Pound-Yen Rate: Bullish Reversal Pattern on Major Trendline

Image © Adobe Stock

- GBP/JPY stalls and starts to reverse at major trend line

- Possibility of a recovery higher conditional on break of trend line

- Yen to be driven by global risk trends

The Pound-to-Yen exchange rate is trading at around 129.07 at the time of writing after climbing 1.68% in the week before and studies of the charts show the pair has probably reversed trend in the short-term and the bias is now more to the upside.

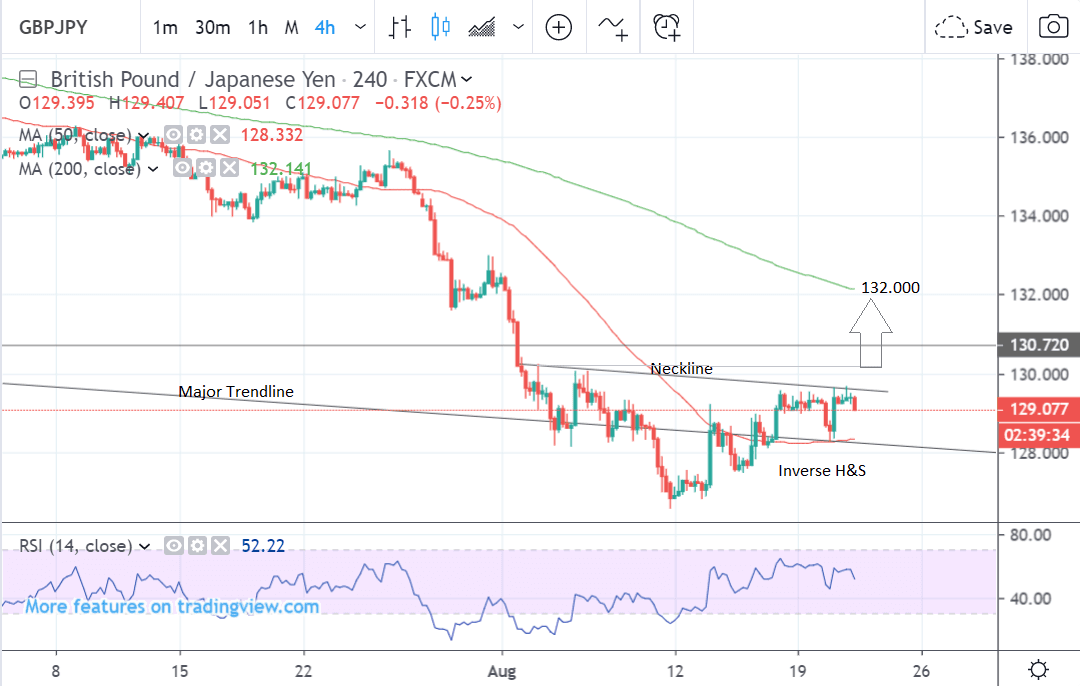

The 4 hour chart - used to determine the short-term outlook, which includes the coming week or next 5 days - shows the pair having based on a major trendline and forming a reversal pattern called an inverse head and shoulders (H&S).

The combination of the reversal pattern and trendline support provide a bullish signal despite the previous strong downtrend, yet even so further upside is dependent on a break above certain levels for confirmation.

A break above the neckline and the 130.23 highs would provide confirmation of more upside to a target at 132.00 in the short-term.

The RSI momentum indicator is rising quite strongly in tandem with the exchange rate and further suggests more upside on the horizon.

