Australian Dollar Retreats as Inflation Shows Signs of Peaking

- Written by: Gary Howes

Image © Adobe Stock

Australian inflation is running hot, but data released midweek did not provide the kind of upward surprise required to pressure the market into increasing expectations for the size of future Reserve Bank of Australia interest rate hikes.

The Australian Dollar was softer against most G10 currencies after Australian inflation for the second quarter of 2022 grew 1.8% quarter-on-quarter, coming in below the first quarter reading of 2.1% and the market's expected reading of 1.9%.

Inflation rose 6.1% year-on-year in the second quarter, more than the first quarter's 5.1% but again below consensus at 6.2%.

"It looks like we’re moving past the peak in quarterly inflation," says Catherine Birch, Senior Economist at ANZ.

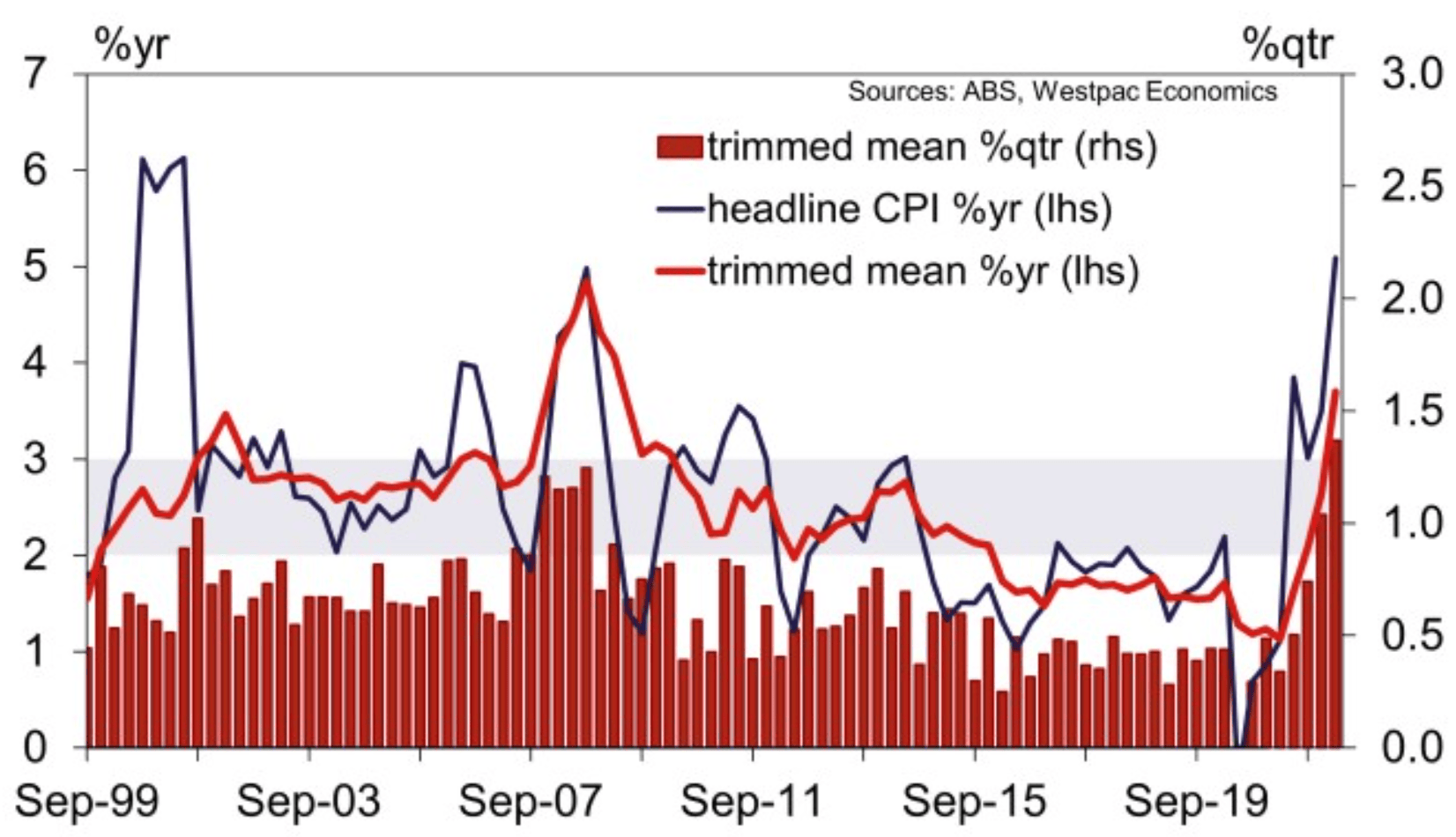

Above: Australian headline and core (trimmed mean) inflation, chart courtesy of Westpac.

The RBA has this year raised interest rates to 1.35% in light of surging inflation and market implied expectations show investors anticipate a further 210 basis points of hikes over the remainder of 2022, more than any other major central bank.

Expectations are therefore elevated and the below-consensus inflation readings from the second quarter could see them unwind somewhat and potentially provide headwinds to the Australian Dollar.

"At the margin, it tempers the argument for a 75bp hike next week," says Adam Cole, Senior FX Strategist at RBC Capital Markets.

"We had forecast a 75bps RBA hike at next week's meeting. We now expect the Bank to hike 50bps at the meeting," says TD Securities in a regular research briefing following the inflation data release.

The Australian Dollar was softer by a third of a percent against the U.S. Dollar at 0.6927 at the time of writing.

