U.S. Dollar and Federal Reserve Outlook: Analyst and Economist Views

- Written by: James Skinner

Image © Adobe Images

Most U.S. Dollar exchange rates slipped lower in the penultimate session of the week after the Federal Reserve (Fed) raised interest rates and broadened its options in relation to future policy decisions but this and multiple other factors mean that analyst and economist views on the outlook are more nuanced than market prices might imply.

Dollars were sold widely but particularly against currencies linked with commodities and Asia Pacific economies while being bought for Pounds, Euros, Swiss Francs and Japanese Yen in a subtle shift of the earlier pecking order of performance with some prior outperformers becoming underperformers and vice versa.

But the broad trajectory of the Dollar overall remained to the downside as analysts, economists and the market at large contemplated new policy guidance given by the Federal Reserve on Wednesday when announcing its 10th increase in the Fed Funds rate range in little more than a year.

New guidance was that labor market conditions, inflation pressures and inflation expectations, and financial and international developments will be monitored closely as the Federal Open Market Committee considers whether it will be necessary to raise interest rates any further in the months ahead.

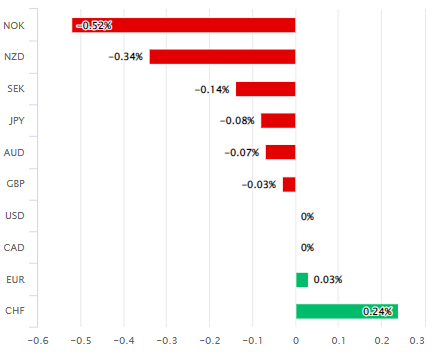

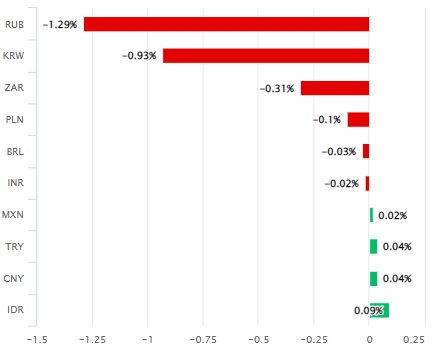

Above: U.S. Dollar relative to G10 and G20 counterparts on Wednesday. Click each image for closer inspection. Source: Pound Sterling Live.

This is with the Fed Funds range sitting between 5% and 5.25%; a level broadly consistent with where the March FOMC forecasts suggested the interest rate cycle would likely end.

But instability in the banking sector and a congressional conflict over government funding are just two factors clouding the outlook for inflation and interest rates.

The banking sector is relevant to the outlook because Fed officials have previously expected and may now be observing a retrenchment of commercial bank risk appetite and contraction in the availability of credit for companies and households.

This is another factor the Fed expects to weigh on demand in the U.S. economy over the coming months and help to reduce inflation back to the 2% target over time but analysts and economists have differing views on the outlook for inflation, interest rates and the Dollar, some of which are included below.

Michael Gapen, U.S. economist, BofA Global Research

"In FX, the FOMC statement prompted a modest knee-jerk USD-negative reaction (along with front-end US rates), which mostly retraced leaving the USD little changed vs most

G10 currencies."

"We think the Fed has reached its terminal rate in this tightening cycle, though we note that there are two employment reports and CPI inflation reports before the June FOMC

meeting (the second CPI report comes on the first day of the June meeting)."

"In terms of the outlook for policy rate cuts, Powell stuck to his prior message. In the Fed’s forecast, where the economy soft lands and services inflation remains sticky, he

stated the committee would not see rate cuts in the near future are appropriate. That said, Powell mentioned, "if you have a different forecast" then we would "factor that in".

Chris Turner, regional head of research for UK & CEE, ING

"The dollar was only slightly weaker at the end of Chair Jerome Powell's press conference and the US yield curve had barely budged on the news that the Fed was shifting to a meeting-by-meeting approach to monetary policy setting. However, in the final few hours of US equity trading, US regional banks - especially PacWest - came under renewed pressure on reports that Pacwest was 'exploring options'. Given that First Republic equity and bondholders were wiped out this week, that clearly caused some concerns."

"The point here is that the 15bp decline in US two-year yields overnight seems to have been driven by the banking crisis - not the Fed commentary.

"Those currencies with the highest correlations to US equities look more exposed (e.g. the commodity currencies of the Canadian and Australian dollars), while the least correlated - such as the Japanese yen and Swiss franc should outperform. This would be our near-term preference given that the US banking crisis is showing no signs of slowing."

"One could be forgiven for thinking that there has been a major re-appraisal of sterling now that GBP/USD is trading closer to 1.26. In fact, this is mostly a dollar move and trade-weighted sterling has not moved much this week. It seems that the view that European banks, including the UK, are better regulated than those in the US is providing some insulation to European currencies."

David Mericle, chief U.S. economist, Goldman Sachs

"We saw the May FOMC meeting as supportive of our call for a pause in June. The FOMC removed from its statement the earlier guidance that some additional policy firming may be appropriate, and while the nod toward a June pause was not quite as strong as we had expected, Chair Powell emphasized twice that this is a “meaningful change.”

"Powell said that he does not expect a recession, unlike the Fed staff, and he made his clearest statement so far that he thinks a soft landing is possible and finds the labor market rebalancing to date encouraging, views that we share."