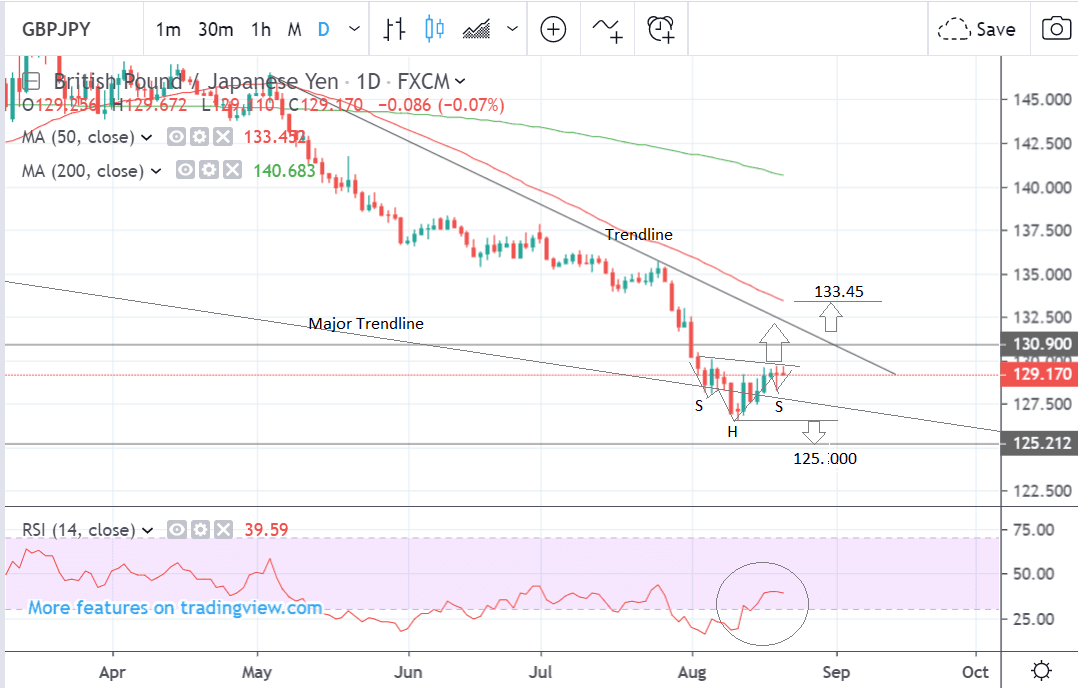

The daily chart shows a similar picture, with the pair falling to support at a major trendline and forming an inverse head and shoulders (H&S) pattern and bullish RSI momentum further supporting the outlook.

Upside is capped by the down-sloping trendline at around 132.000. A break clearly above that would probably lead to further upside to a target at the 200-day moving average (MA) at around 133.45. Major MAs often provide tough resistance to trending prices.

Given the strength of the previous downtrend, there is also still a lingering chance the pair could break lower, with a move below the August 12 lows at 126.65 leading to a continuation of the downtrend to a target at the 125.00 Oct 2016 lows.

The daily chart is used to give an indication of the outlook for the medium-term, defined as the next week to a month ahead.

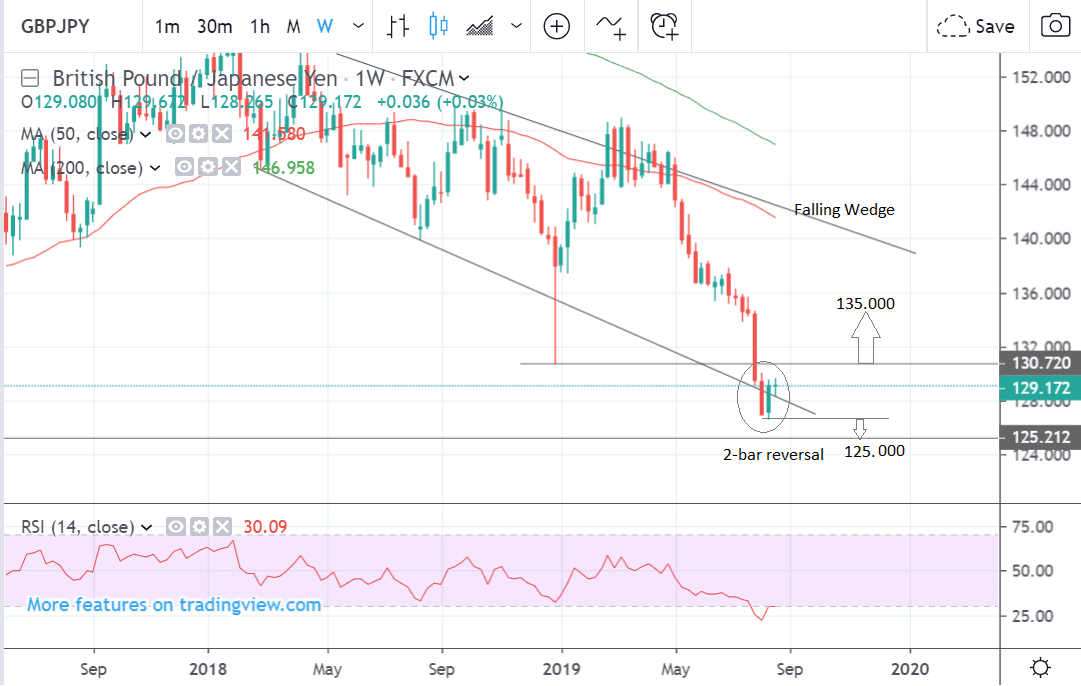

Looking at the weekly chart - used to give us an indication of the outlook for the long-term, defined as the next few months - shows how the exchange rate has now formed a 2-bar reversal pattern after breaking out of the bottom of a possible wedge pattern.

