U.S. Dollar Seen Supported as Market Waits on U.S.-China Deal

- Written by: James Skinner

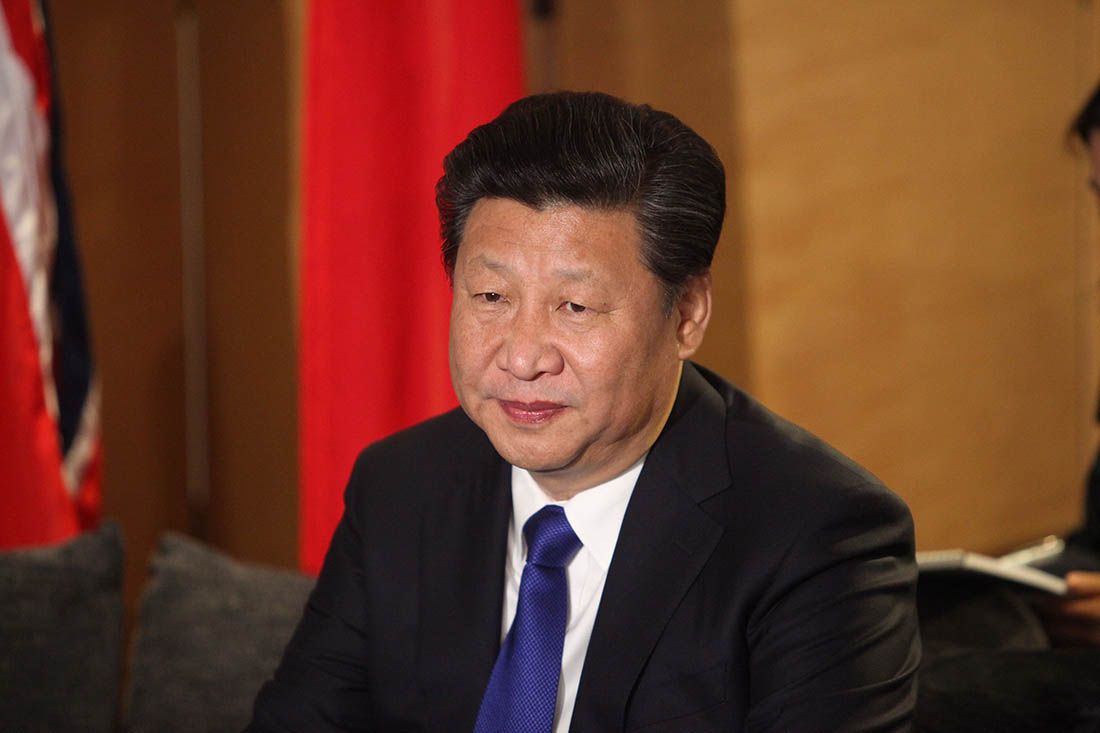

Image © Commonwealth Office. Reproduced under CC licensing

- Markets have priced-in U.S.-China deal, multiple analysts say.

- Leaves markets vulnerable to disappointment, supports USD.

- Rabobank doubts deal will happen at all as others turn cautious.

- Saxo says won't stand in way of trend but flags resistance ahead.

- Weakness of EUR and GBP rates also aids cheers USD outlook.

The Dollar was firm early on Friday as other major currencies softened although it could remain supported in the weeks ahead because a much vaunted 'phase one deal' between the U.S. and China is now in the price of financial assets but is still to actually materialise, some analysts say.

America's greenback ceded ground to 'risk' rivals like the Aussie heading into Friday after China claimed a 'phase one deal' can still be done even if it does take longer than once telegraphed. China also said more of the existing punitive levies on imports from either side will soon be lifted as part of the deal but the Pound didn't share in the celebrations because it was in retreat from the Bank of England (BoE), which revealed some policymakers want to cut interest rates.

"The US dollar remains bid, amid anticipation of a partial US-China trade deal. However, despite USDJPY and USDCHF breaking some key technical levels, price action has been a bit disappointing. Trying to fight the USD uptrend is tough though, so given the momentum I'd look to buying USD on dips. EURUSD support at 1.1029, 1.0990 and 1.0940; resistance at 1.1065, 1.1090 and 1.1120," says Thomas Laubscher, a spot FX trader at UBS.

