Pound to Rand Rate: Tech & Fundamental Outlook for This Week

The South African Rand has a, “mild bias for gains but is really going no-where,” according to strategist Richard Cairns, of Rand Merchant Bank (RMB).

A lack of ‘event risk’ this week combined with traders staying on the side-lines ahead of the Jackson Hole central banking symposium, is leading to a dull sideways trending market.

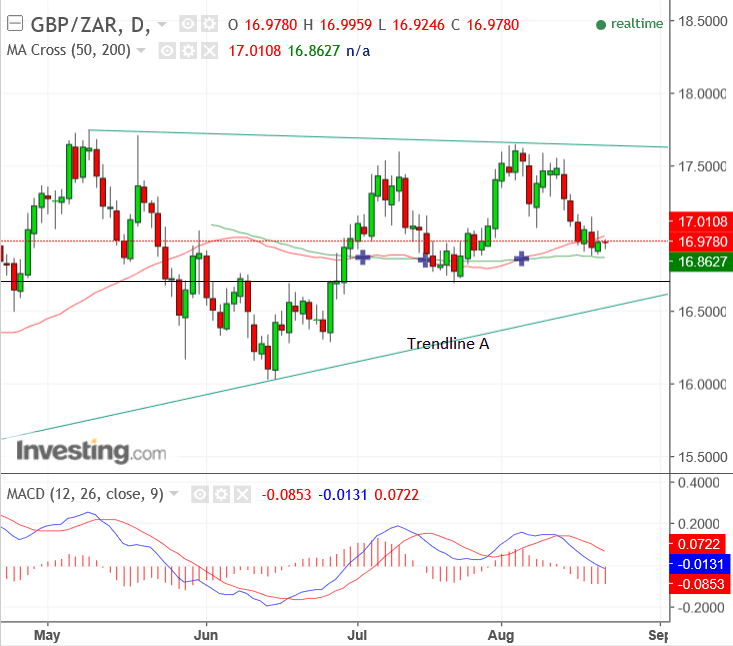

The sluggish exchange rate is reflected in our technical studies of the charts which show the GBP/ZAR pair in a chaotic sideways range reflecting conflicting signals as to the possible future direction for the trend.

Both the 50 and 200-day moving averages are putting a floor on the exchange rate at 16.80-90 – a floor which is unlikely to be easily broken.

A mini-reversal higher, therefore, is possible in the current context but we are reluctant to make a bullish call since the pair remains in a very short-term downtrend which began three weeks ago, and so would have to reverse that sequence lower, which it has not yet done.

As such we remain on the side-lines before awaiting more evidence of more strongly trending activity in either direction.

The Rand tends to rise when markets are optimistic – which hasn’t been the case recently, however, Cairns says that if anything there is a slight bias to markets ‘easing up’, reflected in the volatility index or ‘VIX’ pulling-back, providing the possibility of a rise for the Rand.

“Last week’s risk aversion is, nevertheless, slowly easing, with the VIX falling back to 13 and the dollar suffering some mild weakness. This opens the potential for mild rand gains but there is certainly nothing that suggests the moves will be anything more than a few cents.

Further evidence of improving risk appetite has come from and easing up of the ferocious selling of Rand bonds in recent days, however, “selling has not turned to buying yet so this is not a buy signal,” analyses Cairns.

President Zuma’s signing of the Financial Regulation act has enabled the South African Reserve Bank (SARB) to use macro-prudential policies as part of its monetary policy arsenal in the future.

This means the bank can use more ‘surgical’ measures to impact lending, mortgage lending and liquidity in the economy, by for example, tightening lending standards.

It means it may not have to increase interest rates as much as previously, potentially dampening Rand uplift from interest rate expectations.

Get up to 5% more foreign exchange by using a specialist provider by getting closer to the real market rate and avoid the gaping spreads charged by your bank for international payments. Learn more here.

Outlook for the Pound in the Coming Week

The next major release in the week ahead is The Consortium of British Industry (CBI) Industrial Trends Survey for August, out at 11.00 on Tuesday, August 22, with forecasts of the ‘balance’ – of “yes” to “no” responses – expected to rise to 10, from 8 in the previous month.

Thursday is the main day for Sterling this week, with the second estimate for GDP in the second quarter out at 9.30 BST.

The first estimate showed Q2 GDP rose by 1.7% and the second estimate is expected to show no-change from this.

Q1 growth was 2.0%.

Next come Mortgage Approvals on Thursday at 11.00, which are expected to show 40.2 thousand more approvals in July, according to data from the British Banking Association (BBA).

Some forecasters have stated they will rise to 40.9.

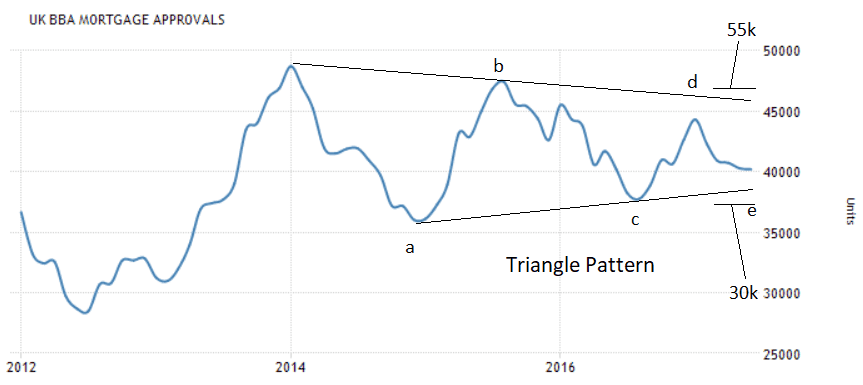

Mortgage approvals have formed a compelling triangle-shaped pattern when seen charted over recent years (see below).

According to research, triangles have a minimum of five component waves, and this pattern has formed fives waves already, labelled a-e, and as such could be complete.

The next move would be expected to be a breakout either higher or lower, however, what is highly probable is a period of high volatility in the not too distance future.

As we noted last month when making the same analysis of mortgage approvals, a reading of above 47,500 would indicate an upside breakout to a target of 55k whilst a reading below 37k would lead to a breakdown to a target at 30k.

Business Investment is a major release for the Pound, also out on Thursday, at 9.30 BST.

Markets will be following the release closely as Investment has been unexpectedly strong since the referendum when it was one of the things which was expected to be hit hardest, given companies need certainty before making investment commitments.

If Investment continues to remain robust that may well help the Pound.

Finally, towards the end of the week the main event for financial markets will be the Jackson Hole symposium in the US, where central bankers will be meeting to discuss monetary policies and the global economy, and where Bank of England governor Carney, may well contribute to the flow of commentary.