Australian Dollar Trounces Rivals this Week but Could be Nearing End of Road

- Written by: James Skinner

© Taras Vyshnya, Adobe Stock

© Taras Vyshnya, Adobe Stock

- AUD grabs 2nd place in G10 league table but obstacles are ahead.

- CBA bulls say "dovish" Fed could get the AUD above key chart level.

- But ANZ says RBA speech poses downside risk to AUD next week.

- AUD running into "tough" resistance on charts says Commerzbank.

The Australian Dollar cooled its heels Friday after running into a "tough" resistance level on the charts and amid a rebound by the U.S. greenback, although the Aussie could face a more protracted retreat next week if analysts at Commerzbank and Australia & New Zealand Banking Group (ANZ) are right.

Australia's Dollar may have stumbled Friday but it's still up half a percent against its U.S. rival and 1.1% against its British counterpart for the week after being buoyed by a jobs report that was better than the headline numbers suggested.

A weaker U.S. Dollar was also a source of gains for the AUD/USD rate after the greenback was undermined by wagers suggesting the Federal Reserve might cut its interest rate by more than 25 basis points at the end of July.

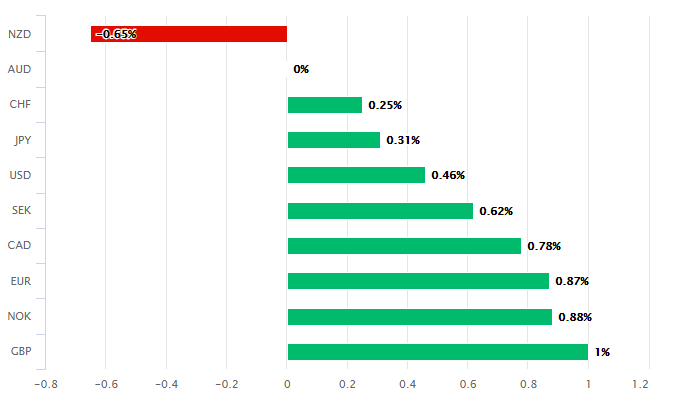

Above: Australian Dollar performance Vs G10 rivals this week. Source: Pound Sterling Live.

That Fed rate trade could still be a key influence next week. Commonwealth Bank of Australia (CBA) says a heavy U.S. Dollar could be enough to help the Aussie across the important chart level that halted it on Friday.

"AUD is just short of the 200‑day moving average of 0.7091. We expect the USD to trade heavy and as a result, see a risk AUD/USD breaks s said late Thursday that U.S. central bankers should not seek to "keep powder dry" amid signs that inflation pressures are ebbing from the economy and while interest rates are still close to their record lows.

I like New York Fed President John Williams first statement much better than his second. His first statement is 100% correct in thatabove its 200‑day moving average in the lead up to the FOMC’s 31 July meeting (the Australian CPI is also released the same day)," says Kim Mundy, a strategist at CBA.

— Donald J. Trump (@realDonaldTrump) July 19, 2019

The comments delivered a temporary blow to the U.S. Dollar and also drew further calls for interest rate cuts from President Donald Trump. The Fed is widely expected to reduce the Fed Funds rate at least as far as 2.25% but many voices are arguing for more than that.

Commonwealth Bank is bullish in its outlook for the AUD/USD rate, tipping it to rise next week and forecasting that it'll close the year up at 0.72, which is way above Friday's 0.7050 level. However, technical analysts at Commerzbank are doubtful the Aussie can sustain its current lofty position and are betting against the AUD/USD rate.

"AUD/USD is probing a very tough band of resistance, namely .7075/91. This is the 200 day moving-average and the downtrend. However intraday Elliott wave count have now turned more positive," says Karen Jones, head of technical analysis at Commerzbank "We will raise our take profit level. Further up resistance can be spotted at the .7207 February high."

Jones sold the AUD/USD rate at 0.7030 and again at 0.7050 but says she'll walk away from the trade if the market reaches 0.7095. She is targeting a move down to 0.6960 over the short-term but will reduce the bet at 0.7000.

Above: AUD/USD rate shown at daily intervals, with 200-day moving-average (orange).

ANZ has flagged a Thursday speech by Reserve Bank of Australia (RBA) Governor Philip Lowe as a threat to the Aussie's recent strength, given expectations for an additional interest rate cut this year have recently ebbed.

The RBA has cut its interest rate to a new record low on two occasions this year, citing below-target inflation pressures and an outlook for the economy that leaves an increase in the consumer price index to levels within the 2%-to-3% target band looking like a long shot.

Markets had been betting heavily the RBA will cut its cash rate again, to 0.75%, before the year is out but the scale of those wagers eased this week after the economy was revealed to created a solid number of full-time jobs in June.

"The RBA’s Lowe will speak on “Inflation Targeting and Economic Welfare”, which will elucidate the RBA’s current framework. While the market expects further easing, the timing is uncertain. Should Lowe describe the currency as the RBA’s preferred transmission channel, we think the recent Fed-induced rally will be undermined, lending downside risks to AUD," says Daniel Been at ANZ.

Above: Pound-to-Australian-Dollar rate at daily intervals, with 200-day moving-average (orange).

Lowe said this month the RBA will "monitor developments in the labour market closely and adjust monetary policy if needed", which also led markets to believe the RBA will sit on hold for a while rather than cut again again.

The Aussie has gained from those easing expectations but Lowes' speech Thursday at 04:05 London time could see this small improvement in the rate outlook go into reverse. Especially if the Governor does as RBA officials quite frequently have and attempts to discourage the Aussie from further gains.

Changes in interest rates are normally only made in response to movements in inflation, which is sensitive to growth, but impact currencies because of the push and pull influence they have over capital flows.

Capital flows tend to move in the direction of the most advantageous or improving returns, with a threat of lower rates normally seeing investors driven out of and deterred away from a currency. Rising rates have the opposite effect.

Time to move your money? Get 3-5% more currency than your bank would offer by using the services of foreign exchange specialists at RationalFX. A specialist broker can deliver you an exchange rate closer to the real market rate, thereby saving you substantial quantities of currency. Find out more here.

* Advertisement