Pound-to-Dollar Exchange Rate Week Ahead Forecast: Threatening to Continue Lower After Weak Bounce

Image © Adobe Images

- GBP/USD to continue falling after weak bounce

- Break below old lows could signal more downside

- Expect critical week for Brexit negotiations to boost volatility

- U.S. Dollar by trade talks and CPI

The GBP/USD exchange rate is trading at 1.2330 at the start of the new week after rising 0.38% in the week before. However, studies of the charts suggest weakness is possible but we note a critical week for Brexit negotiations lies ahead and this could inject heightened two-way volatility into Sterling.

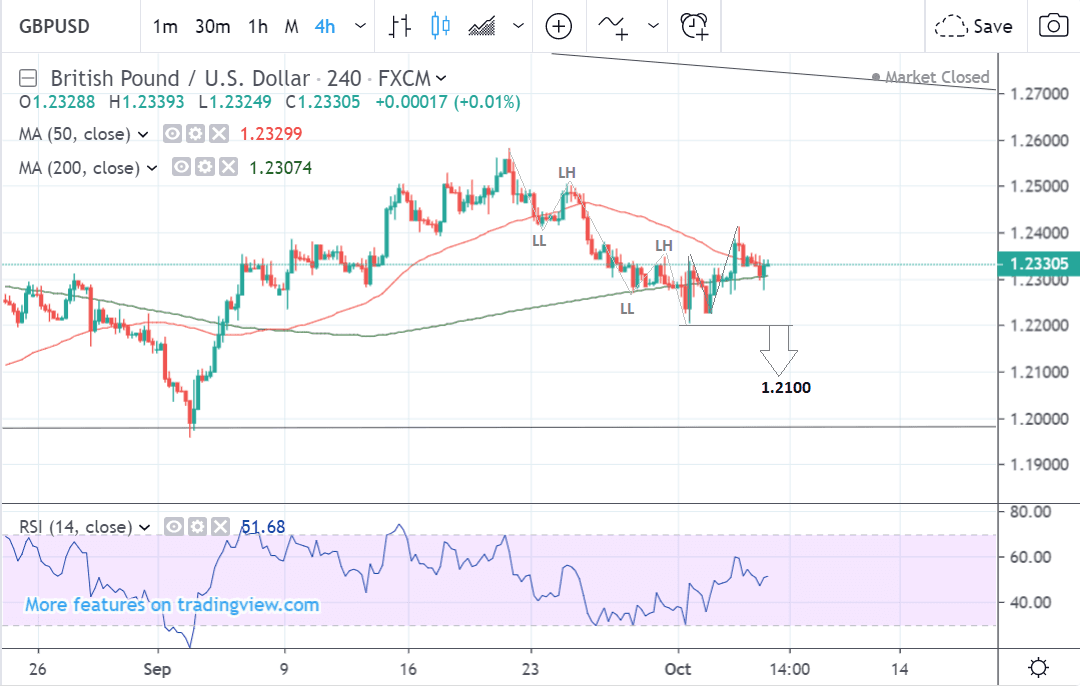

The 4 hour chart - used to determine the short-term outlook, which includes the coming week or next 5 days - shows the pair in the process of pulling back mid-decline.

The pull-back is probably just a temporary recovery which is likely to give-way to further downside eventually.

The downmove from the September 20 highs could be the start of a new trend lower. It has now formed two sets of lower lows (LL) and lower highs (LH) which is one of the first signs of the birth of a new trend.

Yet the pair has hit a tough support zone which will make further downside more difficult to achieve.

It will require a clear break below the bottom of the support zone at 1.2200 to give the green-light to an extension lower down to the next downside target at 1.2100.

