"Stars are Aligned" for an Higher US Dollar Against the Swiss Franc

- The outlook for USD/CHF goes from strength to strength

- Investment potential from carry trade underpins current rally

- Break above 0.98 seen as game-changing

© moonrise, Adobe Stock

The Dollar has risen 4.4% versus the Swiss Franc since mid-February and could be about to accelarate the move suggest analysts; this despite the sizeable global stock market sell-off which would normally be expected to support the safe-haven Franc.

Safe-haven currencies usually strengthen in times of fear, such as the present, however this does not appear to be the case with USD/CHF which has risen due to the USD outperforming CHF - not the other way round.

"Trade tensions have NOT triggered a rush to safe havens. Investors believe there is substantial hot air in the war of words," says Arnaud Masset, an analyst at online lender Swissquote.

The atypical exchange rate movements could be due to the high number of speculators betting against the Franc, borne out by recent FX futures data, which showed fully a fifth of all open bets on the Chicago Mercantile Futures Exchange, are bearish bets against the Franc.

"The latest CFTC speculative positioning data puts CHF net short positioning at 21% (of open interest), compared to 10% the previous week," says Masset.

Another factor could be that US trade tariffs might be positive for the US Dollar as they would be expected to reduce foreign imports. This seems to be the view of Commerzbank analyst Ulrich Leuchtmann, for example, who characterises the Trump administration's attempts to keep the Dollar weak, as an uphill struggle, because "his policy measures so far (tax reform, import duties) are all USD positive."

Demand from carry traders may also be pushing the pair higher since rising US interest rates have diverged dramatically from those in Switzerland. Officially the differential is 1.75% in the US versus -0.75% in Switzerland, but real rates are even wider.

Last week we reported on the view that the pair had investment potential via the carry trade and was undervalued to boot, increasing yet further its attractiveness. The view seems to have become more widespread since then, and the pair has pushed yet higher.

Carry trading involves borrowing a currency in an area will low interest rates, such as Switzerland, and lending it in an area with higher interest rates, such as the US.

The profit is the difference between what it costs to service the loan in Switzerland and what is earned in interest in the US.

"Even if USD/CHF stays flat, investors earn on the interest differential almost 3.4% on a 12-month basis," says Mensur Pocinci, an analyst at Julius Baer.

If the pair continues rising, an unhedged carry trade would earn the investor extra profit on top of the interest rate difference from a fortuitous rise in the exchange rate.

Pocini believes "stars are aligned" for the Dollar to advance on the Franc, and the Greenback "needs to deliver now".

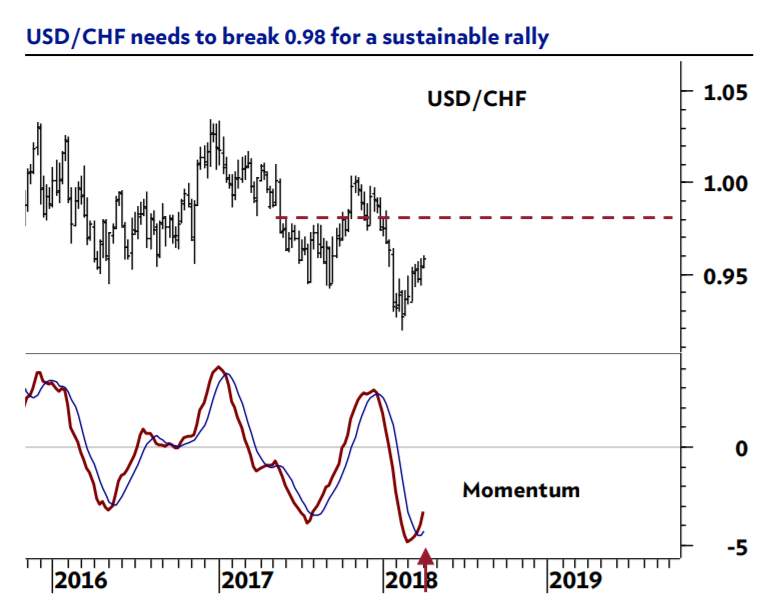

But, our technical studies note the exchange rate has reached a ledge of tough resistance on charts in the form of the 200-day moving average (MA) at 0.9658 which is likely to make progress higher more difficult:

Yet, with "momentum firmly positive" and option pricing showing a growing preference for call options (ie bullish options) over 'puts' (bearish options), the signs are there of, "a good chance that resistance will break to the upside," says Swissquote's Masset.

Options are derivatives which enabled risk controlled leveraged bets on currencies.

The '25-delta risk reversal' is a forecasting device based on the difference between the price of a call option and a put option on the same asset, thus the higher it is the more bullish.

"The 25-delta risk reversal has continuously improved across all maturities since mid-February. The 1-month rose from -1.18% to -0.62% yesterday, while the 6-month jumped from -1.36% to -1.03%," says Masset.

The outlook is positive for the pair since "USD/CHF remains in a medium-term momentum buy signal," according to Julius Baer's Pocinci, who "entered a long position in the currency portfolio on 14 March 2018."

Pocinci would ideally like to see the pair rise past current resistance and above 0.98, "to truly escape the pattern of lower highs and lower lows," and go 'all out' bullish.

Like Masset, Pocinci highlights USD/CHF's 'carry trade' potential which combined with the accelerating exchange rate rally offers a heady mix of arbitrage and currency bet profitability.

"The stars are aligned for the higher US Dollar – now the major resistance at 0.98 needs to be confirmed. We recommend staying long USD/CHF," he concludes.

Get up to 5% more foreign exchange by using a specialist provider to get closer to the real market rate and avoid the gaping spreads charged by your bank when providing currency. Learn more here.