Pound-Yen Rate Likely to Decline over Coming Days as Downtrend Continues

Image © Adobe Stock

- GBP/JPY continues to make step decline lower

- Now closing in on January flash lows

- Yen to be driven by trade war news

The Pound-to-Yen exchange rate is trading at around 134.63 at the time of writing, after falling almost 0.75% in the previous week, and studies of the charts suggest the exchange rate will probably continue its downtrend in the days to come.

The 4 hour chart - used to determine the short-term outlook, which includes the coming week or next 5 days - shows how the pair has rebounded after making new lows on July 18. Since then it appears to have peaked and started going lower again.

The trend is clearly bearish and given the old adage that ‘the trend is your friend’ is expected to continue.

A break below the 133.85 lows would provide confirmation of a further extension of the downtrend down to a target at 133.00, possibly even lower at 132.00.

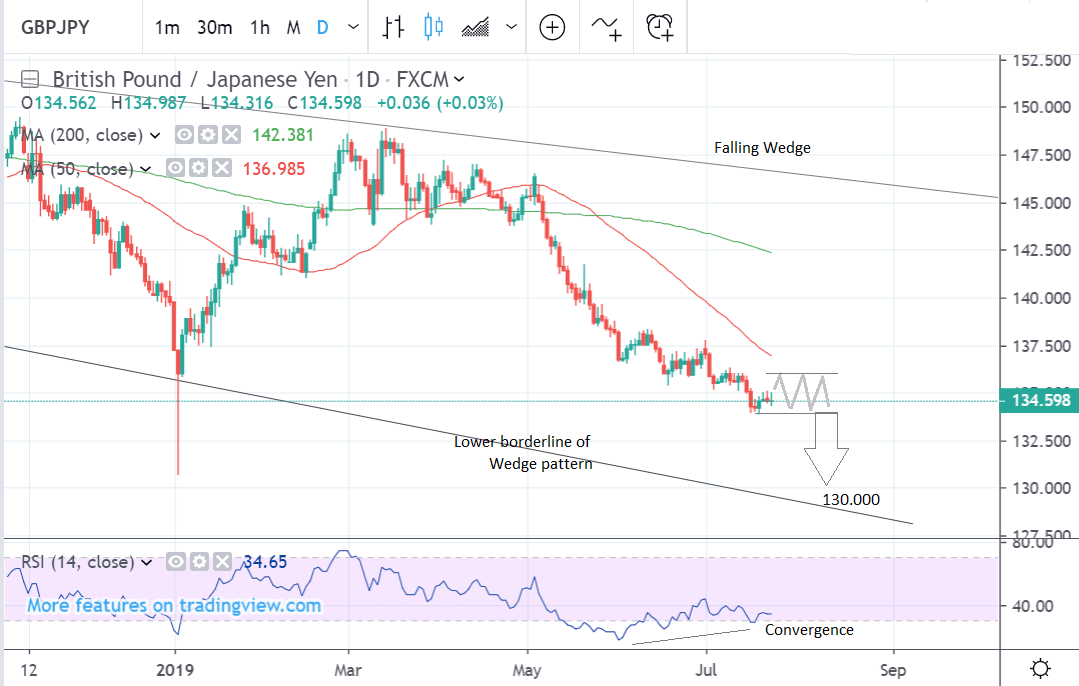

The daily chart - used to give an indication of the outlook for the medium-term, defined as the next week to a month ahead - shows the pair continuing to make lower lows and lower highs, and given the old adage that the ‘trend is your friend’ this step decline is expected to continue.

The break below the 133.85 lows was key to reinvigorating the downtrend. We now see a probable extension down to a target at 130.70 and the January lows.

The RSI indicator is converging bullishly with price, however, which suggests the possibility of a rebound higher or a period of sideways trading. Convergence occurs when price makes a new low but momentum does not - the non-corroboration is a sign of waning bearish enthusiasm and an increased risk of a rebound.

This suggests that a period of sideways consolidation is also possible over the medium-term.

