Bearish Leg Unfolds for GBP/USD Exchange Rate Suggests Technical Analysis

Above: Lucy Lillicrap at AFEX sets out potential next levels for the Pound.

GBP/USD managed break below the 1.2600 level in mid-week trade, making fresh multi-week lows.

Market focus remains on politics as negotiations continue to proceed between Tories and the DUP despite the Government presenting its legislative programme to Parliament with guarantees of support from the Northern Irish party yet to be made.

"With no discernable progress yet in talks, the market is becoming worried about the prospect of a minority government and Ms. May’s ever so tenuous hold on power," says Boris Schlossberg, Director at BK Asset Management.

The domestic instability comes as the UK begins all-important Brexit talks; something that already poses a headache to the Pound.

"The air of uncertainty has turned sentiment against cable and the pair is now in sell the rally mode until the market gets better clarity on the political conditions in UK. Next week the UK eco calendar remains dormant, but if the eco data starts to falter the decline in cable could take it well below the key 1.2500 support level," says Schlossberg.

Dollar Aided by Fed Talk

In the UK, Governor of the Bank of England Mark Carney disappointed Pound-buyers after ruling out a hike in interest rates, by saying wages were too “anaemic”.

In the US, meanwhile, a voting member of the Federal Reserve’s rate setting committee expressed certainty the Fed would increase interest rates before the end of the year – his comments increased the market’s probability of a rate increase in December from 40% to 50%.

Despite the Pound being hugely undervalued according to most currency valuation measures – which place its true value in a range between the mid-1.30s and the 1.55s – Sterling lost almost a whole percent in trading on Tuesday.

“The U.S. Dollar maintained a gentle tail wind after prospects of another U.S. rate hike this year gained traction. Dollar bulls have William Dudley to thank, a member of the Fed’s dovish core who said Monday that the pieces were largely in place for wages and inflation to rise, giving the Fed leeway to increase borrowing rates,” remarked Joe Manimbo, Currency Analyst at Western Union.

Manimbo said the chances of another rate hike this year had risen to 50%, however, he added that for the Dollar to, “have a shot at making meaningful gains,” another hike would have to become an “odds-on favourite.”

Where Next for GBP/USD?

FX broker Associated Foreign Exchange (AFEX) believe Pound Sterling is likely to remain under pressure against the Dollar going forward.

“Shorter-term trends remain negative and indeed an argument could be made for current GBP weakness being part of a broad sell-off back to and then below 1.1800 eventually,” said AFEX’s research team.

The 1.3000 level is a key resistance zone with, “subsequent rebounds contained by 1.2975/85 resistance.”

For a more unambiguously bearish view they would want to see a penetration below 1.2615/25 support, which would thereafter target 1.2450/1.2275 next.

EUR/USD has Already Bottomed; GBP/USD to Follow

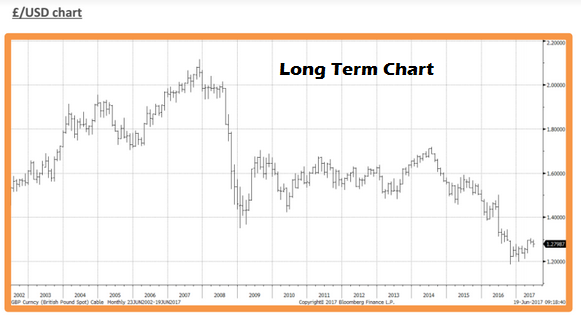

The GBP/USD bear trend may extend beyond the short term as the pair makes new cycle lows, according to AFEX’s analysis.

“An argument can be made for any loss of the notable 1.1855 (October 2016) lows completing macro downtrends from 1.7192 (July 2014 high) and potentially 2.1160 (November 2007 peak) as well.”

Historically GBP/USD has tended to bottom after EUR/USD, and since AFEX argue that EUR/USD has already bottomed the lag is about right for GBP/USD to soon follow suit.

“The assumption is that EUR/USD has already bottomed out but much as was the case in 2000/01 (the last such major bearish trend reversal) GBP/USD still needs to score one more new low before its descending sequence can be confirmed complete. Note: whereas EUR/USD made a final low of 0.8228 in October 2000 Cable didn’t reverse meaningfully and sustainably higher until some 9 months later,” said AFEX.

AFEX noted that Sterling normally lags other assets such as commodities as well, which have also already bottomed.

“Many developing market pairs and also most commodities looked to have already started their bullish trends early last year when the CRB index turned around from 350 or so. However, Sterling typically lags such developments anyway and thus recent price action is not too surprising.”

Once GBP/USD has finally bottomed Sterling should begin a broad based recovery as it did in 1985 but until then it is forecast to remain under pressure.

Cable’s declines tend to be quite ‘compartmentalised’ into short periods of highly volatile discounting, which, “If repeated suggests that an awaited final low may well unfold much sooner than later but in anycase most of the available downside risk should be realised by the end of 2017,” said AFEX.

From this fact the broker extrapolates the view that the Dollar will start to make a broad-based decline in 2018 when all Dollar pairs – Sterling included – synchronise.

“Looking ahead into next year (with all of the major USD-based pair cycles thereby more aligned) the presumption is that increasing Dollar bearishness will start to become much more of a dominant focus or feature in FX terms,” concluded AFEX.

End of the Dollar Rally

Of course much of this negative view on Sterling-Dollar relies largely on the assumption that the cyclical uptrend in the Dollar restarts.

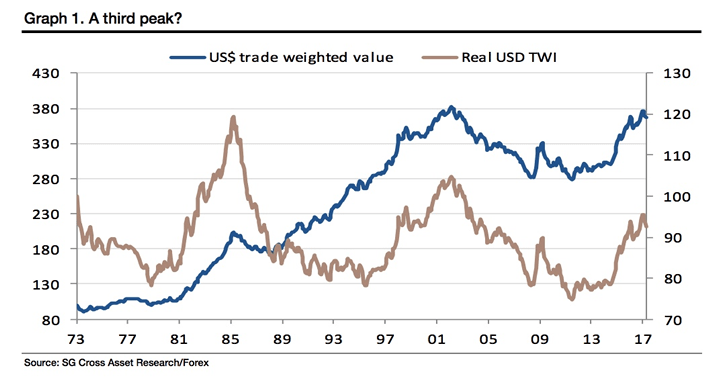

The Dollar has been rising since 2012 as the US economy leads the world in exiting the great financial crisis of 2008, but there are signs this trend might be stalling as the rest of the world catches up.

The Dollar trends in multi-year cycles and there are suggestions that the third upswing of the post-Bretton Woods era has come to an end.

If so, we would question whether or not that big loss in GBP/USD is actually likely.