The Australian Dollar Holds its Ground Even After Chinese Economic Growth Slows to Post-crisis Low

- Written by: James Skinner

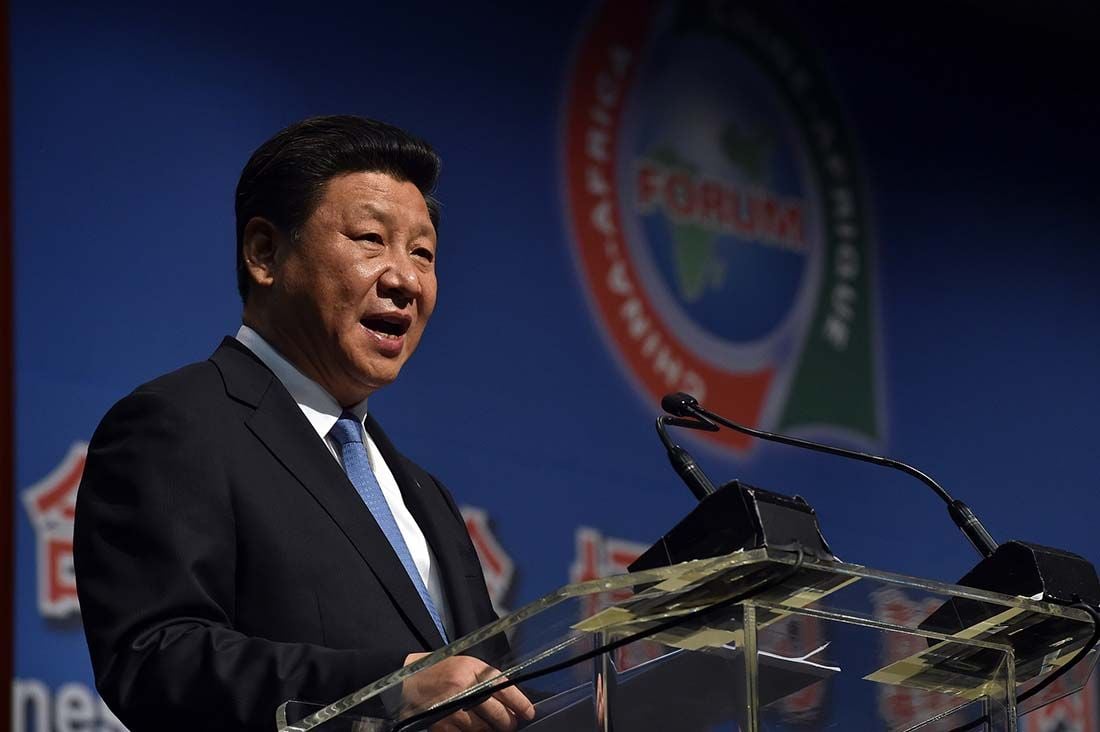

© GovernmentZA, image Reproduced Under CC Licensing

- Chinese GDP and industrial production data dissapoint market.

- Both slow in face of U.S trade war, government investment rises.

- A continued slowdown will hurt the already-beleaguered AUD.

The Australian Dollar rebounded from an overnight dip Friday as concerns about a growth slowdown in China were offset by speculation the government will soon step in with fresh stimulus to support the world's second largest economy.

Chinese growth slowed to an annualised pace of 6.5% in the third quarter, down from 6.7% previously and beneath the consensus for an increase of 6.6%.

This marked the economy's slowest expansion since the first quarter of 2009, although it still leaves China on track to meet its government-imposed growth target of 6.5% for 2018.

"The official figures have been too stable in recent years to be taken at face value but there is little doubt that the economy is currently cooling. Our in-house measure of growth – the China Activity Proxy – edged down last quarter

and has declined by over half a percentage point during the past year," says Julian Evans-Pritchard, an economist at Capital Economics.

Industrial production growth fell to 5.8% during September, down from 6.1% previously and also beneath the consensus for growth of 6%, marking the slowest increase since February 2016.

Fixed asset investment growth surprised on the upside, rising from 5.3% to 5.4% when markets had looked for it to remain steady, as local government's and the private sector stepped up spending on capital equipment.