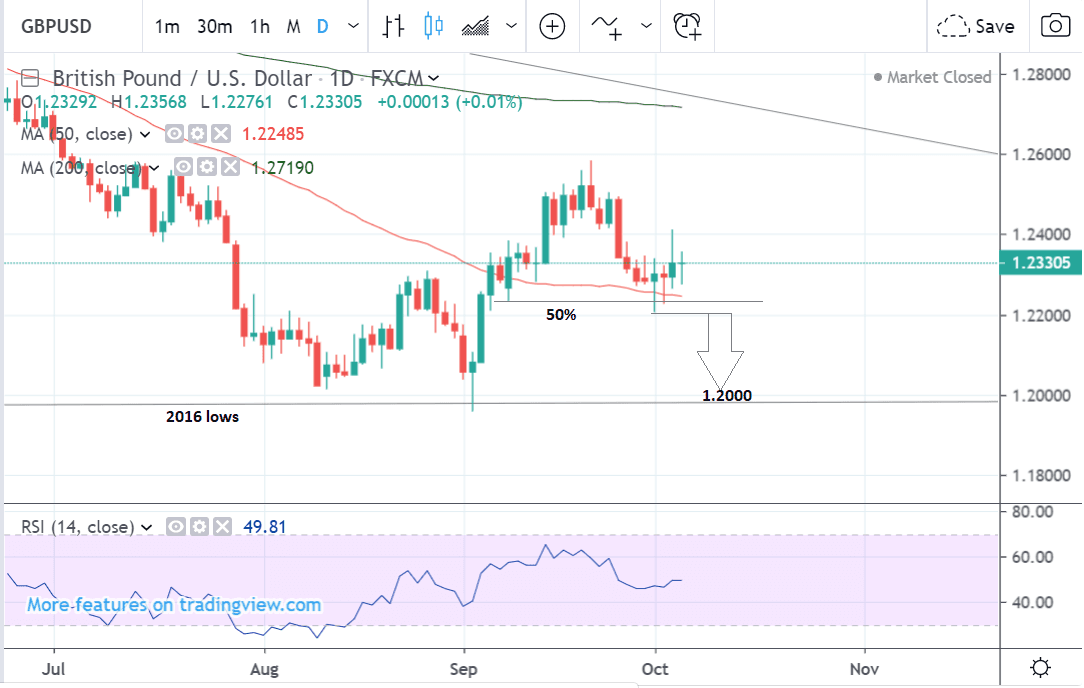

The daily chart shows how the pair has fallen to important support from the 50-day moving average (MA) at 1.2262 and the 50% level, or midpoint, of the September rally.

The midpoint of the prior rally has a special significance which increases its support and resistance qualities, and this combined with the MA, produces a tough level for bears to crack.

As noted above, if the exchange rate can push below 1.22 it will provide confirmation of more downside to a target at 1.2000 and the key 2016 lows.

The daily chart is used to analyse the medium-term trend, which is the next week to month of price action.

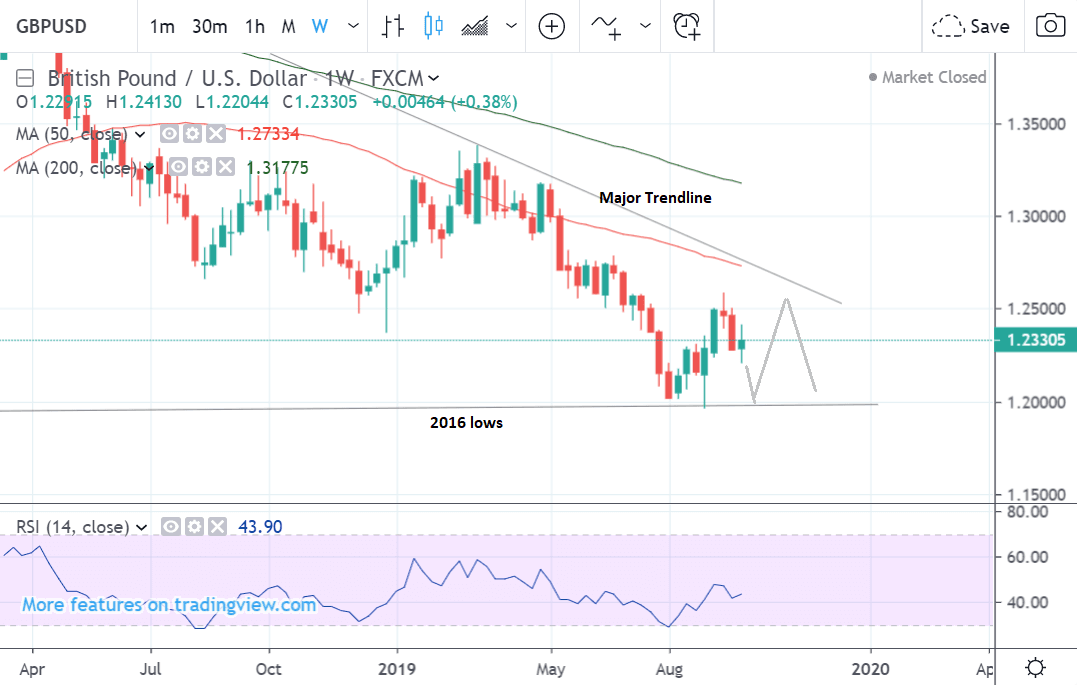

The weekly chart shows how the pair has been falling long-term in a downtrend and given the old adage ‘the trend is your friend’ this downtrend is more likely to extend than not.

The pair will probably fall to 1.2000 and the 2016 lows and then bounce, perhaps all the way back up to 1.2500 and the major multi-year trendline.

This could well produce resistance going forward, which could see the pair pull-back down.

The 2016 lows are a major historic level which has been touched many times and a rebound from there is likely.

The weekly chart is used to give an idea of the longer-term outlook, which includes the next few months.

Time to move your money? Get 3-5% more currency than your bank would offer by using the services of a specialist foreign exchange specialist. A payments provider can deliver you an exchange rate closer to the real market rate than your bank would, thereby saving you substantial quantities of currency. Find out more here.

* Advertisement

The U.S. Dollar: What to Watch

The main drivers of the U.S. Dollar in the week ahead are likely to be the outcome of U.S - China trade talks, the release of Federal Reserve policy meeting minutes on Wednesday, and CPI data on Thursday.