Assuming the pair has reversed its downtrend and is now in a short-term uptrend, there is a possibility it could rally all the way up to a target at 135.000. Wedge patterns are normally considered bullish and this adds the potential for more upside.

Alternatively, there is still a chance that the entrenched downtrend may continue down to a target at 125.000 and the October 2016 lows.

Time to move your money? Get 3-5% more currency than your bank would offer by using the services of foreign exchange specialists at RationalFX. A specialist broker can deliver you an exchange rate closer to the real market rate, thereby saving you substantial quantities of currency. Find out more here.

* Advertisement

The Japanese Yen: Drivers to Watch

The main fundamental driver of the Yen is risk trends because of the currencies safe-haven qualities that see it do well in times of equity market stress.

Elevated concerns that the global economy is heading towards a recession dominate market concerns at present, and many analysts suggest such an environment proves supportive of the far-eastern currency.

“Against a backdrop of falling global rates, JPY is well supported, with USD/JPY down 0.3% to 106.30," says Jason Wong, an analyst at BNZ Bank. "Hedge funds see JPY as the safe-haven of choice in the current global economic environment, while the BoJ has limited options to ease policy further to keep up with other central banks.”

Bloomberg has meanwhile run a story highlighting how speculative positioning has turned positive, after being negative for much of the past few years.

A new risk event hitting investor radars this week is that of Italian political uncertainty after prime minister Giuseppe Conte resigned in the wake of the collapse of the country's coalition government.

How the political crisis evolves will be important for global investor risk trends. For now, the most likely outcome is that a new government will form composed of a new collation between the 5 Star party and the Democrat Party.

This would be considered a positive outcome by markets and, therefore. negative for the Yen.

If no new coalition can be formed elections will be held in the Autumn and this may rattle markets, possibly helping the Yen in the process.

The general air of gloom surrounding the outlook for the global economy is likely to extend as talks between the U.S. and China continue to go nowhere.

Although the U.S. extended the Huawei ban and exempted some more items from the 10% tariff increase late last week and early this week the most recent commentary remains mixed.

For example, the U.S. secretary of state Michael Pompeo told CNBC on Monday that Huawei isn’t the only Chinese company that poses risks to the U.S. whilst at the same time, saying he also sees the U.S. and China continuing their talks - at least by phone - over the next week or 10 days.

At the end of this week there may be a lot of news concerning central banks and the outlook for global monetary policy which could affect the Yen.

Key releases include the minutes of the Federal Reserve and European Central Bank's August and July policy meetings, and the yearly Jackson Hole symposium of central bankers from around the world.

The speech by Fed chairman Powell at the event is also touted as providing insight on future policy moves and a major event for markets. Indeed, many market participants view Wednesday's Fed minutes as being inconsequential in light of the Jackson Hole event.

Currently, the base expectation is for most central bank interest rates to continue falling becasue of slowing global growth. This, in turn, would support the Yen because of its safe-haven credentials.

The probability that the Fed will cut interest rates at their September meeting has shifted marginally lower to 98.5% from 100% last week when the yield curve inverted.

The curve has since 'un-inverted' and is now rising again with 2-year rates at 0.95% and 10-year rates at 1.25%. This means the Fed doesn’t have to panic as much about making an emergency cut for the sake of the yield curve.

If the market-based probability of the Fed cutting rates were to start steadily falling from now on and were backed up by a less dovish speech from Chairman Powell on Friday, it would be negative for the Yen and support GBP/JPY - much as the technicals also appear to be inferring.

Time to move your money? Get 3-5% more currency than your bank would offer by using the services of foreign exchange specialists at RationalFX. A specialist broker can deliver you an exchange rate closer to the real market rate, thereby saving you substantial quantities of currency. Find out more here.

* Advertisement