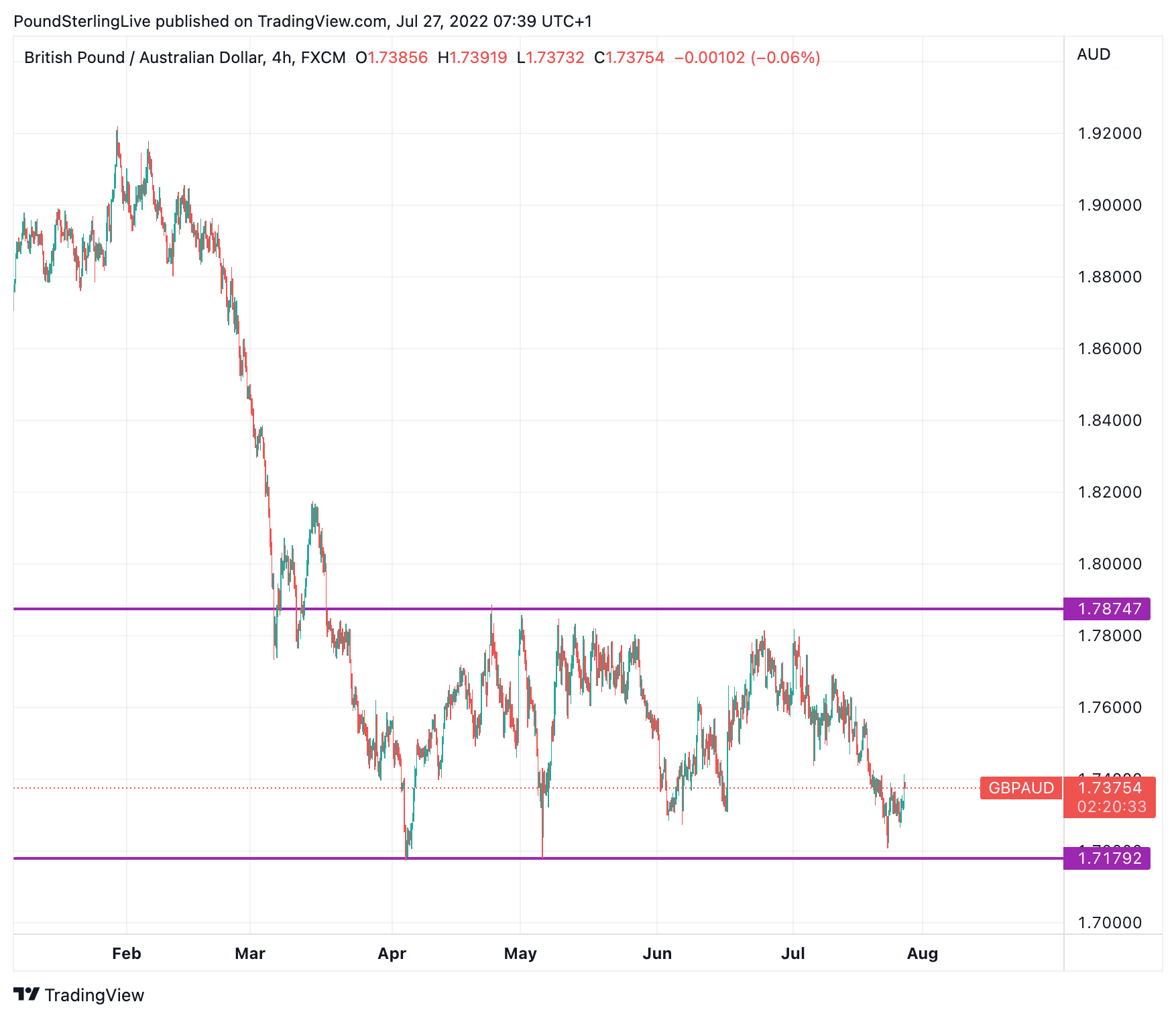

The Pound to Australian Dollar exchange rate was higher on the day at 1.7374, with the inflation data helping ensure it defends the bottom of a multi-week range:

Above: GBP/AUD at four-hour intervals showing the defined sideways range post-March.

Compare GBP to AUD Exchange Rates

Find out how much you could save on your pound to Australian dollar transfer

Potential saving vs high street banks:

A$4,875.00

Free • No obligation • Takes 2 minutes

"The market was looking for an upside surprise in today’s data to help justify some risk of a 75bp rate hike by the RBA next week, so the data is a weight on the AUD," says Valentin Marinov, Head of FX Strategy at Crédit Agricole.

The broad spread of price rises facing Australians means inflation rates will be slow to retreat and this should ensure the RBA remains vigilant.

Australian trimmed mean inflation - which is essentially core inflation in the U.S. and UK - showed broad domestically generated inflation rates, coming in at 1.5% quarter-on-quarter.

"The annual pace of the trimmed mean lifted from 3.7%yr in March to 4.9%yr in June, the fastest pace since September 1991," says Justin Smirk, Senior Economist at Westpac.

He adds that the widespread nature of this inflationary pulse was further emphasised by the rise in the share of components of the CPI running faster than a 2.5% year-on-year pace.

Although Australian inflationary pressures might not have delivered a surprise it nevertheless appears sticky and while economists at ANZ see signs of a peak they reckon the RBA still has some more work to do.

"This doesn't change our view on the RBA’s near-term meetings, where we expect 50bp hikes. The target cash rate is still well below the RBA’s estimates of neutral, and we expect the labour market to continue tightening. This will prompt the RBA to take the cash rate above the lower bound of what it deems the neutral range," says Birch.

As such, ANZ maintains a 3.35% year-end forecast for the RBA's interest rate.

Regarding the currnecy outlook, Francesco Pesole, FX Strategist at ING, says in all this the RBA continues to play a secondary role for the Australian Dollar.

The RBA will deliver their next rate hike on August 02 and Pesole expects any reaction by the Aussie Dollar to prove short-lived.

"In the current unstable market environment, risks to the 0.67-0.68 area in the pair remain material, even though our baseline scenario is still a gradual appreciation back above 0.7000 in the fourth quarter," says Pesole, of the AUD/USD exchange rate.

Compare GBP to AUD Exchange Rates

Find out how much you could save on your pound to Australian dollar transfer

Potential saving vs high street banks:

A$4,875.00

Free • No obligation • Takes 2 minutes