Australian Dollar Forecast to Strengthen in 2nd Half 2022 by Bank of America

- Written by: Gary Howes

Image © Adobe Stock

The Australian Dollar is forecast to advance against the U.S. Dollar and British Pound during 2022 by a major global investment bank and lender, however the gains will be loaded into the back end of the year.

This is because foreign exchange analysts at Bank of America anticipate an ongoing stalemate between negative and positive drivers that have kept the Aussie in check in the second half of 2021 to extend a while longer.

"The tug-of-war between the China slowdown and RBA policy normalization is likely to be the key theme for AUD in 2022," says Adarsh Sinha, Head of Asia-Pacific FX Strategy at Bank of America in Hong Kong.

He says a slow pace of policy easing in China coupled with the RBA maintaining its dovish guidance will remain negatives near term.

"In addition, we expect a faster pace of Fed policy tightening and a stronger USD," says Sinha.

But an alignment of positives in the second half of the year will allow the currency to make a more notable advance that could see AUD/USD reach 0.76 from 0.7121 at present and GBP/AUD reach 1.59 from 1.8590 at present.

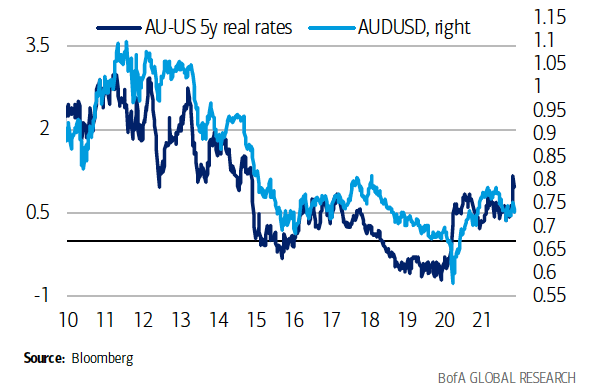

Above: "AUD/USD vs. 5y real rate differential. Relative policy stance matters for exchange rate." - Bank of America.

- GBP/AUD reference rates at publication:

Spot: 1.8582 - High street bank rates (indicative band): 1.7938-1.8069

- Payment specialist rates (indicative band): 1.8460-1.8490

- Find out about specialist rates, here

- Set up an exchange rate alert, here

Bank of America economists forecast above consensus Australian economic growth in 2022 at 4.0%.

"In 2H 2022, we expect a rather constructive backdrop for AUD," says Sinha.

The Reserve Bank of Australia is expected to react to strengthening economic conditions and hike rates in the fourth quarter.

Confidence to raise rates from record lows will be build on faster progress on meeting inflation, wages and unemployment targets.

Wages growth is seen moving towards 3% by the end-2022, thereby meeting a key RBA objective ahead of higher rates.

Sinha says the Australian Dollar has proven resilient to slowing Chinese growth and a static RBA over recent months, which suggests to him headwinds "may be priced in to some degree".

"There remains a meaningful risk premium in the exchange relative to its terms of trade," says Sinha.

Bank of America economists expect more proactive policy easing in China in 2022 and this would bolster China’s import impulse as well as Australia’s commodity export prices.

"China policy easing should prove supportive but with some lag and later in 2022," says Sinha.

The Australian Dollar to U.S. Dollar exchange rate is forecast at 0.74 at the end of the first quarter 2022, 0.74 at the end of the second quarter and 0.76 by the end of the third quarter.

By the end of 2022 Bank of America's point forecast is at 0.78.

The bank's point forecasts for GBP/USD at the above points are 1.30, 1.27, 1.25 and 1.24.

On a cross basis based on the above, the Pound to Australian Dollar exchange rate is forecast at 1.76 by the end of the first quarter, 1.72, 1.65 and 1.59.

More: Australian Dollar a Potential Winner in 2022 says HSBC