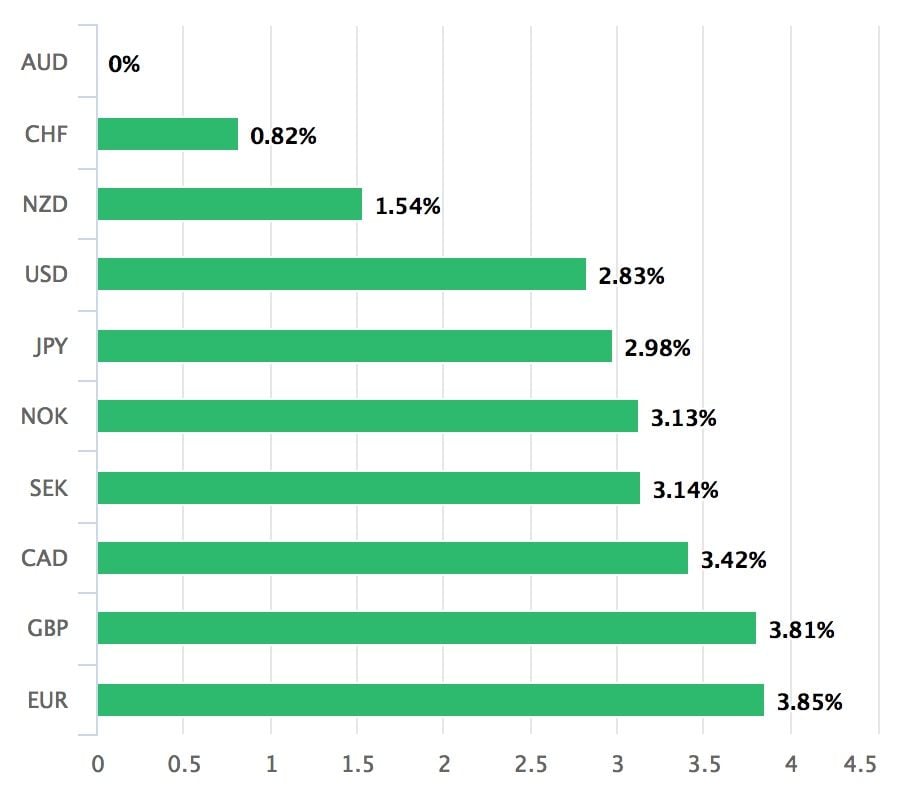

The Australian Dollar was seen higher across the board following the release ensuring the currency retains its title as the best-performer of the past month:

The AUD/USD rate was quoted 0.42% higher at 0.7654 during early trading mid-week and the Pound-to-Australian-Dollar rate was 0.29% lower at 1.7532.

Advertisement

Get up to 5% more foreign exchange by using a specialist provider to get closer to the real market rate and avoid the gaping spreads charged by your bank when providing currency. Learn more here

