SA Rand at Risk as the Real Downgrade to Junk Looms in Early 2018

South Africa is a notch away from sub-investment grade, and the potential capital outflows of an initial downgrade could amount to $14bn which will pose significant headwings for the Rand.

The country has already gone sub-investment, or achieved ‘junk status’, on its debt denominated in foreign currency.

It is important to stress that it is only South African bonds denominated in foreign currency that are sub-investment - thisa class accounts for only 10% of debt issued by the South African government.

Of more importance is the status of local currency bonds which account for 90% of the country’s debt pile.

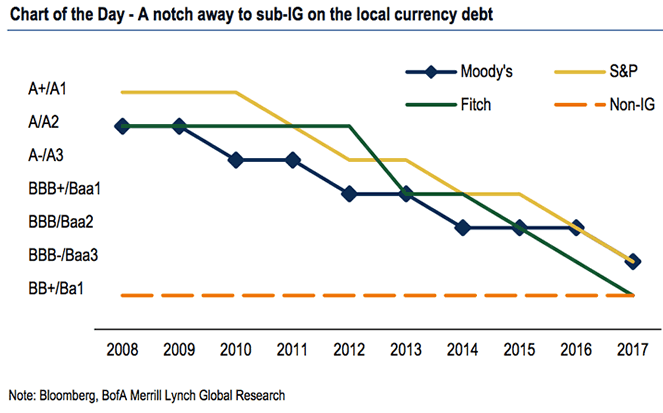

Thus far, these bonds have managed to maintain investment-grade status:

The trend in the investibility of this debt is clear though.

“All rating agencies continue to be directionally negative as economic fundamentals deteriorate. S&P will likely to be the next one to move to sub-IG by June 2018,” says Ferhan Salman, an economist with Bank of America Merrill Lynch Global Research.

Salman says a downgrade move would likely to be driven by growth and fiscal underperformance while the institutional framework continues to be tested.

Downgrades from both S&P and Moody's would trigger exclusion from the Citi WGBI.

“Together with exclusions from other local and hard currency indices, we estimate potential outflows to reach USD14bn,” says Salman.

Such outflows would have a negative impact on the Rand as the currency is put on offer on global FX markets to fund the outflows.

Why Debt Ratings Matter

South Africa’s financial system and economy require large external funding requirements as the country is a net importer and ongoing portfolio inflows are critical to financing South Africa’s current account deficit.

This requires that investors continue to see value in South Africa’s large stock of debt and equity assets.

Notably this year’s inflows into South Africa have largely been into sovereign bonds - otherwise known as debt markets.

South Africa’s ability to issue debt in local currency means that South Africa’s share of hard currency in its external sovereign debt is a relatively small 10%.

According to the IMF, US$2bn of outflows would result from the downgrade to junk status of the foreign currency rating, but a more sizeable 2.5% of GDP (around US$8bn) of outflows should be realised were the local currency rating be cut to junk.

What Next?

BofAML say that they don’t believe South Africa will suffer a downgrade in 2017 as the mid-term budget in October will fix issues surrounding revenue shortfalls.

However, “continued political noise around radical economic transformation in the run-up to the ANC-elective conference is the next thing that rating agencies will watch,” says Salman.

The analyst argues any deterioration in institutional capacities undermining policy implementation and discussion around the mining charter, land expropriation and the SARB mandate would score negatively on the rating card.

“While we do not anticipate another political event on the scale of Nenegate or cabinet reshuffle, risks will remain heightened,” says Salman.

The next big event would be the Budget for 2018/19 due in February, BofAML say this will also fall short of stabilising debt and allow slow deterioration in the fiscal.

“Materialisation of contingent liabilities will also be rating negative,” says Salman.

According to the IMF, a realisation of contingent liabilities on state-owned enterprises could add up to 18% to the debt-to-GDP ratio.

Get up to 5% more foreign exchange by using a specialist provider. Get closer to the real market rate and avoid the gaping spreads charged by your bank for international payments. Learn more here.