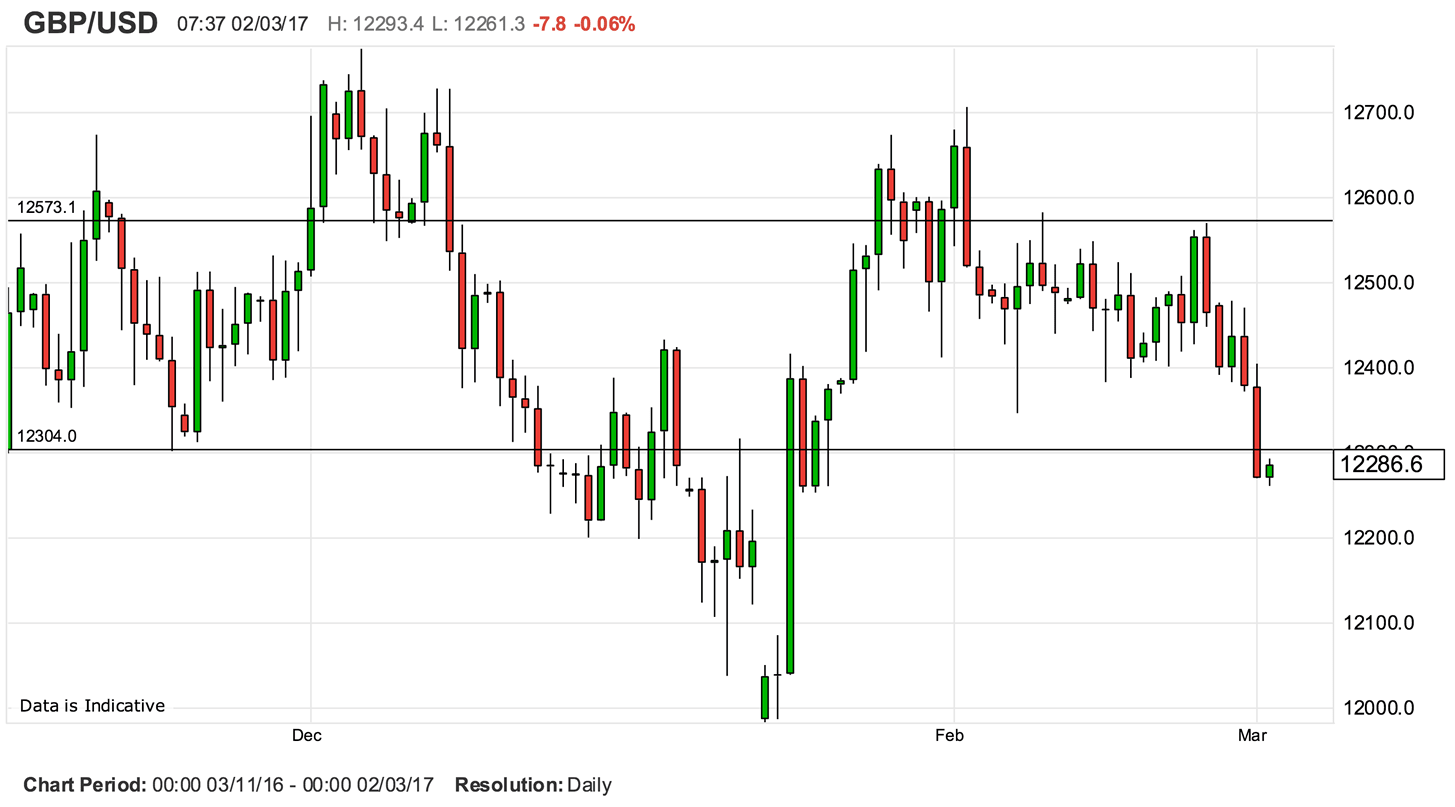

The Pound is ‘Poised for a Deeper Slide to 1.22’ Against the US Dollar

The US Dollar continues to extend gains against all of the major currencies and is the week's best performing currency ahead of the weekend.

As a result GBP/USD remains near its lowest levels since January 19, with 1 GBP buying 1.2265 USD on the spot markets at the time of writing.