"The economic data released today is likely to encourage the Chinese authorities to keep macro-economic policy settings supportive. We expect monetary policy to remain 'prudent' and fiscal policy to remain 'more proactive'. We still expect the People's Bank of China to cut the Required Reserve Ratio by another 2pp to 12.5% by early 2019," says Joseph Capurso, a currency strategist at Commonwealth Bank of Australia. "Nevertheless, there are some green shoots in the Chinese data. Investment spending by state-owned enterprises (SOE's) lifted significantly in September."

Chinese growth data is important for the Aussie because the Antipodean currency is underwritten by Australia's mammoth commodity trade with the world's second largest economy. This means whenever the Chinese economy or currency gets hurt, so too does the Australian Dollar.

That relationship explains why the Aussie has lost around 8% of its value relative to the U.S. Dollar this year, amid President Donald Trump's "trade war" against China. The trade war itself explains why analysts and traders will be applying abnormally close scrutiny to Friday's data emerging from China.

Above: AUD/USD rate shown at daily intervals. Covers 2018 to 18 October.

The AUD/USD rate was quoted 0.15% higher at 0.7106 Friday but is down 9% for 2018, while the Pound-to-Australian-Dollar rate was 0.11% lower at 1.8323. The USD/CNH rate, which measures the U.S. currency against China's offshore Renmimbi, was 0.11% lower at 6.9367.

Above: Pound-to-Aussi rate shown at daily intervals. Covers 2018 to October 18.

"The first and most visible pain from the trade war is on the export sector, which has already reported dwindling sentiment. So far, the overall robust export growth around 10% was supported by exporters frontrunning the tariffs, that is, to export before the tariffs hit," says Amy Yuan Zhuang, an economist at Nordea Markets. "We expect Chinese exports to decelerate in the coming few months before contracting in 2019, when the latest tranche of US tariffs sees a rate increase to 25%."

Already Chinese industrial production growth has declined from 7.2% in February, the month before White House tariffs on Chinese steel and aluminium were announced, to just 6% in July when the levies were actually implented. Meanwhile, fixed asset investment growth has slowed from 7.9% to just 5.5% over the same time period.

This slowdown comes after President Donald Trump imposed tariffs on more than $250 billion of China's exports to the U.S. back in July. He is now threatening to target the full $500 billion or more of goods that China sells to the U.S. each year if the country does not abandon its "unfair trading practices", and the measures are now beginning to bite into the Chinese economy.

"Before today’s GDP report, China’s financial regulators commented on recent economic environment as well as the financial market meltdown," says Hao Zhou, an analyst at Commerzbank. "These statements from Chinese financial regulators clearly suggest that the Chinese authorities are deeply concerned about the sluggishness towards China’s growth and financial markets outlook. It appears that China’s policy stance is shifting towards stimulus."

Shanghai Stocks, Renmimbi Spell Trouble for AUD

The Shanghai Composite Index, which also has a close price relationship with the Australian currency, is already down 22.8% at 2,550 for 2018.

"We think that the Shanghai Composite, which has slumped by 3% today, will weaken again given the outlook for China’s economy and the US-China trade war," says Oliver Jones, another economist at Capital Economics. "We doubt that the willingness of the US to compromise on trade with Mexico and Canada will extend to China either. The more likely outcome in our view is that the US-China trade war gets worse, whatever the result of the midterm elections in the US next month."

The Capital Economics team forecasts continued pressure on the stock market over coming months and into next year, as fears over the corporate profits grow in tandem with the continued escalation of trade tensions, which could take the Shanghai Composite down a further 7% to 2,300 before the end of 2019.

"USD-CNY spiked up to 6.94 this morning, sending CNY to the weakest level since January 2017, reflecting the bearishness towards the economic and currency outlook," says Commerzbank's Zhou, in a note to clients Thursday. "We see increasing risks that CNY could depreciate further from its current level. However, Chinese authorities should think twice before giving up the critical threshold for USD-CNY at 7 too lightly as this could unleash forces that are even more difficult to control."

The prospect of further weakness in the Renmimbi is also a threat to the Aussie not only because of the economic connection between the two countries, but also due to the latter's role as a surrogate for speculators seeking to express bearish views about China's state-managed currency. Both the Renmimbi and Australian Dollar have tracked each other closely in 2018.

Advertisement

Get up to 5% more foreign exchange by using a specialist provider to get closer to the real market rate and avoid the gaping spreads charged by your bank when providing currency. Learn more here