Markets cheered China's comments but other almost contradictory statements have since emerged and analysts were already suggesting that investor optimism wouldn't last long without tangible progress. Risk currencies have done well in recent weeks and safe-havens suffered as U.S. and Chinese officials tempted investors with the prospect of a deal between the two, which would be a form of balm for the struggling global economy and for the asset prices that have been reduced by the tariff fight.

"The market is celebrating an apparent breakthrough in US-China trade talks, but may have thoroughly priced in the news at this point, suggesting that an extension higher from here may run into resistance fairly soon. The smaller currencies in the G10 and EM currencies are having a field day on the news," says John Hardy, chief FX strategist at Saxo Bank. "It seems there is still plenty of room for trade talks to break down between now and what is will likely prove a very delayed date for the signing of whatever deal, if any, is reached. USDCNY traded to a new local low this morning and was below 6.98 as of this writing."

Hardy says markets like the fact that Thursday's comments came from the Chinese side rather than the White House but is sceptical of how much longer investors will continue to bid 'risk' assets up for in the absence of an actual deal. He spots resistance ahead on the charts for many currencies but says the Saxo strategy team won't "stand in the way" of the optimistic trend in markets.

Above: AUD/USD rate shown at hourly intervals alongside Pound-to-Dollar rate (orange line, left axis).

President Donald Trump said on October 11 a 'phase one deal' to end the trade war had been reached and that it would likely be formalised at the APEC summit on November 17. But that gathering has since been cancelled and both parties have now pushed back the date by which they expect the eagerly anticipated accord to be revealed and signed. Trump said last month it would cover intellectual property protections and the currency, in exchange for tariff relief.

"It didn’t happen in October. It won’t happen in November. Now it might happen in December. Or it might not," says Michael Every, a strategist at Rabobank. "Luckily, the nasty news was preceded by some really strong German data (factory orders up 1.3% m/m), a signal which for once does perhaps portend better times ahead for global manufacturing. Nonetheless, back to what, as we argued yesterday, is supposed to matter the most."

Every, who's based in Hong Kong, flags Reuters' quotation of a Chinese official who's reported to have said it's still possible that a deal does not get reached and that one is simply "more likely than not". Every also noted in a morning missive to clients, a new 'data protection' law recently passed by the Chinese government that he suggests might circumvent anything ceded to Trump when it comes to intellectual property protections. A key issue in the tariff fight, which has often appeared to be as much about competition for global hegemony as it is said to be about "fair" trade.

That suggests the 'breakthroughs' reported of late, and claims made in recent weeks, about the prospects of a deal may have been substantially embellished. Both parties have entered talks and agreed repeated ceasefires on multiple occasions in the last year but the fruits of those efforts have tended to wither on the vine in no time at all.

Above: Dollar Index shown at daily intervals.

If progress in the latest talks has in fact been over-egged then it would be good news for the safe-haven Dollar and Yen while bad for the likes of the Pound and Euro as well as Australian and Kiwi Dollars - all of which have been injured during the last 18 months or so of trade war. However, not everyone sees it that way and some have a nuanced view.

"With a lot of good news priced now, a move toward removal of previous tariffs is probably required to maintain risk appetite. The euro was relatively unmoved on the negative headlines yesterday. This suggests that while the tone regarding trade talks remains within a relatively limited range (without a major upset), there could be more upside potential for the euro than downside in the near term," says Fritz Louw, an analyst at MUFG.

It only takes a rising or falling Euro to tip the balance for the Dollar index although both the Euro and Sterling were retreating on domestic factors Thursday. Sterling was hurt by the division at the BoE while the Euro was clobbered amid dismay over the European Commission's (EC) latest forecasts.

Thursday's EU forecasts asked awkward questions of a market that was not only revelling in hope of a 'phase one deal' but also tentative signs that an economic turnaround might be lurking in the long grass of next year. However, and as much as they aren't good news for the Euro, the EC's numbers are no more than forecasts that were made at a time when there's a lot on the table that's still to play for as far as the outlook goes.

Time to move your money? Get 3-5% more currency than your bank would offer by using the services of a specialist foreign exchange specialist. A payments provider can deliver you an exchange rate closer to the real market rate than your bank would, thereby saving you substantial quantities of currency. Find out more here.

* Advertisement