The fall in the spot rate means some banks areoffering exchange rates below 1.20 for international payments while independent providers are still quoting above 1.21.

But with US Dollar bulls being back in control further weakness could be possible.

The Greenback is trading higher against all of the major currencies as markets latch on to the fact that the US Federal Reserve is going to raise interest rates on at least three occasions in 2017.

"Senior Federal Reserve officials are falling over themselves to talk up the prospect of an increase in the funds rate this month. Governor Lael Brainard said yesterday higher rates would be appropriate 'soon'. Investors seem delighted by the idea: they were buying everything in sight on Wednesday," says a foreign exchange briefing to clients issued by MoneyCorp, the London-based brokerage.

Buying Dollars using Sterling has been a popular pastime amongst investors as a result.

“Having broken below 1.2380 and the 50/100-day SMA, GBP/USD extended its losses below 1.23 and appears poised for a deeper slide to 1.22,” says Kathy Lien, co-Director at BK Asset Management in New York.

"The bears have now taken control on Cable as the dollar has strengthened in the past few days. Strong bear candles have been posted now on four successive days and the market has not only breached the recent support at 1.2345, but a closing break confirms the deterioration in the outlook," says Richard Perry, a technical analyst with Hantec Markets.

With the spot exchange rate now at 1.2288 we note that banks are charging a rate in the vicinity of 1.1971 for GBP/USD payments while independent providers are offering more competitve rates closer towards 1.2150-1.22.

The Pound to Dollar exchange rate was seen experiencing negative momentum at the end of February as expectations for a Bank of England interest rate over coming months receded alongside a softening of the countries economic growth.

The trend towards a slowing UK economy was cemented further on March 1 when IHS Markit and the CIPS reported that manufacturing activity slowed more than expected in the month of February.

But, Brexit remains the point of content for the Pound as the bottom line remains that months of uncertainty lie ahead for the UK and this will ultimately weigh on investment decisions by both small and large companies whether they be foreign or domestic.

Yes, investment decisions continue to be made - just look at Dyson announcing plans to build a massive tech hub in the Cotswolds - but the point is a lot of decisions are being put on hold.

This was confirmed in the latest set of GDP data which showed business investment slow 1.0% in the final quarter of 2016.

Meanwhile, Theresa May's Brexit bill suffered a setback when the House of Lords sought to add an ammendment.

The Lords will have to cede to the Government’s wishes but what they are doing is causing more ‘back and forth’ on the terms of exit which prolongs the process and adds uncertainty.

“It won't stop Article 50 from being triggered but puts Brexit back in the headlines. Between a possible Scottish referendum and the trigger of Article 50, March could be a tough month for GBP,” says Lien.

Lien has a point, but others suggest that the Brexit story is growing old and might not have the downside influence that it once had which suggests the damage could be limited this time around.

“We think the focus has moved away from worries after Brexit,” says analyst Hans Redeker at Morgan Stanley. “Theresa May has set out her plans to trigger article 50 in March with enough detail that should already be priced into the market.”

However, from a technical perspective we would argue that it is too early to suggest the Pound has a one-way ticket to fresh multi-year lows as there is a good body of evidence that suggests the worst is over.

Our technical studies of the pair, for example, suggests that further consolidation is likely but a break-out could soon occur that favours the bulls.

We have also reported that ABN AMRO believe the Dollar’s ‘sweet spot’ of appreciation is over and that Sterling should ultimately consolidate around the 1.25 level

Lloyds Bank meanwhile see a move above 1.30 as per their latest foreign exchange forecast briefing.

“GBP is currently undervalued and has stabilised, which we think offers a strategic opportunity to buy. In contrast, Eurozone political risks stay high as we get closer to elections. The ECB is unlikely to change its accommodative stance as inflation rates remain wide across the Eurozone,” says Morgan Stanley’s Redeker.

While the Pound is undervalued and should ultimately recover, patience is required by those hoping for a stronger exchange rate as there remains little incentive to build up exposure to UK assets at the current time.

"Cable is super-cheap at these levels, but we think it can get a little cheaper. We have support at 1.2250/55, below which 1.20 beckons," says Chris Turner, Global Head of Strategy at ING in London.