New Zealand Dollar Forecast to Rise vs. Dollar but Fall vs. Pound Sterling by Year-End: BNZ

Image © Pavel Ignatov, Adobe Stock

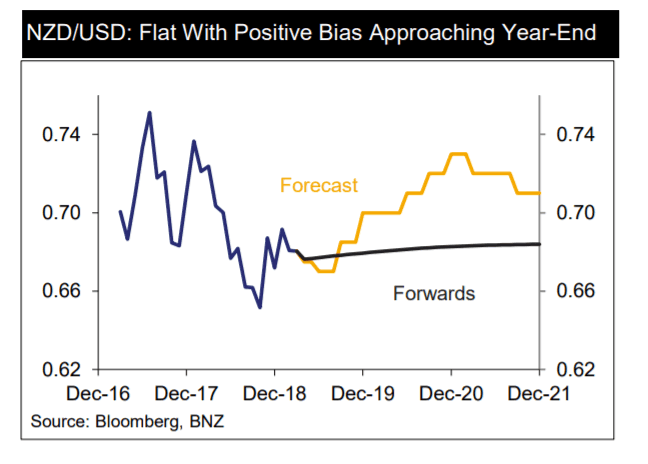

- Stronger Kiwi in 2019 on easing global factors

- Rising to 0.70 versus U.S. Dollar

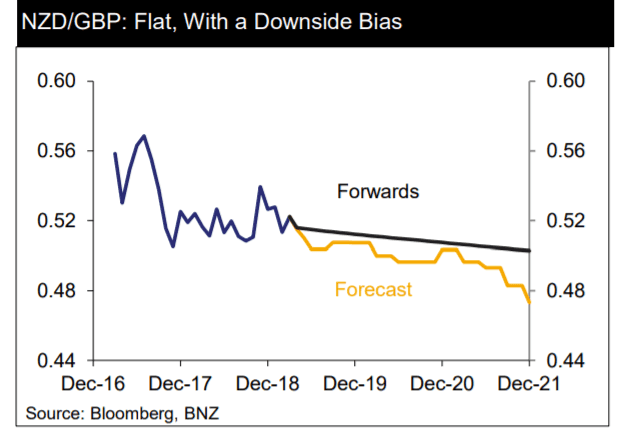

- Forecast to fall versus Pound on soft-Brexit assumption

A brighter outlook for the global economy amidst easing trade war fears between the U.S. and China should lead to an appreciation of the New Zealand Dollar over the remainder of 2019 say BNZ.

The New Zealand lender tells their corporate clients in a note out in mid-April they are forecasting gains against the U.S. Dollar, but versus Sterling losses are likely as a soft-Brexit outcome eventually supports the Pound.

The call comes as the Kiwi currency nurses a 2.0% loss against the Pound thus far in 2019, and is flat against the Dollar.

Expected gains in the against the Greenback will come despite perceived ongoing domestic economic headwinds and growing expectations for an interest rate cut at the Reserve Bank of New Zealand.

Indeed, the New Zealand Dollar took a knock on April 17 after New Zealand inflation data undershot expectations by a wide mark, coming out only 0.1% in the first quarter of 2019 - below the 0.3% forecast - and at an annualised rate of only 1.5%, down from 1.9% previously.

The easing in headline inflation increases the pressure on the Reserve Bank of New Zealand to cut rates from their current level at 1.75% at their next meeting in May.

"With weak growth likely to keep a lid on inflation for some time, we think the Bank will cut its policy rate twice in total before the year is out," says John Higgins, an economist with Capital Economics in London.

The New Zealand Dollar has for many years derived support from its higher interest rates relative to other nations. This advantage tends to draw in foreign capital as investors seek out higher yields, which in turns boosts the currency. However, cutting the interest rate would rapidly reduce this key element of support.

The soft inflation data and growing expectations for a RBNZ rate cut took NZD/USD down to a low of 0.6668 before it recovered to 0.6732 at the time of writing following the release of stronger-than-forecast Chinese GDP data.

GBP/NZD spiked higher to a peak of 1.9556 after the release before falling back down to 1.9385 in the wake of the Chinese data release.

This volatile daily move in the NZ Dollar that saw it fall on domestic numbers but ultimately recover on a more positive global story could provide a template for the longer-term outlook.

“As the year progresses, we expect a more positive tone to the global economic backdrop to prevail – a factor which the NZD is sensitive to – supporting a move to 0.70 by year-end,” says Stephen Toplis, head of research at BNZ.

If BNZ is right, these lows are likely to mark the bottom of the range for the Kiwi-Dollar because BNZ forecasts the pair eventually rising up to a target at 0.7000 by year end.

Tentative evidence the global economy is at an “inflection point” and could be about to improve, is a positive factor for the Kiwi, argues the bank.

China in particular, “has been at the coal-face of the global economic slowdown and recent data have been more positive,” says Toplis.

Indeed, the Chinese trade balance surplus rose to $32.6bn from $5.5bn previously - markets had only expected a rise to $7.05bn.

Chinese Q1 GDP data, on Wednesday, was also supportive of the global backdrop after showing a growth rate of 6.4% in Q1 when markets had forecast a slide to 6.3%.

U.S. and China are more likely than not to sign a trade agreement over coming months which should add a further boost to the Kiwi. BNZ rates these global forces as more important for the New Zealand Dollar than New Zealand (NZ) monetary policy.

“Our projections still have the NZD ending the year around 0.70, a little higher than the top of its trading range this year, as these more positive global forces predominate. By contrast, the case for a lower NZD would be if global economic momentum lurched downwards and/or the RBNZ cut rates by more than 50bps over coming quarters,” says Toplis.

Kiwi-Sterling Outlook

The profile for the Pound-to-New Zealand Dollar is a lot flatter in 2019 as Brexit uncertainty continues to fester away, says BNZ.

UK politics remains a “tinderbox” risk which could explode at any moment if a general election is called and/or Labour wins a majority. Such a scenario would send Sterling lower.

Kicking the Brexit can down the road until October 31 appeared to have little discernible effect on the Pound which suggests, “ that until the fog is completely clear, the market is unwilling to drive the currency significantly higher,” says Toplis.

Yet despite the pessimism BNZ’s base case remains for a soft Brexit deal to push GBP higher and outperform NZD eventually, with an end-of-year forecast of 0.51 (from a current 0.5159) and an eventual forecast low of 0.50 in 2020.

This translates into an end of 2019 forecast of 1.9550 and 2020 forecast of 2.0000.

Flat Start

During 2019 so far the NZD/USD exchange rate has been stuck trading in a range between 0.6650 and 0.6950. BNZ puts this down to conflicting bullish and bearish fundamental factors. On the one hand higher commodity prices and risk appetite have helped support the Kiwi, whilst on the other uncertainty over the global backdrop has pressured. Remove the latter and the pair should rise, as BNZ expects.

The risk of inflation continuing to fall substantially more than it already has is made unlikely by the relatively weak Kiwi, which will increase imported good inflation, and thus drive up the overall rate of inflation, says BNZ.

A lower Kiwi would come from the Reserve Bank cutting interest rates by more than 0.5% and the global backdrop worsening.

“By contrast, the case for a lower NZD would be if global economic momentum lurched downwards and/or the RBNZ cut rates by more than 50bps over coming quarters, against a backdrop of unchanged policy expectations for other central banks,” says BNZ.

Time to move your money? Get 3-5% more currency than your bank would offer by using the services of foreign exchange specialists at RationalFX. A specialist broker can deliver you an exchange rate closer to the real market rate, thereby saving you substantial quantities of currency. Find out more here.

* Advertisement