"We see this as dovish too—if Powell thinks that a recession is not necessary to solve the inflation problem, he will be reluctant to deliver future hikes that he thinks would materially raise the risk of pushing the economy into a recession."

Mazen Issa, senior FX strategist, TD Securities

"The Fed is nearing the end of its tightening cycle, but still has to make up its mind regarding the appropriate peak Fed funds rate. They are concerned about the uncertain impact of tightening credit conditions, but are also taken aback by the stubbornly elevated rates of core inflation, which seem to be stabilizing at above-target levels. The Fed will closely monitor data on inflation and the labor market between now and the June meeting to."

"While not an overt signal that the Fed was hitting pause, the stakes may be higher. We think the market will treat it as such. Thus, we think an asymmetry to trade the USD to the weak side will remain particularly as banking pressures will persist. NFP will also hold crucial weight in the USD's near-term fate. All told, we are biased to further EURUSD upside and especially USDJPY downside (we are short through options)."

Ian Shepherdson, chief economist, Pantheon Macroeconomics

"We expect the two rounds of payroll, CPI, PPI and activity data between now and the June meeting to confirm that the economy has weakened markedly and that inflation pressure is receding, so we think the Fed will leave rates on hold."

"Note that it is entirely possible that the debt ceiling situation is at crisis point at the time of the June meeting, with markets in turmoil, adding to the case for the Fed not to act. We think the Fed’s next move will be an easing, in September or November."

"The Fed has now hiked by 500bp from the low. In the past, cumulative hikes of more than 300bp or so have been enough to push the economy into recession, even without the assistance of a banking crisis. No previous Fed since at least 1960 has continued hiking after the peak in core inflation."

"In the past seven cycles they have eased before the peak, in the knowledge that it was coming. This Fed is in uncharted waters, with all the risks that entails. We think they have done more than enough, and that the economy likely is now shrinking.

Pierre-Antoine Dusoulier, CEO, iBanFirst

"FX-wise, the FOMC meeting is not a game-changer in the short-and medium-term. About 85 % of market participants expected a 25 bp hike to 5.00-5.25 %."

"In our view, the banking crisis with dozens of regional banks in disarray and uncertainty about the debt ceiling will negatively weigh on the U.S. dollar in the short-term. Other banks will need to be saved. Based on CDS and stock evolution, the market considers rightly or wrongly that PacWest Bancorp will be the next regional bank to fail."

"In the interim, the political circus around [the debt ceiling] will probably be another net negative for the U.S. dollar. Dollar weakness will continue. We reaffirm our bullish case on the euro and the sterling. The GBP/USD cross is above water with a strong bullish bias. We would not be surprised if it reaches the 1.27 level in the coming weeks."

"Expectations of higher rate differentials between both sides of the Atlantic will continue to drive the euro higher. Other factors are pushing the single currency such as a structurally positive trade balance in the eurozone, capital flow coming from the United States to the European continent, the lack of monetary fragmentation between the North and the South and low credit risk (Portugal and Greece benefit from looser credit conditions than any other BBB/BB-rated countries, for instance)."

"What is perhaps more surprising is the euro is seen as a hedge against the U.S. recession by traders and institutional investors. This is atypical. But this reinforces our view that the EUR/USD cross could peak at 1.15 this year."

Ulrich Leuchtmann, head of FX strategy, Commerzbank

"What is much more important than the question as to whether there will be another rate step in June is: Will the key rate remain at high levels for a long time or will it fall again soon (the market expects this to happen as early as the autumn)? Fed chair Jay Powell did not give us much news on that yesterday."

"To hike first and then cut rates again quite quickly is not usually the Fed’s style. We know that from the ECB, but not from the US central bankers. However, that would only be a comment for the next few months not for the more important medium- to long-term view (as described above)."

"What matters for that horizon is something quite different: it is all about how inflation develops and how the Fed will react to these medium- to long-term developments. The Fed can tell us anything, but that is not USD-relevant if the market does not believe the Fed."

"Our Fed watchers do not expect another rate hike. This would require the disinflation trend to be notably disrupted. Possible, but not very likely. And therefore, I have a lot of sympathy for our Fed watchers’ new point of view."

"Should regional bank stress stabilize, labor markets stay tight, and inflation stay elevated, a rate hike in June could become appropriate."

Marc Giannoni, chief U.S. economist, Barclays

"Based on today's information, we keep our rate forecast unchanged. In our baseline projection, today's rate hike was the last of the cycle, and we expect the FOMC to maintain the funds rate target range at 5.00-5.25% through the rest of the year."

"This projection assumes that economic activity will slow gradually, turning into a mild recession in the second half of the year, with the labor market easing, the unemployment rate increasing, and core PCE inflation gradually declining toward 3.5% in Q4. In particular, we assume that the turmoil in the banking sector does not morph into a severe financial crisis."

"The FOMC has been keen for some time to communicate that it intends to maintain a tight policy stance in order to bring inflation back to its 2% target, even if this causes the economy to weaken."

"For the FOMC to maintain its policy rate unchanged at the June meeting, it will need to be confident that with the current policy stance, economic activity gradually slows, the labor market cools with the unemployment rate increasing, and core PCE inflation continues to moderate, all broadly in line with the March SEP for this year."