RBNZ Hammers Home Negative Rates Message

- RBNZ says prolonged monetary support necessary

- NZD down against EUR, GBP and USD

- 0.50% interest rate cut likely in April says ANZ

- Quantitative easing to be expanded in Nov. says UOB

Above: File image of RBNZ Governor Adrian Orr at a press conference. Image courtesy of RBNZ.

- GBP/NZD spot rate at time of publication: 1.9245

- Bank transfer rates (indicative guide): 1.8570-1.8700

- FX specialist rates (indicative guide): 1.9000-1.9070

- More information on specialist rates here

The New Zealand Dollar gave ground to the Pound, Euro and U.S. Dollar in the wake of a decidedly downbeat update from the Reserve Bank of New Zealand which opted to keep policy settings unchanged at their September meeting but warned that further easing was likely over coming months.

The New Zealand Dollar would have likely bounced had the RBNZ shifted to a more optimistic tone that pushed back expectations that interest rates would be cut to 0% and below in 2021, however the takeaway from the September event is that Governor Adrian Orr and his team remain intent on slashing rates further.

The RBNZ said "steps to boost the provision of bank credit, a move to negative interest rates, and the purchase of foreign assets," remained key objectives.

The developments ensured the Pound-to-New Zealand Dollar exchange rate remains above its technical floor at 1.90 and is quoted higher at 1.9245 at the time of writing. The New Zealand-U.S. Dollar exchange rate is meanwhile 0.33% down at 0.6605, a strong move that also has an element of U.S. Dollar strength to it. The Euro-New Zealand Dollar exchange rate is quoted higher at 1.7679.

The RBNZ said "prolonged monetary support" remains necessary in order to support the economy that has been hit by the covid-19 crisis and as such the Bank's quantitative easing programme - the Large Scale Asset Purchase (LSAP) Programme - would continue to at pace until the RBNZ had purchased up to $100BN worth of government bonds.

The Official Cash Rate (OCR) is held at 0.25% but, "reflecting the possible need for further monetary stimulus, the Committee noted the progress being made on the Bank’s ability to deploy additional monetary instruments. The instruments include a Funding for Lending Programme (FLP), a negative OCR, and purchases of foreign assets," said the RBNZ.

The New Zealand Dollar has underperformed the majority of its major peers in 2020 with foreign exchange analysts saying the RBNZ's aggressive policies to support the economy are the cause.

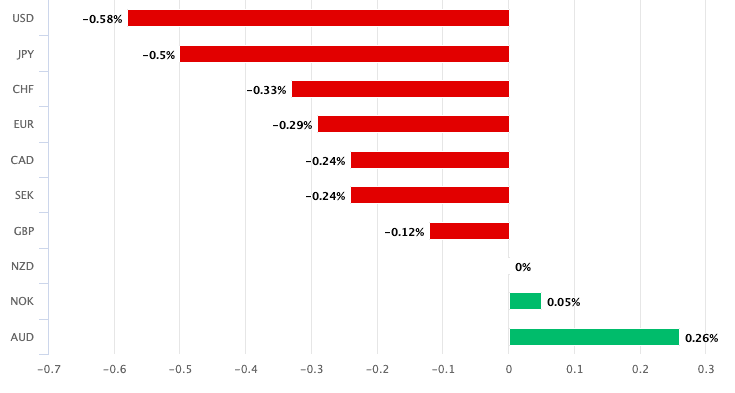

Above: NZD underperforms its peers in wake of RBNZ policy event

The current signposting by Orr and his team is that more is to come, which should keep a lid on any bouts of NZ Dollar strength over coming weeks and months.

"Whilst the dismal data did not prompt the RBNZ to embark on a back-to-back easing move; we expect a further increase in the LSAP at the next 11 November meeting, perhaps to $120BN," says Lee Sue Ann, Economist at UOB.

The RBNZ is meanwhile expected to introduce a new policy to provide cheap finance to banks with the specific objective that this money is then passed on to businesses under a Funding for Lending Programme (FLP) - similar to that deployed by the Bank of England. This move would be expected to precede a move to cut interest rates to 0% or below.

The reason the FLP would come before negative interest rates is because the RBNZ has identified the potential pitfalls that negative interest rates pose for the New Zealand banking sector. With interest rates below 0% the profitability of lending at commercial banks becomes almost non-existent.

Progress on the FLP is in itself a strong signal that negative interest rates are likely in 2021.

"What was different this time around, however, was the comments on the progress being made on the Bank’s ability to deploy additional monetary instruments. First, the RBNZ was explicit in noting that these alternative instruments could be deployed independently, rather than as a package of measures. Second, it was noted that the FLP would be ready before the end of this calendar year, an explicit signal to banks to get things ready now," says Mark Smith, Senior Economist at ASB.

ASB are expecting the RBNZ to cut interest rates again in April, a date another major New Zealand lender has settled on.

"The RBNZ stopped short of promising a negative OCR, saying rather that they “are prepared to provide additional stimulus”. But it’s pretty clear which way the wind is blowing. We continue to expect that the RBNZ will cut the OCR 50bp in April to -0.25%, with risks skewed to another cut after a pause to check that things are panning out as hoped," says Sharon Zollner, Economist at ANZ.

External drivers nevertheless remain supportive of the New Zealand Dollar - namely the strong recovery in China which has traditionally been a boon for New Zealand exports - therefore downside in the currency should ultimately have its limits.

That said, owing to the staunch easing stance at the RBNZ, any upside should be limited and the currency faces further losses against a number of its G10 peers, including the Euro, Australian Dollar and U.S. Dollar.

"The NZD will continue to underperform given the more activist RBNZ policy," says Dominic Bunning at HSBC.