But Market Enthusiasm Contained

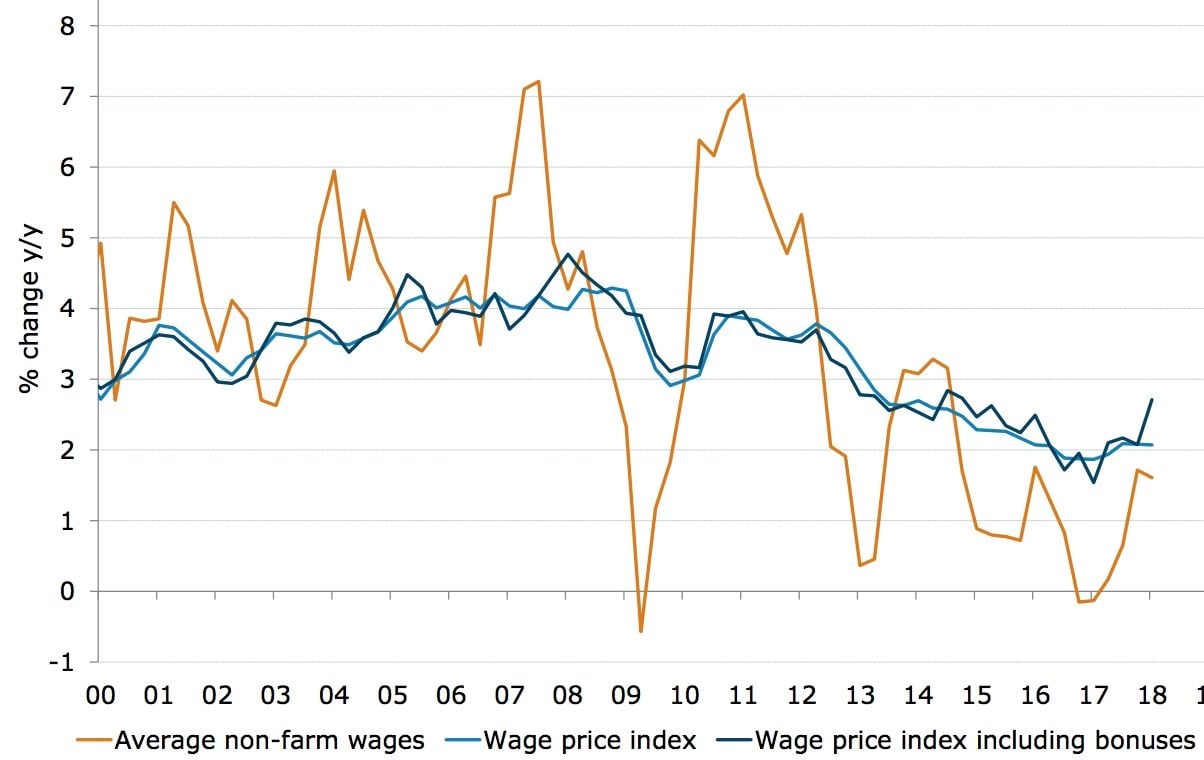

However, and on the downside, household consumption was a meagre contributor to GDP growth in the first quarter, with consumer spending rising by just 0.3% while wages are not yet picking up to the levels that might prompt the RBA into an interest rate rise.

"Private consumption (nearly 60% of GDP) was feeble in this report and fuels ongoing concerns about a household credit crunch curbing spending going forward. The RBA adds to these concerns by regularly claiming that the outlook for consumption is the Bank’s main source of “uncertainty”," says Annette Beacher, chief Asia Pacific macro strategist at TD Securities.

Debt-laden households that have been burdened with years of meagre wage growth are a key concern to the Reserve Bank of Australia. With low inflation aside, the bank has frequently cited uncertainty about whether such households could cope with higher borrowing costs as one of the reasons it has held off from raising Australian interest rates. Moreover, some say the consumer outlook could be about to become more challenging.

"Over the past year, consumer spending was supported by brisk jobs growth and by a decline in the savings rate. Going forward, the household sector remains vulnerable at a time of relatively weak wages growth, high debt levels and slipping house prices," says Westpac's Hanlan. "An unfolding slowing in employment growth from the recent hiring burst will act to reduce consumer spending power - note that jobs growth was only 1.4% annualised for the initial four months of 2018."

And for all of the market excitement about the strong first-quarter numbers, they leave Australian economic growth sitting exactly in line with the latest RBA forecasts for GDP to rise "a little over 3%", which means they will do little to bring forward the date at which the central bank becomes willing to raise its interest rate.

"3% GDP growth now may be a little early for the RBA (mid-year projection 2¾%) but the Bank has been saying for a while that GDP will be just over 3% this year and next," says TD Securities' Beacher. "We need inflation and wages growth to get them to budge off their neutral perch."

Above: Wages are past their trough, but not near the levels the RBA would like them to be. Graphic source: ANZ Research, ABS

The RBA has held its interest rate at a record low of 1.5% for 22 months in a row, citing below target inflation, weak wage growth and debt laden households as grounds for sitting on its hands while central banks elsewhere in the world raise their interest rates up from post-crisis lows.

This dynamic has put downward pressure on the Australian Dollar in recent months, forcing it to 2018 losses against almost all of the developed world currency basket, as relative short-term interest rates have returned as the dominant driver of exchange rates in 2018.

The effect of these developments is that investors are incentivised to sell Aussie Dollars and to buy other currencies in order to invest in bonds where interest returns are more favourable. This is the opposite of how the so called carry trade, which has traditionally propped up the Aussie relative to its international peers, used to work.

Advertisement

Get up to 5% more foreign exchange by using a specialist provider to get closer to the real market rate and avoid the gaping spreads charged by your bank when providing currency. Learn more here