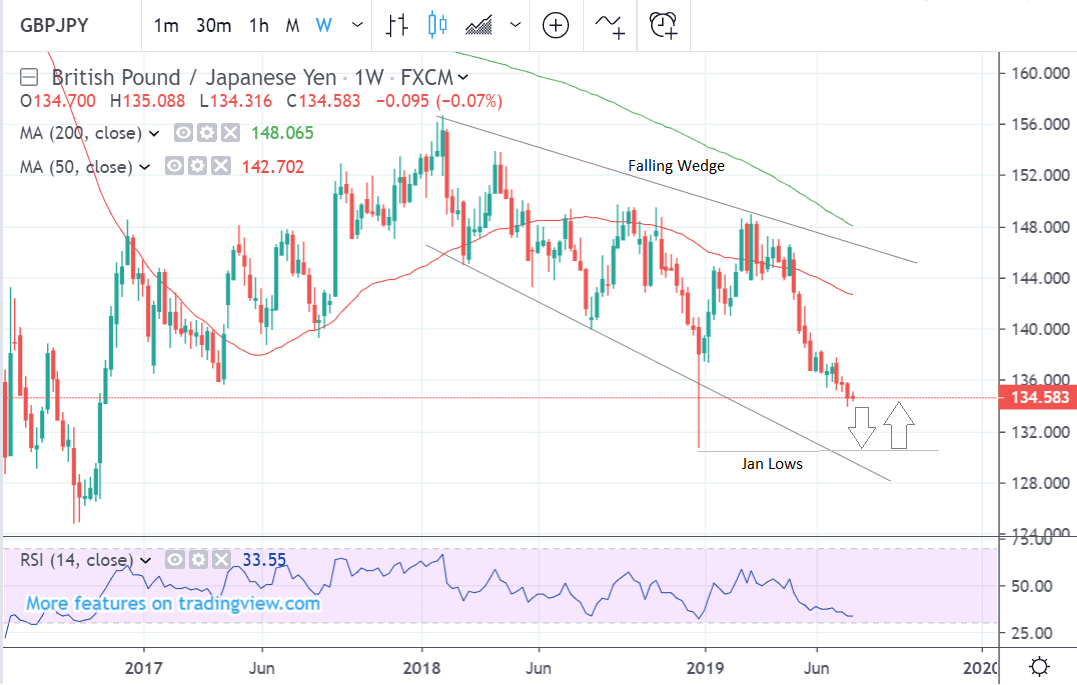

The weekly chart - used to give us an indication of the outlook for the long-term, defined as the next few months - shows the large wedge pattern which the pair has been forming since the start of 2018.

Although wedge patterns are generally considered as bullish the exchange rate is currently falling within the pattern after a false breakout at the start of the year.

The downtrend is so entrenched that we expect a continuation lower to the 130.70 target and then a probable bounce from there higher.

The Japanese Yen: Eyes on South Korea Spat

The Yen’s main driver is global investor risk appetite since it acts like a safe-haven currency, meaning it rises when the outlook for the global economy worsens and falls when the outlook improves.

Normally Chinese data drives market sentiment on the outlook for the global economy but there is no major Chinese data in the week ahead so this is unlikely to be a factor.

Another driver of risk sentiment is international trade talks. Currently, the two most important for the Yen are Japan’s own trade talks with Korea, the prospect of talks with the U.S. and China - U.S. trade talks.

Japan has imposed restrictions on the export of certain key materials to South Korea used in the manufacture of semiconductors which are components in most high-tech devices including smart-phones.

Japan also has plans to remove Korea from preferential trading partner status with Japan in August. This would involve removing South Korea from a “white list” of countries deemed trustworthy by Japan.

“If Tokyo goes ahead with its plan, Japanese exporters will need licenses to ship to South Korea some 850 items that could be used in weapons-related applications, according to IHS Markit,” says Yen Nee Lee, a reporter for CNBC.

There is no light at the end of the tunnel.

“The probability of further escalation is quite likely,” says Jesper Koll, of Wisdom Tree Investments. “There is no prospect at this time of bilateral talks between Japan and Korea.”

Whilst the trade spat with Korea is potentially damaging for Japan it is more so for South Korea since Japanese exports to Korea are only $26.9bn out of $694bn gross exports so only account for 3.9% of gross Japanese trade. This is not high, thus the impact on the Yen is likely to be contained.

Of more importance are trade talks with the U.S. which are now more likely to begin. It is early days yet but the talks are likely to focus on Japan opening up its protected agricultural markets in rice and beef to U.S. import competition in return for the U.S. withholding tariffs on Japanese cars.

As far as U.S. - China trade talks are going, the indications from both the Chinese media and Treasury Secretary Mnuchin appear to be positive. Trump also recently said things were going better although he changes his view quite frequently. Only the previous week he was saying a deal was a long way off and Google should be investigated for its links with China - so the news on this keeps flip-flopping.

Nevertheless, there appear to be some concrete efforts taking place which show some headway has been made in line with what was agreed at the G20.

The Chinese media, “noted some goodwill gestures on both sides, including the US pushing to allow US companies to supply Huawei with technological goods. The Chinese government met with domestic soybean buyers about a plan to purchase more US supplies, including wavering China’s retaliatory tariffs on the goods,” says Wong.

Though rarely moved by hard data, Tokyo Core CPI is quite important as it tends to lead nationwide CPI. It forecast to show a 0.8% rise year-on-year in July, slowing a basis point from the 0.9% previously, when it is released at 00.30 on Friday, July 26.

Inflation impacts interest rate expectations which are highly correlated to currencies. Low inflation as has been the case in Japan for many years, results in the central bank setting lower interest rates and this weighs on the currency.

Time to move your money? Get 3-5% more currency than your bank would offer by using the services of foreign exchange specialists at RationalFX. A specialist broker can deliver you an exchange rate closer to the real market rate, thereby saving you substantial quantities of currency. Find out more here.

* Advertisement