A fresh round of trade talks between the U.S. and China are scheduled to kick off on Thursday with the possibility of deal being done.

There may be incentives for both sides to agree a deal.

Trump may want to appease his base in the run up to next year’s elections; and the Chinese may wish to prevent any greater decline in growth.

If there is a deal, the Dollar will probably rise as it will suggest better growth in the U.S. and a lower probability of the Federal Reserve (Fed) having to cut interest rates to stimulate growth - a negative policy for the Dollar.

“A failure to reach a limited deal would further undermine market sentiment, likely sending stocks lower alongside the dollar, as the implied chances for more Fed rate cuts in the coming months soar. The defensive yen and gold could be the biggest beneficiaries in this scenario. The opposite reactions would likely take place if a deal is struck,” says Marios Hadjikyriacos, investment analyst at XM.com.

CPI data is forecast to show a 0.1% rise in September and core CPI a 0.2% rise. Core CPI is forecast to rise by 2.4% compared to a year ago when the data is released on Thursday at 13.30 BST.

Given the poor ISM data out last week the risks may be tilted to an undershoot rather than an above-expectations result, and if that is the case the Dollar may weaken.

The Fed policy meeting or FOMC meeting minutes out on Wednesday at 19.00 could also move the Dollar.

The minutes include the deliberations of Fed officials and sometimes contain new information about the possible future trajectory of interest rates.

Higher interest rates tend to support the Dollar and lower weaken it.

This is due to the influence of rates on net foreign capital inflows which tend to increase the higher rates rise.

The Pound: What to Watch

Brexit news will continue to dominate the Pound in the week ahead, whilst on the hard data front industrial and manufacturing production are the main releases along with the second estimate of Q2 GDP.

From a Brexit standpoint, the main focus will be on whether the UK and EU can strike a deal or at least a semblance of a deal - if they can the Pound could rise strongly. Dominic Cummings, a leading force behind the UK's Brexit strategy, has reportedly told aides that if the EU do not strike a compromise and agree to a new plan this week then the UK will be leaving without a deal.

The stakes are certainly high, particularly as there is very little insight into how Prime Minister Boris Johnson intends to exit the EU without a deal on October 31.

According to government papers submitted to a Scottish court on Friday, Johnson will send a letter to the European Union asking for a Brexit delay if no divorce deal has been agreed by October 19. This means the Government intends to abide by the Benn Act which forces the Prime Minister to seek a Brexit extension if a deal has not been passed by parliament on October 19.

However, the British Pound actually went lower on the day as Government sources maintained that while they intend to follow the law, they will still not seek a delay. Steve Baker, the Conservative MP who heads up the party's Eurosceptic European Research Group responded to the government's court papers saying: "a source confirms all this means is that Government will obey the law. It does not mean we will extend. It does not mean we will stay in the EU beyond Oct 31. We will leave."

The UK recently submitted an alternative proposal to solve the problem of the Irish 'backstop' but the initial reaction of leading EU Brexit negotiators and stakeholders was not very positive and suggests the two sides were a long way from meeting in the middle.

Leo Varadkar, the prime minister of Ireland, said the UK’s present proposals “do not form the basis for deeper negotiations.”

The EU's chief Brexit negotiator Michel Barnier said, “there’s improvement...we are not there yet,” but privately was concerned about the proposal’s custom’s checks on the island of Ireland, a red-line for the EU.

Guy Verhofstadt, who heads up the EU Parliament's Brexit oversight committee commented that the proposals were “not positive in that we don’t think really there are the safeguards that Ireland needs.”

The proposal was however well-received by the government’s own party, however, including leading Brexiteers on the one hand and rebel Tory independents on the other. We noted that there is a decent chance the Government could win a majority were they to present a deal based on their latest plans, and this is an all-out positive development for Sterling.

A deal still looks to be some way off however as the further the government moves to meet the demands of the EU, who basically want a customs union in Ireland, the more it will alienate the ERG and DUP, without whose support it has no chance of getting the deal approved by Parliament.

This may overall lead to further pressure on the Pound in the week ahead.

Turning to the economic data, investors will be closely watching industrial and manufacturing data, which are both expected to show a -0.1% result in August from 0.1% and 0.3% respectively in July, when released on Thursday and 9.30 BST.

A combination of Brexit uncertainty and the global manufacturing slowdown have started to show up in British economic data and the recent Services PMI report said there was a heightened chance of a technical recession happening in the UK.

If the results show a deeper-than-expected contraction in the data the Pound will probably weaken.

Q2 GDP is expected to remain unrevised for its second estimate, with the quarterly reading to continue to show 0.0% growth, yearly 1.3% and monthly 0.3%.

If results are revised down the Pound will follow suit.

Time to move your money? Get 3-5% more currency than your bank would offer by using the services of a specialist foreign exchange specialist. A payments provider can deliver you an exchange rate closer to the real market rate than your bank would, thereby saving you substantial quantities of currency. Find out more here.

* Advertisement